These are the high-dividend but undervalued stocks to buy for high total returns in the coming months.

How much do dividends yield? In this article, we’ll explore 5 high-dividend (and discounted) stocks to consider investing in.

Finding profitable and safe investment opportunities is more important than ever. With stock markets at record highs and in a state of overbought, attention is increasingly focused on stocks that offer generous dividends while presenting the potential for a discount to their intrinsic value.

In recent years, investors’ attention has been monopolized by growth stocks, neglecting dividend investment strategies. However, one should not forget that seeking stable and potentially high returns can help overcome the feeling of loss in investing.

Let’s see the ranking of the shares with the highest dividend yield but with a still affordable price.

1. Altria

- Altria weekly graph

- Source: Tradingview

Altria Group Inc (NYSE) is the leading tobacco manufacturer in the United States, known for its iconic brand of Marlboro cigarettes.

With a long history of success in the industry, Altria has maintained a prominent position in the market, demonstrating remarkable resilience even in the face of the gradual decline of tobacco consumption in the United States. The company also stands out for its commitment to shareholders, with a rolling dividend target and a recent announcement to return additional value to investors through the sale of part of its stake in Anheuser-Busch InBev (BUD). Altria has an impressive history of increasing dividends for more than 50 years, earning it a place on the exclusive Dividend Kings list.

The stock currently offers a dividend yield of 9.1%, positioning it as one of the highest-yielding stocks on the market. Despite declining revenues and earnings in the fourth quarter of 2023, Altria maintained adjusted EPS in line with analysts’ expectations, demonstrating the strength of its operations. Looking ahead to 2024, Altria expects an adjusted diluted EPS growth rate of 1% to 4%, from a base of $4.95 in 2023, confirming its position as a reliable choice for investors who seek stable returns and growth potential.

2. Petróleo Brasileiro

- Petróleo Brasileiro weekly graph

- Source: Tradingview

In second place in the ranking of high dividend stocks, we find Petróleo Brasileiro, better known as Petrobras (PBR), with a dividend yield of 13.51%. Petrobras is an integrated and diversified energy multinational company headquartered in Brazil, founded in 1953 by the Brazilian government, it was originally a state-controlled company.

For the current quarter, Petrobras is expected to post earnings of $0.78 per share, representing a change of -29.7% from the prior year. For the current fiscal year, consensus estimates indicate a change of -19.1%, while for the next fiscal year a change of -6.1% is expected. Despite this, Petrobras has topped consensus EPS estimates in two of the most recent four quarters, although it has only topped consensus revenue estimates once in this period. Petrobras is listed on the Brazilian stock exchange, the NYSE, and in Madrid.

leggi anche

5 overvalued stocks insiders are dumping

3. Valid

- Vale weekly graph

- Source: Tradingview

Shares of the Brazilian mining giant Vale (NYSE) are currently at two-year lows due to falling iron ore prices and the Chinese real estate crisis. Despite this, Vale is trying to reassure investors by enticing them with a dividend and share buyback program. The four-year average dividend yield is 9.87%, which places Vale among the top three companies with the highest dividends.

The board of directors recently approved dividends and capital interest totaling 10.57 billion reais (about $2.1 billion), as well as a share repurchase program that could involve up to 150 million shares.

Vale’s decision comes following a decline in iron ore production and recent drops in ore prices, caused by concerns over Chinese demand. Despite operational problems and pricing pressure, Vale reported adjusted earnings ahead of rising rumors compared to the same period a year earlier.

4. Energy Transfer

- Energy Transfer weekly graph

- Source: Tradingview

Energy Transfer LP Unit (NYSE) ranks fourth on our list of high-dividend, discount stocks. The dividend yield at the beginning of April stood at approximately 7.90%.

With an impressive 23% gain over the past year, the P/E multiple is less than 15. The company owns and operates the largest and most balanced collection of energy infrastructure in the United States, which includes 125,000 miles of oil and gas pipelines, export facilities on the Gulf Coast and East Coast, as well as liquid natural gas fractionation capacity of more than 1 million barrels per day. Its market relevance is evident, accounting for 20% of global liquid natural gas exports and connecting to all major hydrocarbon basins in the United States.

Energy Transfer is an integrated midstream company covering a broad range of activities, from harvesting and processing to fractionation, storage, and transportation of hydrocarbons. Its diversification and presence in key segments such as motor fuel distribution and natural gas compression services make it resilient to commodity cycles. The company plans to invest between $2 billion and $3 billion per year in growth projects, funded solely by cash flow generated after distributions are paid. Robust distribution coverage and strong growth prospects confirm Energy Transfer’s stability and financial strength, positioning it for a successful future in the energy sector.

5. Rio Tinto

- Rio Tinto weekly graph

- Source: Tradingview

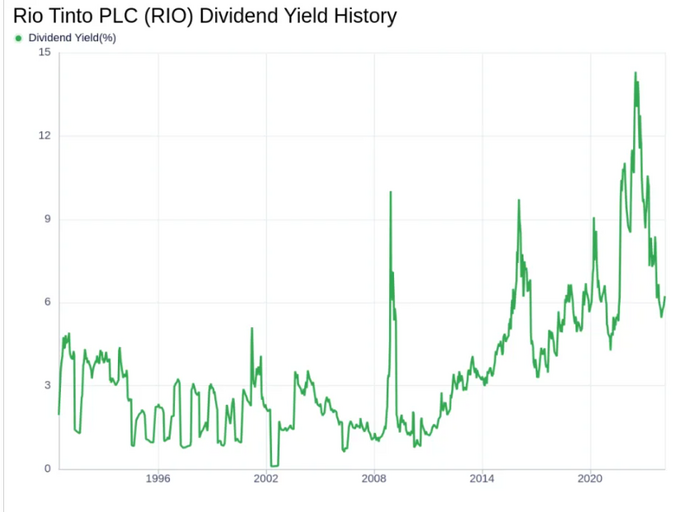

Rio Tinto (NYSE) is one of the largest mining companies in the world. However, the stock has been in the red for some time due to reduced demand from China and headwinds in the iron ore industry. Rio Tinto is a diversified global miner, with iron ore dominating its assets, followed by smaller contributions from copper, aluminum, diamonds, gold, and industrial minerals. The company has maintained a solid record of dividend payments since 1985, currently paying dividends on a semi-annual basis.

- Rio Tinto dividend history

- Source: Yahoo Finance

Rio Tinto plc’s 12-month trailing dividend yield is 6.30%, with a 12-month forward dividend yield of 6.84%, suggesting expectations of further dividend payments. Over the past three years, the annual dividend growth rate was 3.80%, rising to 13.00% over five years and 16.70% over ten years. Based on this data, the 5-year cost yield on Rio Tinto plc shares is currently 11.61%. Considering Rio Tinto PLC’s dividend payout ratio, which is 0.61 as of 12-31-2023, and Rio Tinto PLC’s profitability rating, which scores 8 out of 10 from GuruFocus, the company appears to be a compelling choice for investors. income-oriented investors.

| DISCLAIMER The information and considerations in this article should not be used as the sole or primary basis for making investment decisions. The reader maintains full freedom in his own investment choices and full responsibility in making them, since he alone knows his risk propensity and his time horizon. The information contained in the article is provided for informational purposes only and its disclosure does not constitute and should not be considered an offer or solicitation to the public for savings. |

Original article published on Money.it Italy 2024-04-12 07:41:00. Original title: 5 azioni ad alto dividendo (e scontate) da monitorare