Several factors could contribute to a new Bitcoin rally. Here are 4 reasons why it could set a new all-time record by 2024.

Bitcoin price, 4 reasons why it will rise to $98,000 by 2024. After gaining almost 10 percentage points in a month, rising to almost $38,000, the cryptocurrency could be preparing for a new increase.

Investors and sector enthusiasts are carefully scrutinizing the trend of Bitcoin, looking for signs of continuity in this phase of renewed dynamism. In the context of growing interest rates and debate on its future prospects, there are 4 key elements to take into consideration. From rising hash rate to miner sell-offs, from dwindling exchange balances to November challenges, let’s explore the latest trends that could shape Bitcoin’s fate in the coming months.

1) Hash rate record

Bitcoin has reached new records in hash rate, surpassing the 500 exahash per second threshold for the first time. This is not only an important psychological milestone but embodies miners’ confidence in future profitability. The hash rate represents the computing power used per second, and higher rates make it difficult for bad actors to gain control of 50% of the Bitcoin network.

The increase in hash rate signals an increase in mining activity, with miners investing in more efficient machinery to optimize profits. Although the price of BTC is currently below 50% of its all-time high, miners demonstrate considerable confidence in the solidity of the network.

Hashing, which is crucial in converting data into fixed-length character strings, plays a key role in the security of Bitcoin transactions.

As the halving approaches, during which the amount of Bitcoin allocated to miners is reduced by 50%, miners are demonstrating their commitment to improving the efficiency and sustainability of the industry, despite criticism over energy consumption.

leggi anche

Global economy, the 10 trends of 2024

2) Bitcoin flows from miners

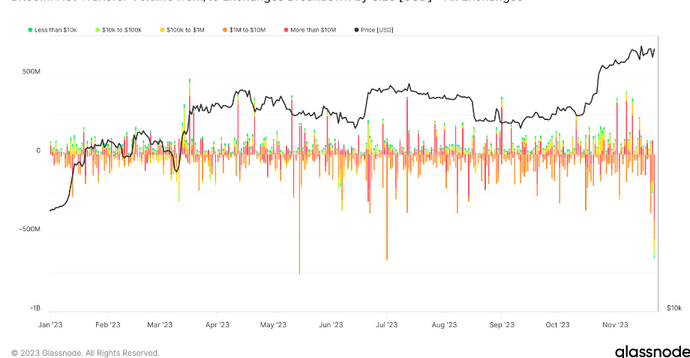

Monitoring Bitcoin flows from miners is critical to understanding the health and sustainability of the Bitcoin network. The graph of Bitcoin trading flows highlights how miners, in response to market volatility and in preparation for the halving, are selling part of their reserves, with a monthly average of 90 BTC, the lowest since 2017.

At the same time, monitoring miners’ revenue represents a crucial indicator for assessing the health of the Bitcoin network: in the period from January to June 2023, mining revenue decreased from $9.53 billion to $7.7 billion, due to a drop in Bitcoin prices, increased mining difficulty and reduced transaction fees. The following period saw an increase to reach $9.34 billion in November, the highest level in 19 months. This confirms the positive sentiment of miners.

- Bitcoin net transfer volume from exchanges

- Source: Glassnode, CryptoSlate

The interconnection between mining revenues and the price of Bitcoin is clear, with an increase in price stimulating mining profitability and influencing miners’ sentiment.

3) BTC balances on exchange

After a month characterized by shocks in the world of cryptocurrencies, with withdrawal suspensions and lawsuits against major crypto exchanges, we are once again seeing a decrease in Bitcoin balances. This trend, which has persisted for five years, denotes a significant decline in BTC reserves on exchanges. According to the latest data from Glassnode, as of November 26, aggregate assets across major exchanges have shrunk to 2.332 million BTC. Aside from the low recorded in October, this represents the lowest level since April 2018. To give an idea of the change, in March 2020, in the turmoil caused by the COVID-19 market collapse, the total reached 3.321 million BTC.

The general picture became more complicated in November, with traders’ reactions to the record fine of 4.3 billion dollars imposed on Binance and the interruptions of withdrawals on Poloniex and HTX, caused by a cyber attack computer piracy. These events have significantly influenced the cryptocurrency market context, influencing the dynamics of exchanges and the perception of investors. The change in balances on exchanges represents a critical indicator of how the sector is reacting to external events and internal challenges, painting an overall picture of the current situation of Bitcoin in the market.

4) Bitcoin ETF

The fourth crucial element in the Bitcoin landscape concerns the imminent approval of the first spot ETFs on the cryptocurrency, an event destined to significantly simplify access to investments in Bitcoin and expand the panorama of potential investors. Hopes have strengthened in recent weeks, following the favorable ruling of the United States Court of Appeals for the District of Columbia regarding the conversion of the Grayscale Bitcoin Trust into a spot ETF. The SEC’s decision not to appeal has fueled optimism, opening the door to a possible approval of a Bitcoin ETF in the coming months.

An approval that lines up giants of the caliber of BlackRock, Invesco, Franklin Templeton, Fidelity and ARK, all waiting to get the approval by the SEC to launch its own physical Bitcoin ETF in the United States.

The regulator, which had previously rejected such requests citing the risk of manipulation in the Bitcoin spot market, now appears to be opening up to a more favorable outlook. Steven Schonfield, former CEO of BlackRock and current CEO of MarketVector Indexes, expects the SEC to be able to give its consent by January 2024, avoiding granting competitive advantages to individual players and ensuring a uniform approach.

Well-known investor Cathie Wood, founder and CEO of Ark Invest, is also awaiting approval of her own ETF. According to Wood, the SEC is showing a more open attitude, raising growing hopes for the approval of one or more Bitcoin ETFs. The ardent Bitcoin advocate believes that the price of Bitcoin could rise to $682,800 by 2030 in her base case scenario or even up to $1.48 million in the most positive scenario.

|DISCLAIMER

The information and considerations in this article should not be used as the sole or primary basis for making investment decisions. The reader maintains full freedom in his own investment choices and full responsibility in making them, since only he knows his risk appetite and his time horizon. The information contained in the article is provided for informational purposes only and its disclosure does not constitute and should not be considered an offer or solicitation to the public for savings.| Original article published on Money.it Italy 2023-11-29 07:54:00. Original title: Prezzo Bitcoin, 4 motivi per cui salirà a $98.000 entro il 2024