The increase in the volumes of these financial instruments could herald a market reversal. Let’s see in detail what it is and what to monitor to reduce the risks.

The financial markets have grown significantly since the beginning of the year, but there are signs of tension that cannot be ignored. One particularly worrying sign is the increase in trading in stock options with very short-term maturities, known as "0DTE" (zero days to expiry), just as the US stock market rally is showing signs of stalling.

This phenomenon, which has in the past been associated with subdued volatility in the markets, is raising concern among options market pundits, who fear that the resurgence of this strategy could set the stage for a correction in the near future.

Growing interest in ’0DTE’ options

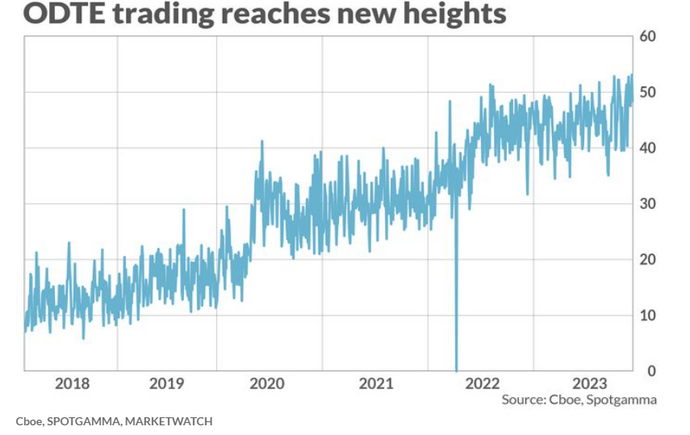

Trading in so-called "0DTE" options reached its all-time high a week ago, according to data from SpotGamma, an options market data and analysis company. The percentage volume of these options out of all options tied to the S&P 500 reached 53%. This figure includes options linked to the S&P 500 index (SPX), including those on ETFs such as the SPDR S&P 500 ETF Trust (SPY).

In the past, "0DTE" trading strategies were popular among some more aggressive traders, such as Reddit’s "Wall Street Bets" subreddit, due to their risky nature. However, this strategy is now mainly adopted by institutional traders as tool to hedge risk in view of events considered potentially serious for the markets. These options are also used in strategies to profit from intraday swings in the markets.

Market trend and possible consequences

Data analysis shows that 0DTE trading volume declined in June, after the S&P 500 index sharply breached the 4,200 mark, accelerating the 2023 stock market rally. However, more recently, volumes started to recover as the rally slowed.

Brent Kochuba, the founder of SpotGamma, explained that the high volatility associated with 0DTE strategies is usually related to "mean reversion".

In other words, a high flow of 0DTEs tends to trigger intraday reversals in the markets as traders and market participants try to push the market to their advantage.

For example, the increase in 0DTE volume last Friday coincided with a sell-off that pushed Wall Street stocks into negative territory. A similar dynamic was seen on Wednesday as stocks reversed their initial losses.

0DTE strategies are known to suppress market volatility expectations, as measured by the VIX, as 0DTE trading volumes are not included in the fear index.

According to some analysts, this could increase the likelihood that markets will be taken by surprise by a sudden increase in volatility.

This happens more violently when the VIX is low. The scenario of apparent calm depicted by a low VIX could unexpectedly change into a wave of volatility, thus generating a possible "crash" in the markets. This happens because the VIX inexorably tends to return to its historical average; after hitting historic lows, a sudden increase is almost inevitable.

- VIX graph

- Source: TradingView

In practice, this means that during periods of low volatility, markets could hide a potential danger lurking. Investors, in a rush for attractive yields, may be tempted to ignore warning signs. Yet, as history suggests, volatility can emerge suddenly, leaving the unprepared vulnerable to sharp price swings.

The role of 0DTE options in market crashes

According to some analysts, "0DTE" options can exacerbate market stress during times of panic. This could increase the risk that market makers will have to cover their positions quickly, potentially triggering a sudden surge in the Vix and subsequent correction in equities.

In the past, a well-known quantitative analyst at JPMorgan warned clients that 0DTE strategies could trigger a new "Volmageddon." The original "Volmageddon" occurred on February 5th, 2018, when a popular low-volatility strategy in the derivatives markets collapsed, causing the collapse of an ETF that used to allow retail traders to profit from volatility-reducing bets on the market.

In a low VIX environment, some investors may be tempted to leverage financial instruments such as the ProShares Short VIX Short-Term Futures (SVXY) ETF, which positions short on VIX futures. However, these products can have sudden pitfalls and can suffer rapid and significant losses if the VIX rises.

Conclusions and perspectives

The stock market has shown signs of slowing down despite the strong rally in 2023. Intensive trading of "0DTE" options could play a key role in determining future market direction.

While this strategy can bring significant profits, it also risks exacerbating volatility and causing sharp corrections. Investors should remain vigilant and alert to market developments, especially in relation to "0DTE" options trading and its possible impacts on the US stock market.

Original article published on Money.it Italy 2023-08-11 16:00:00. Original title: I mercati finanziari non possono ignorare questo segnale