The crisis of the Silicon Valley Bank gives rise to absolutely interesting purchasing opportunities: this is the case of Charles Schwab (SCHW US). Let’s see why.

The Silicon Valley Bank case also brings with it investment opportunities.

Its liquidity crunch has triggered fears of systemic crises that, at present, do not match the reality of the US credit system as a whole. The Fed has intervened with guarantees in favor of depositors, but we are confident that it will not fail to provide emergency credit lines in the event that other small or medium-sized banks are faced with the massive withdrawal of money by their depositors.

Let’s say right away that the SVB crash is solely the fault of SVB’s management, which made sensational mistakes in the integrated management of liabilities (on sight) with its own assets (30-year US Treasuries and long-term investments at start-ups -up). The Fed therefore has no fault with its interest rate hike in the origin of the SVB crisis. Suffice it to say that other large banks such as Citi, Goldman Sachs or JP Morgan obsessively take care of the balance between the average duration of their liabilities and the average duration of balance sheet assets, and the Federal Reserve’s rate hike has not threatened their financial stability.

However, the market seems to "throw the baby away together with the bath water" in these situations: the sales hit both "problematic" stocks and stocks that absolutely do not deserve to be punished by volatility. Thus creating formidable purchase opportunities for the long term.

This is the case of the bank CHARLES SCHWAB (SCHW US) in the USA.

The bank takes its name from its founder, Charles Schwab, in fact. In 1971, he founded the firm as a traditional securities firm, with $100,000 borrowed from his uncle.

Today, the company processes an average of 6 million transactions per day on all international financial markets, involving over 30 million customer accounts for an average day-by-day value of $7.1 trillion.

From the March 13 release, we know that total assets deposited by clients amounted to $7.38 trillion at the end of February, a decrease of 4% compared to February 2022 and 1% compared to January 2023. It is a leading provider of financial services with approximately 34.0 million active brokerage-trading accounts, 2.4 million customers participating in company pension plans, in addition to 1.7 million bank current accounts.

Through its operating subsidiaries, the firm provides a full range of asset management, securities brokerage, classical banking, ID payment and collection services, custody and financial advisory services to individual investors and independent investment advisers. Its main banking subsidiary, Charles Schwab Bank, SSB (member of the FDIC, i.e. member of the bank deposit guarantee and protection scheme in the USA), provides banking and loan products and services to ordinary customers.

I was struck by a shocking fact in recent statements from corporate executives: Over the past 40 days, the company’s core net new assets from new and existing customers were $41.7 billion . Many of these are ex-SVB clients. In short, this crisis of SVB was a godsend for Schwab.

The thing that is decidedly interesting is that the financial performance, in the light of the strong net inflows of new collections in the month of February and the first ten days of March, continues to be strong.

In view of the first quarter 2023 results, which will be announced by April 17, the company expects revenue growth of approximately +10% compared to the first quarter of 2022, with a pre-tax interest margin (difference between interest paid to depositors and interest received on loans) in the order of 45-47%.

The CFO of the bank, Peter Crawford in the press release of 13 March u.s. it was very clear:

“ …More than 80% of our total bank deposits are within FDIC insurance limits, ($250,000) and is one of the five highest guaranteed deposits to total deposits ratios among the top 100 banks in the United States…”.

And he also stated:

“...The loan/deposit ratio of our banks is around 10% and almost all loans are secured by mortgages or securities of primary credit standing (US Treasuries)...".

And this - in our opinion - means that the ratio Net NPL / Total loans is almost zero.

It’s still:

“…The rest of our assets are invested in high quality, liquid securities with maturities within 2-3 years, through our available-for-sale portfolio, through the equity of our holding company - parent company or the proprietary portfolio of broker-dealer branches, or in our HTM (Held to Maturity) securities portfolio, i.e. securities to be held to maturity, not intended for proprietary trading. But one thing needs to be stressed: focusing on unrealized losses within the HTM portfolio presents a logical fallacy, because these securities will mature at par and, given our significant access to other sources of liquidity, (credit lines interbank bonds and facilities to be used at the Fed) it is very unlikely that we need to sell them before maturity (as the name suggests)..."

Those are reassuring statements. However, this did not prevent SCHW from being involved in the sell-off of the regional banks, as if it too was about to go bankrupt, due to its own securities portfolio. Nothing more wrong.

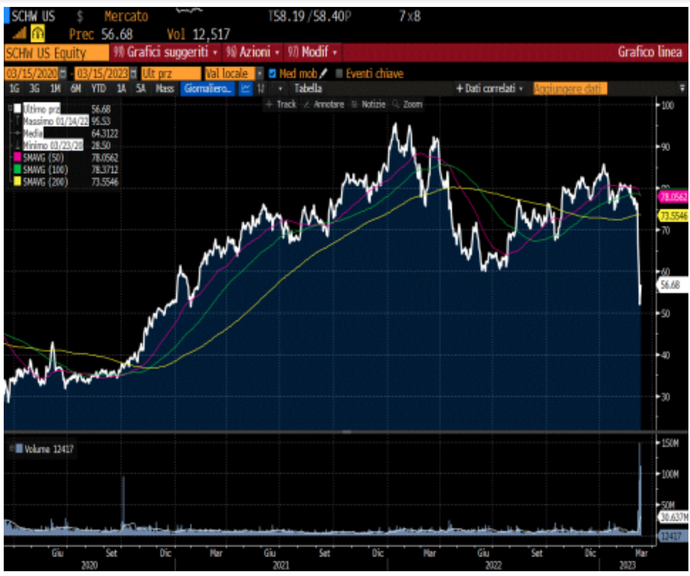

A bit of graphic analysis.

If we look at the Bloomberg chart below, we realize that the SVB cyclone unfairly penalized SCHW causing it to lose 35% in a few days (from $80 on 2/24/23 to last Monday’s lows of $52). However, on 3/14/2023, however, it rebounded well up to $56.7.

What to say? With an ROE of around 17% and a P/E of around 14x, and an absolutely conservative and prudent business model, the stock is somewhat undervalued at these prices.

Conclusions: from a graphic point of view, the recognition of the intrinsic quality of the company business by the market and the absolute extraneousness to SVB-style liquidity crises could bring the stock back to its MM200gg in a short time ( yellow line Bloomberg chart above) equal to about $73.5, with a potential upside of about +30% compared to the close of $56.58 on Tuesday evening 3/14/2023.

By R.F.

DISCLAIMER: the information contained in this article is believed to be true and updated as of March 15, 2023. The considerations contained in this article are mine alone and do not involve the responsibility of Money.it and, at the same time, do not constitute solicitation of public savings in any way. Investing in shares is a risky investment and can also lead to the loss of 100% of the invested capital.

Original article published on Money.it Italy 2023-03-15 15:49:00. Original title: Le opportunità di investimento con la crisi di SVB