So far, the United States avoided a recession thanks to high consumer spending. Unfortunately, Americans are running out of money.

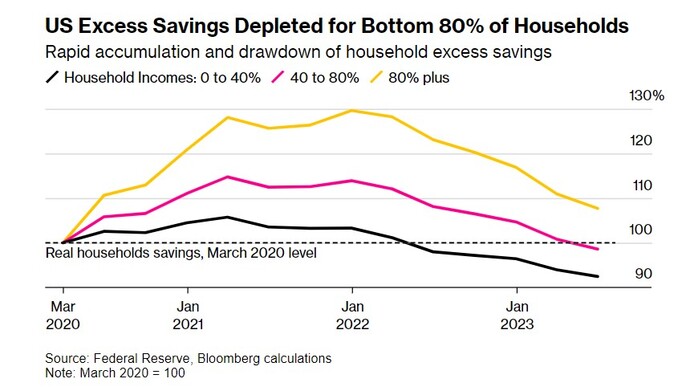

A Federal Reserve study of household finance reveals that Americans are running out of money, eating into their last pandemic savings. As of September, only the richest 20% of households still retain excess savings.

According to the study, Americans reached their peak savings in early 2021, when households were still afraid of going outside and many businesses were closed.

Constant government stimulus during the lockdown increased household savings, although they still could not use them. Once the pandemic was over, Americans fueled economic growth with their amassed savings, quickly revamping the economy.

According to the Fed’s calculations, this was rather unusual compared to other recessions. The economy rebounded very quickly and passed pre-Covid levels already 12 months after the pandemic ended.

However, this also means that liquidity ran out faster than expected, with only the richest households retaining roughly 8% of their pandemic savings.

This could have immediate impacts on American consumer spending, although it increased more than expected last summer.

A sign of recession?

Withholding all their savings and then spending them all at once had the undesired effect of accelerating inflation. Later exacerbated by the war in Ukraine and the energy crisis, inflation in the US started creeping up after the pandemic due to a massive influx of liquidity hitting the economy.

With inflation rising uncontrollably, the Federal Reserve was forced to hike interest rates, resulting in the fastest tightening policy in US history.

Such a strong hike cycle would have normally led to an inevitable recession, but Americans continued to eat into their savings and kept the economy resilient with their spending. American GDP continued to grow, sometimes even more than expected, and a recession was avoided.

Now that Americans don’t have enough savings to keep spending, will high interest rates lead to a recession?

At their latest meeting, the Federal Reserve announced a “higher for longer” strategy. In their view, interest rates should remain high throughout 2024.

Markets reacted negatively to this intention, with long-term US bonds rising to a 16-year high. Long-term bonds’ yield increases only when markets predict a coming recession.

But without any additional hike, a recession might indeed be avoided. For the remainder of 2023, the US economy will keep growing according to every projection. For a recession to hit the United States before the November election, the economy should contract for every consecutive quarter of 2024.

Although not impossible, this scenario appears highly unlikely given the current economic trends. But wrong projections happen all the time, and one negative quarter could be enough to trigger a recession.