The FTSE Mib closes an uninspiring stock market week. With the opening of the real earnings season, will it be possible to see a recovery?

These days appear to be a time of concern for investors who have recently entered the Italian stock market, in the wake of the good results at the beginning of 2023 and the widespread idea that - perhaps - the worst is over. The current situation, however, still appears complex according to many experts. Certain dynamics seem to bring down the European stock markets, and the FTSE MIB 40, the index of the 40 largest capitalizations on the Italian stock market, seems to be suffering the effects of these uncertainties.

What is bringing down European prices?

Investors are weighed down by a complex of unpleasant geopolitical, economic, and financial situations. Recently, however, the component linked to the company earnings season has also been added, which began this week with results that do not seem to have managed to lift the spirits of investors. The trend of European EPS is still growing by 18%, but despite this, the STOXX600 closed Friday down by 1.1%, constantly decline. Global economic instability therefore seems to play an unfavorable role for European prospects.

Likewise, even in Milan the climate is becoming increasingly tense, in the wake of the terrible performances recorded in the rest of Europe. The FTSE MIB 40 index is contracting by more than one percentage point. On the podium of the worst performances are those of the oil sector, in sharp contraction compared to the highs reached last week with the shock of the Middle East, and the banking institutions, in the wake of the collapse (again) of the US regional banking sector.

Last week, Brunello Cucinelli SpA and S. Ferragamo opened the Italian earnings season, both with good results. Their positive accounts seem to have been reflected in the stock market price of Brunello Cucinelli SpA, which closed Friday’s session with a result clearly out of alignment with the rest of the market and the sector to which it belongs, recording growth close to 5%. The market, however, tries to project itself forward, on the week’s deadlines, such as the banking profits, coincidentally among the worst of the week.

leggi anche

Do Israel, Iran and Hamas have nuclear weapons?

FTSE MIB 40: a look at the reference chart levels

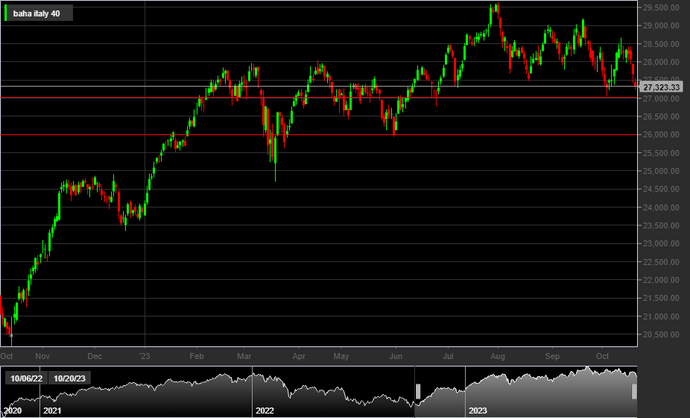

Friday’s close brings the reference index of the Italian stock market close to the lows of October, a technical level whose breakdown would open the doors to uninspiring bearish scenarios. Many observe with concern the target of 26,000 points, an area of particular graphic and historical relevance for the index. It should be borne in mind that this week’s contraction appears to be mainly due to a situation of substantial global uncertainty rather than a concrete situation of difficulty. Based on this premise, it could be interesting to observe how demand will react near the lows, perhaps signaled by oscillators such as the RSI.

- FTSE MIB 40, 1D

- Source: TeleTrader.

Original article published on Money.it Italy 2023-10-23 10:49:27. Original title: Piazza Affari, FTSE MIB verso i minimi. Occasione d’acquisto?