GDP data from the United States concerning the first quarter of 2023 was released on Thursday, painting a disappointing picture.

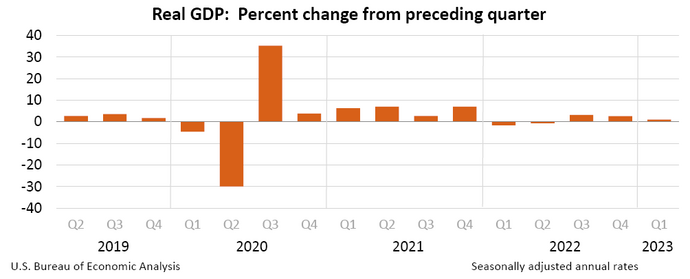

Real GDP in the first quarter of 2023 was disappointing for the United States, even more than expected. And expectations were all but high in the first place. According to the data released on Thursday, the American GDP grew 1.1% year-on-year in the first three months of 2023.

This amount is down from the 2.6% year-on-year growth of Q4 in 2022. Last year, the United States narrowly avoided recession even though GDP decreased for two quarters in a row.

Luckily, the American economy rebounded and ended the year on a positive trait. Analysts believe, however, that we will not be that lucky this year.

“While private investment may pick back up later this year,” said the chief economist for Morning Consult John Leer, “it tends to be highly volatile from quarter to quarter. Without a robust consumer, we’re likely to see more volatility and uncertainty in economic activity through the end of the year.”

In English, what this means is that the American economy will likely keep growing at extremely low pace next quarter, only to eventually fall into a recession at the end of the year.

In the following days, GDP data from important European countries like Germany and Italy will also come out, signaling how far they are from recession. On Friday morning, the Eurozone will also unveil its GDP data.

What will the Fed do?

Overall, this GDP measure was even worse than economists predicted. The situation is rather grim, and only the hard core optimists believe the world will manage to avoid a recession.

The decrease in GDP is mainly due to the American Federal Reserve increasing interest rates, followed by the European Central Bank and the Bank of England. This strategy is needed to fight off inflation, which is indeed working.

American inflation went down to 5%, and Personal Consumption Expenditure (PCE) increased by 4.9%, more than expected. This means that indeed prices are lowering and consumers are buying more.

At their following meeting next week, the Fed might decide to hike interest rates for one last time, then letting inflation lower by itself. Then, probably in September, inflation should be low enough for the Fed to lower interest rates again.

But inflation in the European Union and in the United Kingdom is still extremely high and will likely impact interest rates more than in the US. Indeed, the UK might be the first developed nation to fall into recession given their dismal economic data.

Nevertheless, the UK will likely be followed by the European Union and the United States, causing another economic recession after just three years from the last one.

All the while, China enjoys its steady GDP growth…