Looking at the international stock markets it is possible to identify an underlying that has represented a fair compromise between return and sustained risk.

Real investors don’t improvise. It might seem obvious, but today, looking at the multitude of information available to everyone, the topic of investments and their very understanding seems to be trivial.

We talk about the need to introduce the now increasingly widespread and called financial education, but, often, the fundamental aspect of having to spread the true meaning behind this unknown subject is overlooked: that of financial awareness. This, which for many could be a subtle difference, however, represents the most important obstacle to face and overcome.

An "educated" subject may sometimes not correspond to a subject "aware" of what he should have learned. It is enough to remember those testing situations in the school environment which, although yielding to an unexpected degree of sufficiency, found, in the following days, a complete void.

In this case, the formal role of a student certified the passing of the test taken, but the reality of the facts, instead, showed the state of a child without consciousness. Once this potential discrepancy between being educated and being aware has been consolidated, from a financial point of view, the closest consequence that derives from it is synonymous with an almost certain failure or rather: the loss of money.

To avoid confusion between knowledge and the perception of knowledge, it is recommended to follow an approach that emphasizes obtaining objective information when making investment decisions. In finance, objective information is typically represented by numbers. Once this information has been obtained, subjective factors can be considered, if necessary, by reviewing reports, outlooks, and judgments. At the base, however, there are the numbers. And today we will talk about numbers, very interesting numbers.

The continued bullish trend of stock markets no longer seems to be newsworthy. Wherever the gaze can search for information, estimates are found with a view to new records and, rarely, some sporadic recommendations for prudence which are mostly dictated by a rare (subjective) common sense.

leggi anche

How to invest in Bitcoin

At this moment, it is easy to draw conclusions based on current events, but difficult to find something performing better than they are. Except for individual titles. In today’s in-depth analysis, we instead want to bring attention to some key pillars that support a solid asset allocation.

Aware (financially) of the usual three-way division of the individual asset classes (equity, bonds, and commodities), space has also been made for new entry alternatives. It is obvious how the "historic trident" represents - still - the hard core of a portfolio (so-called core component), leaving the remaining investment solutions with a residual margin (so-called satellite component). In addition to all this, however, very often, the most sought-after source that generates alpha or more simply sought-after added value is underestimated (thus neglecting the investment).

To rediscover (or discover) this hidden treasure, it is useless to underline it, but several hours of research, in-depth analysis, and above all verification of the probably infinite numbers are necessary.

Today, we wanted to bring a first element to the attention of all of you, starting from a question: by looking at the international stock markets, is it possible to identify an underlying that has represented the right compromise between return and sustained risk?

Theoretically, the best answer would be the one that achieves a high return while assuming a low risk. But, as mentioned, this is a theory. Question: what if, instead, this win-win combination was present and under everyone’s eyes? Well. The answer we provide is this: it is there, it exists, it is real and, as you can imagine, it is not known to many. We can say many. We are talking about an international, sectoral stock index which, even from a rational point of view, finds its reason for being in everyday life. Therefore, nothing to do with futuristic opportunities, AI, cyber security, etc., but rather, simply our daily consumption.

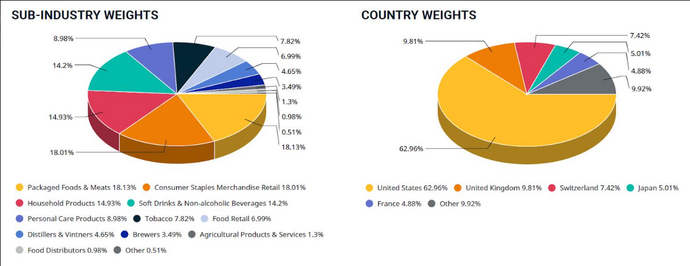

- Source: MSCI Index Factsheet

Specifically, it concerns the well-known MSCI World Consumer Staples Index which, taking up a description extracted from a common document containing the key information underlying this investment instrument, reports: “conceived to reflect the performance of the listed shares of some companies in various developed countries. Shares are issued by companies operating in the major consumer goods sector. The core consumer goods sector includes, for example, food, food retail, and household and personal care products. The weighting of a company in the index depends on its relative capitalization, determined as a function of the overall value of the free float (readily available shares) of a company compared to that of other companies”.

Looking at the details of the information sheet of the MSCI provider, the aforementioned developed countries are 23, namely «Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK, and the US" while the type of company is the usual large and mid-cap.

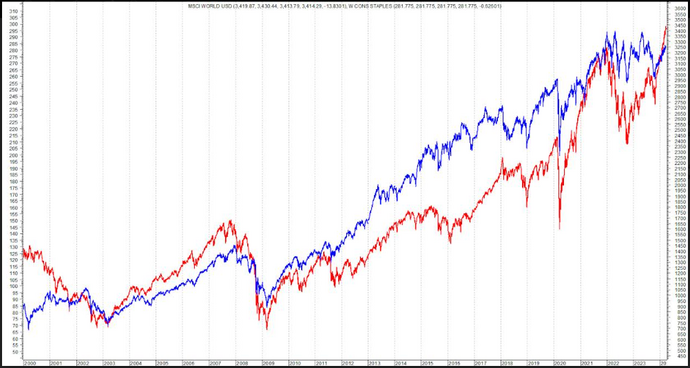

- Comparison between MSCI World USD (red line) and MSCI World Consumer Staples Index (blue line)

Having revealed "the what", now it is necessary to "how much" of this unknown "financial artifice". Comparing the historical series of the MSCI World USD index with those of the sector competitor, the parallelism is objective to the advantage of the latter.

Starting from January 2000: the global international equity underlying goes from 1,420 to the current 3,400 points. Conversely, the rediscovered World Consumer Staples Index sees its values rise from area 84 to today’s 282 points. The comment is yours. Furthermore, if this time frame were too long, even on a more limited and recent horizon (2010-2022) the sector performance (from 116 to 278 points) shows the upper hand compared to that of the shareholding structure (from 1,166 to 2,607 points).

Only by including last year can we find a change in the first place (MSCI World leader) of this two-way race. Having cleared the efficiency in quantitative terms (ref. performance), now, an - objective - synthesis is necessary in the qualitative field (ref. risk). Also from the MSCI information sheet, the following percentage values of annualized standard deviation emerge contextualized to specific time frames (three, five, and ten years): 13.58%, 13.39%, and 11.79% for the World Consumer Stample versus 17.05%, 18.05% and 14.90% of the World macro index.

Original article published on Money.it Italy 2024-03-27 16:01:00. Original title: Mercati azionari, ecco come guadagnare di più (e rischiare di meno)