The 10 countries with the highest inflation in the world present truly frightening figures: what are they and what are these countries suffocated by skyrocketing prices at risk?

Which countries have the highest inflation in the world? While the Eurozone and the US despair that consumer price increases have not slowed enough, there are nations living with inflationary rates that dwarf their respective 5.5% for the Eurozone and 3% for the US (June annual data).

Even in the worst-case scenario, price hikes have been a drop in the bucket in these areas compared to the rates people in some less developed economies have lived with for years.

Several countries, including Venezuela, Argentina and Sudan, have been saddled with skyrocketing costs for decades. Last year, Venezuelan consumer prices were more than four times higher than a year earlier. In Argentina they were nearly double what they were in 2021, according to data from the International Monetary Fund.

The ranking of the 10 states with the highest inflation rate: what they are and why the numbers really have an impact.

The 10 countries with the highest inflation in the world

If we want to leave room for the numbers, the first observation to make, as suggested in an analysis by CNN Business, is that in advanced economies in general, inflation has averaged 2.4% since the 1990s, the first aggregate data available to the IMF.

The period of very low inflation ended in 2021, due to factors such as the pandemic and the Russian invasion of Ukraine, according to research by the Federal Reserve. In 2021, inflation in advanced economies – including the European Union, the United Kingdom, and the United States – rose to 5.3%, before growing to 7.3% in 2022.

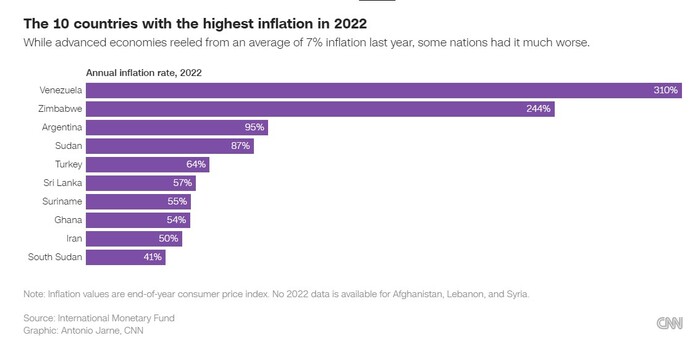

There has been a leap, but it doesn’t hold a candle to other areas of the world. Here, in a graph, are the 10 countries with the highest inflation in the world:

While Venezuela’s inflation has been continuous since at least the 1980s, according to IMF data, it has been unprecedented in recent years. The Latin American country saw hyperinflation of more than 130% in 2018 when the government had to create a new currency, the Bolivar Soberano, worth 100,000 old bolivars, to streamline transactions. The price of a can of Coca-Cola went from 2,800,000 "old" bolivars to 28 "new" bolivars.

In 2022, Venezuelan inflation was still at 310%, the highest in the world that year. In South America, Argentina is also experiencing high rates, colliding with the umpteenth financial crisis underway. Furthermore, the case of Turkey should be highlighted, with the unorthodox monetary policy led by Erdogan which led to low-interest rates, a devalued lira, and skyrocketing prices.

What’s happening to countries with record prices

In Venezuela, retirees and public sector workers have been hardest hit, said Andrés Guevara, an economics professor at the Andrés Bello Catholic University in Caracas and chief executive of Omnis, a consulting firm. The state pays public employees’ pensions and salaries in the local currency, so as the bolivar devalues “it loses purchasing power and greatly impoverishes these sectors of the population”, he told CNN.

I can only buy a piece of cheese "with my pension", Venezuelan retiree Nelson Sánchez told CNN. He gets help from his children.

Meanwhile, with the price increase in Argentina, wages are going up. “There are unions in some economic sectors that ask for reviews every two months”, said Emiliano Anselmi, chief economist at Portfolio Personal Inversiones, an investment firm based in Buenos Aires.

Another effect of inflation is that people spend their money as soon as possible. “Since everything will be more expensive tomorrow, people will spend their money while receiving it, increasing inflation”, Anselmi told CNN.

In the affected economies, credit is limited, especially for the less well-off. “The credit market does not exist [in Argentina]. If you want to buy a house, you put it together dollar for dollar and pay for it all at once,” he added.

As governments grapple with their finances, people have found ways to deal with these circumstances. One of the most common solutions is to use a more stable currency, specifically the US dollar.

Using US currency for transactions is common in Venezuela, as people don’t trust the volatile local currency, according to Guevara. “There has been a real dollarization of the Venezuelan economy ”, he said.

In this dramatic context, aggravated by volatile factors in the global economy such as the prices of raw materials, the outcome of the war, and the China-US escalation, these countries suffocated by record inflation may succumb before others.

Original article published on Money.it Italy 2023-07-12 12:14:44. Original title: I Paesi con l’inflazione più alta del mondo, con numeri che spaventano