How high can Bitcoin rise? Between the new historical highs and a certain confusion, here is the only certainty we have for the near future.

“How much beautiful youth is still fleeting! Whoever wants to be happy, let him be”, there is no certainty about Bitcoin. Though we regret distorting the beauty of the famous poem by Lorenzo de’ Medici, we believe the time has come to provide clarity on the future of Bitcoin.

There’s no need to remind readers about the upcoming Bitcoin halving. There has been a lot of discussion in recent months and weeks, so it would be redundant to provide yet another guide for current or prospective Bitcoin owners.

Today, however, much more than in the past, the underlying question is simply this: Will Bitcoin rise again? The opposing factions have played (and will play) all the possible and innumerable arguments in favor of both theses.

Choosing between the pro- and anti-Bitcoin sides in this debate only adds to the argument without reaching a reasonable agreement. Upon examining the most recent and current events, the data that can be obtained regarding the halving is essentially this: following the previous interventions, over the subsequent years, there was a significant increase in the value corresponding to each reduction.

- Bitcoin: daily graph on a logarithmic scale

In fact, through the graphic representation in a logarithmic scale of the historical trend of Bitcoin, the objective added value that the time factor has duly recognized to all owners emerges. This is a "confirmation", however, only apparent and equally potentially misleading.

The reason is very simple: checking with the usual hindsight we find that - after four years - there has been a significant revaluation. Unfortunately, it is necessary to underline how, from 2009 to today, the only three cases of halving cannot represent a robust sample in statistical terms, confirming a non-certainty about the near future.

Another source of uncertainty is that attributable to the rediscovered institutional interest, i.e. those authorized on the market who, through suitable financial instruments, have begun to take their first steps involving the public.

leggi anche

4 cryptocurrencies to beat Bitcoin (by a lot)

Looking at the number of volumes achieved so far, we cannot concretely associate their positioning as a trigger to support the current and recent rise. The investment industry is indeed expected to expand further in the future. However, it is still important to evaluate the potential impact on the current price trend, including any possible systemic effects.

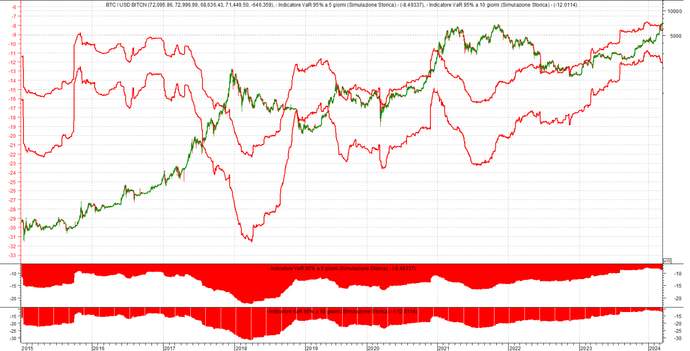

- Bitcoin: daily graph on a logarithmic scale / VaR indicator 95% at 5 and 10 days

Finally, we come to what we consider the only certain thing about Bitcoin’s future.

Investing capital in this type of instrument carries a high level of risk. Those who are potentially interested in investing should evaluate the potential risk-return trade-off. Using historical data alone for quantitative analysis, such as the use of indices related to the maximum drawdown and recovery period, only partially satisfies the actual need for knowledge.

For our part, this approach is considered reductive and too simplistic as it can be associated with a form of ex-post passivity which, inevitably, sees assets exposed to the mother of all unknowns: time. Humbly, we aim to provide a precise magnifying glass on the actual risk of Bitcoin: its Value at Risk (VaR).

In short, this tool identifies the maximum potential loss (limited to a confidence level) within a given period.

By taking its usefulness to the extreme, VaR tries to satisfy (ex-ante) the need to know the quantum of a possible loss within a specific time frame. Here, now, the only certainty of Bitcoin has been revealed. In the event of a drop in prices, the current VaR values (calculated with a confidence level of 95%) estimate a potential loss of over 12 percentage points if weighted over ten days, while a drop of more than ’8% in case of a five-day horizon.

Compared to the values at the beginning of the year (with Bitcoin in the $42,000 area), the respective five- and ten-day VaRs have undergone an increase in size (amount of potential loss) which, if contextualized to history, seem to represent an (anticipatory) signal of exhaustion of the current movement.

Objectively, this is an element that should not be underestimated. Therefore, returning to the initial "question of questions" on the subject of Bitcoin, a possible answer could be this: if, as estimated, we are willing to bear such potential losses, then the rise will not be able to scare anyone. Target at $100,000? That’s more than welcome. Over $100,000? Even better. Having reached this unavoidable certainty, from today, everything will depend only on everyone’s ability to resist. But the market is not interested in this.

Original article published on Money.it Italy 2024-03-13 15:50:00. Original title: Bitcoin: ecco svelata l’unica certezza sul suo futuro