These 5 companies could establish themselves in their respective sectors and offer market-beating returns in the long term, capitalizing on the megatrend of artificial intelligence.

The 5 most disruptive tech stocks of 2024 according to UBS could dominate the stock market over the next decade. The race for technological innovation is becoming increasingly intense, with companies all over the world competing for the title of leader in the sector.

According to UBS, the next big breakthrough will come from sectors such as artificial intelligence, cybersecurity, healthcare, green technology, and fintech. These sectors, the bank argues in a March 14 report, will form the leaders of the future by 2030. Now, with a keen eye on long-term growth opportunities, UBS has selected 29 names that could offer market-beating returns. Among these, 5 companies stand out for their innovation and revolutionary potential.

Let’s see which securities are involved and the reasons behind the choice of UBS.

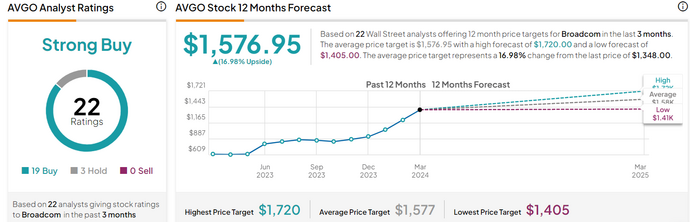

1. Broadcom

- Broadcom graph

- Source: Tradingview

UBS views Broadcom as one of the undisputed leaders in semiconductor design, with a strong ability to generate free cash flow and an efficient capital expenditure profile. Over the last year, the stock has grown by 110% and over the last ten years (including dividends) by 2,600%. With a market capitalization of $600 billion, Broadcom ranks among the world’s largest companies. Industry experts predict that this blue-chip could reach a valuation of $1 trillion by 2024.

Despite a 13% decline from all-time highs reached in early March following the release of quarterly results, analysts expect Broadcom to report consistently growing revenues and earnings over the next decade, thanks to the AI megatrend.

Broadcom CEO Hock Tan, commenting on the recently released financial results, said: “Strong demand for our networking products in AI data centers, coupled with hyper scalers custom AI accelerators, is driving growth in our segment of semiconductors”.

On March 7, Broadcom reported quarterly earnings of $10.99 per share, beating consensus analysts’ estimates of $10.29, an increase of 6.39% over earnings per share of $10.33. dollars in the same period of the previous year.

- Broadcom target price

- Source: TipRanks

Looking ahead, the company is well-positioned to meet the growing demand for services related to 5G, data center storage, and industrial applications. Additionally, revenue diversification from recurring revenues from software and services brings stability to its earnings base.

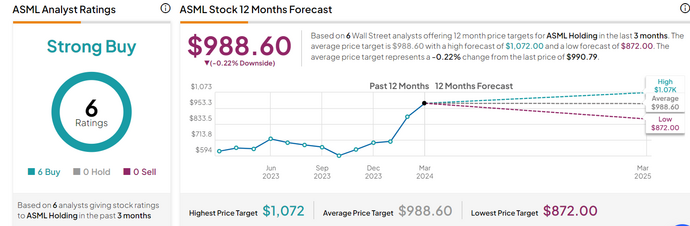

2. ASML

- ASML graph (Euronext)

- Source: Tradingview

ASML, the Dutch semiconductor company, holds a monopoly on EUV lithography technology, which is essential for the production of advanced chips. UBS expects capital spending on lithography to continue to increase in the coming years, allowing ASML to outpace its competitors. The growth of ASML is closely linked to that of NVIDIA: without ASML machines it would not be possible to create the GPU graphics processing units essential for training large language models. Nvidia’s H100 AI GPU can only be produced using a custom 5-nanometer process node from Taiwan Semiconductor Manufacturing. In turn, TSMC can only make these 5nm chips with ASML machines.

According to some estimates, the EUV lithography market could register a compound annual growth rate (CAGR) of 22% through 2032, generating $63 billion in annual revenue at the end of the forecast period. Semiconductor industry-related industries are estimated at $222 billion in 2032, up from $83 billion in 2022.

- ASML target price

- Source: TipRanks

The ASML stock was analyzed by Bernstein experts who raised the "buy" rating on the stock with target price to 980 euros, from 890 euros previously.

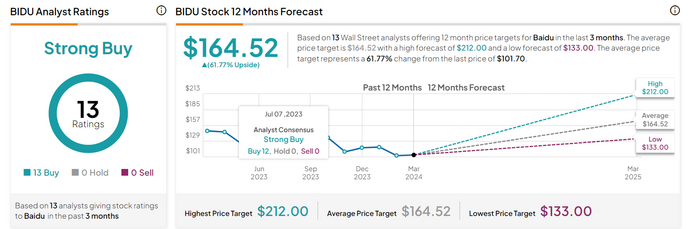

3. Baidu

- Baidu graph

- Source: Tradingview

Baidu, the Chinese Internet giant, is very well positioned in cloud computing and artificial intelligence, two sectors identified by UBS as key to the company’s long-term growth. Through its non-advertising businesses, such as autonomous driving service Apollo Go and operating one of the largest AI cloud infrastructure service platforms in China, Baidu can take full advantage of the growth opportunities offered by these expanding sectors. With over 5 million rides accumulated to date, Apollo Go has emerged as the world’s most successful autonomous ride-hailing service, confirming Baidu’s role in innovating in the field of intelligent driving.

While these AI-powered operating segments are contributing to Baidu’s organic growth, the heart of the company remains its Internet search engine. With an Internet search share hovering between 60% and 85% over the past nine years, Baidu continues to be the go-to place for Chinese consumers and merchants looking to reach their audiences. This leadership in online search gives Baidu considerable advertising pricing power, ensuring a steady stream of revenue.

Additionally, Baidu has a strong financial position, with more than $28 billion in cash and short-term investments as of the end of 2023. This strong financial foundation provides Baidu with the flexibility to continue investing in innovation and growth while offering further security for investors. With a P/E ratio of just over 8, some Wall Street analysts consider Baidu stock remarkably cheap, predicting a price target of $210 within the next 12 to 24 months.

- Baidu target price

- Source: TipRanks

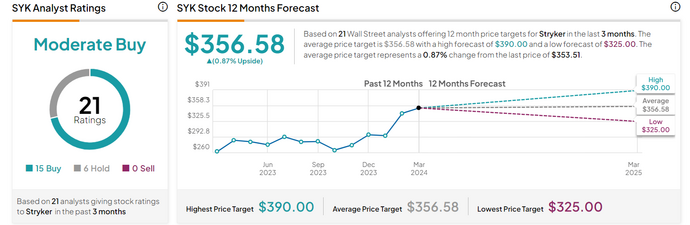

4) Stryker

Stryker Corporation is one of the companies under UBS’s lens in the medical technology sector, thanks to its leadership in the orthopedic and robotic surgery markets. The company continues to outpace market growth rates, anticipating a high sales outlook in 2024. Investors can rely on its ability to improve margins and grow earnings, supported by a solid foundation of consistent, healthy volumes in surgical sectors.

- Stryker graph

- Source: Tradingview

Stryker is well positioned for growth thanks to the robustness of its robotic arm-assisted surgery platform, Mako, and a diversified product portfolio. With a market capitalization of $135.6 billion, it is among the world’s largest medical device companies, with earnings expected to grow 10.3% over the next five years. Stryker’s 3.3% earnings yield comfortably beats that of the industry.

Stryker’s broad product portfolio protects it from potential economic turmoil, while its significant exposure to healthcare robotics and AI keeps it at the forefront of MedTech.

Stryker’s ongoing commitment to innovation is reflected in its research and development expenses, which in 2023 amounted to 5.1% of net sales. This commitment is expected to lead to the launch of new products, further consolidating its leading position in the industry.

Additionally, Stryker is implementing a series of cost-cutting measures, including restructuring plans, as it prepares to meet market challenges with greater efficiency. With strong customer demand for its existing products and growing interest in new launches, the company’s outlook for 2024 appears promising.

- Stryker target price

- Source: TipRanks

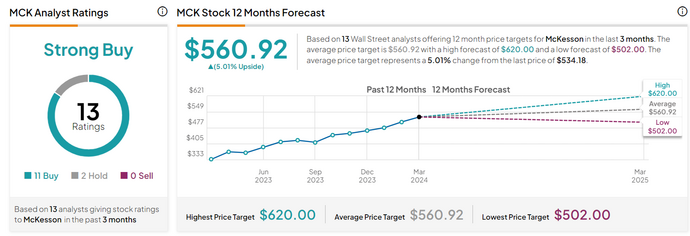

5) McKesson

McKesson, with its wide range of healthcare services ranging from the distribution of pharmaceutical products to information technology, presents itself as a key player in the healthcare landscape. UBS expresses well-founded optimism about the company’s prospects, especially considering its growing commitment to data-driven services across the U.S. healthcare value chain.

So far this year, McKesson has returned 11.2%, far outpacing the medical sector average, which has posted a loss of 3.4%. This highlights McKesson’s ability to outperform its peers, a trait that attracts investors’ attention.

- McKesson’s graph

- Source: Tradingview

Analyzing McKesson’s financials, strengths such as adequate debt coverage by earnings and cash flows emerge, as well as an attractive estimated fair value and P/E ratio. However, we see a decline in earnings over the past year and a relatively low dividend compared to other healthcare companies. Additionally, total liabilities exceed total assets, increasing the risk of financial distress.

Despite these challenges, McKesson stands out with its oncology division, which leverages extensive data to glean valuable insights. This unique position gives McKesson a leading role in healthcare innovation, positioning it as one of the companies with technology poised to explode in 2024.

- McKesson’s target price

- Source: TipRanks

In conclusion, the most disruptive tech stocks of 2024, according to UBS, represent an interesting investment opportunity for those looking for long-term growth in key sectors of technological innovation.

|DISCLAIMER

The information and considerations in this article should not be used as the sole or primary basis for making investment decisions. The reader retains full freedom in his own investment choices and full responsibility in making them, since he alone knows his risk propensity and his time horizon. The information contained in the article is provided for informational purposes only and its disclosure does not constitute and should not be considered an offer or solicitation to the public for savings.|

Original article published on Money.it Italy 2024-03-26 17:59:26. Original title: Le 5 azioni tech più rivoluzionarie del 2024 secondo UBS