Here’s how to invest in your favorite team: if the club is listed on the stock exchange, match results have a significant impact on the share price.

In the world of football, finance has long taken its place alongside the passion and emotion that fuels this global sport.

What might seem like an emotional decision, driven by the desire to own part of your favorite team, in reality often turns out to be a concrete and lucrative investment opportunity.

While many of the most prestigious teams are privately owned, such as Real Madrid, Barcelona and Bayern Munich, some have chosen to open up to the public and offer their shares on the stock market. This phenomenon has created a unique synergy between passion for sports and financial potential, opening the way to a wide range of opportunities for investors.

Let’s now look in detail at the best 6 stocks to start investing in football with a detailed overview of their financial performance and future prospects.

1) Manchester United

- Manchester United stock price (NYSE)

- Source: Tradingview

Manchester United (NYSE, MANU) is one of the most famous and profitable clubs in the world, with a market capitalization of $3.2 billion. The club, which generates significant revenue from sources such as sponsorships, merchandising, and television rights, recovered from the collapse caused by the COVID-19 pandemic in 2020. However, 2023 also ended with a loss of 11.2 million pounds, despite revenue in 2023 reaching a considerable £648.4 million.

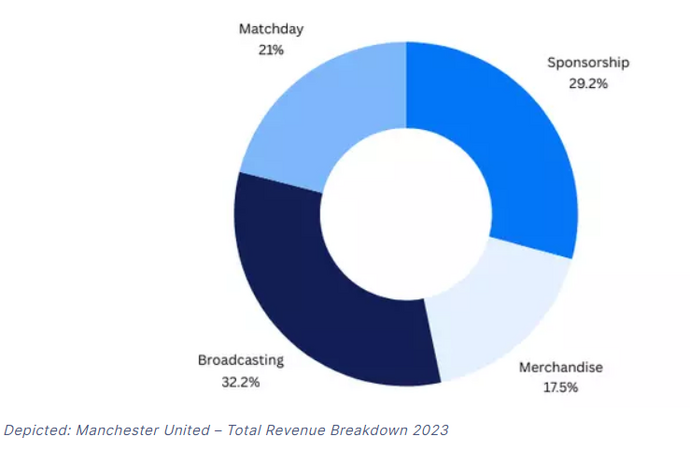

Manchester United’s revenue comes from three main sources: commercial, broadcast, and match day. The commercial component includes revenue from merchandising sales and sponsorship agreements, while broadcasting includes revenue from television contracts. Finally, revenue generated on match days, including season ticket sales, is another significant source of income.

The chart below clearly illustrates the percentage breakdown of these revenue sources compared to the total generated in 2023, highlighting the strategic importance of each in the club’s overall financial context.

- Manchester United revenue breakdown

- Source: Manchester United

2) Juventus Football Club SpA

- Juventus weekly graph

- Source: Tradingview

Juventus (BIT, JUVE) is one of the most successful teams in Italy, but has faced financial obstacles in recent years. Despite their successes on the pitch, the club has struggled on the financial front but expects to unlock new sources of revenue by boosting sponsorships and generating more revenue from match broadcasts.

As with other listed clubs, Juve’s stock market performance was heavily affected by the effects of the Covid-19 pandemic. At the beginning of 2020, Juventus shares were valued at over 10 euros, but the spread of the virus caused prices to collapse. Despite some attempts at recovery, the value of the shares has steadily declined, currently trading at less than €2.50 per share, resulting in a market capitalization of just $621 million.

Juventus’ financial results in recent years have not lived up to expectations. Juventus announced the financial results for the 1st half of the 2023/2024 financial year, highlighting a drop in revenues to 190.63 million euros, a decrease of 31% compared to the previous year. The operating result was negative for 82.66 million euros, with a net loss of 95.13 million euros. Net debt fell to €326.8 million by the end of 2023, while equity increased to €74 million. Despite an expected loss for the entire financial year, a decrease in debt is expected thanks to the completion of the capital increase operation.

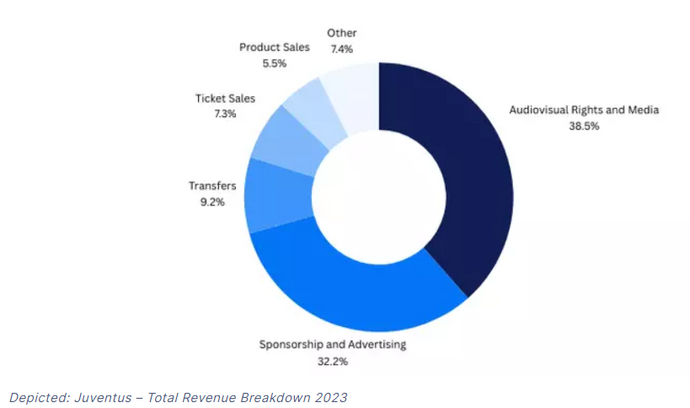

Juventus generates revenue from various sources, including audiovisual rights, sponsorships, player transfers, ticket sales, and merchandising. The chart below shows the percentage breakdown of these revenue sources for the year ending 30 June 2022, highlighting the club’s revenue diversification and reliance on multiple revenue sources.

- Juventus revenue breakdown

- Source: Juventus

3) Borussia Dortmund

Borussia Dortmund (Xetra, BVB) is known for developing young talent and has a solid financial base despite recent difficulties. The club reported profits in 2023 and continues to generate revenue from match operations, advertising, and merchandising.

The latest financial results published in November highlighted a performance improvement: consolidated profit before tax (EBT) was 58.9 million euros, up 15.1 million euros compared to the previous year, mainly thanks to an increase in net transfer income of €20.3 million.

The quarter closed with a consolidated net profit of 52.4 million euros, exceeding the 38.5 million euros of the previous year. Furthermore, consolidated profit before tax (EBT) rose to 58.9 million euros, compared to 43.8 million euros in the previous year, while consolidated earnings before interest, taxes, depreciation, and amortization (EBITDA) was 79.4 million euros, compared to 73.3 million euros in the corresponding period.

Although consolidated revenues decreased slightly to 102.3 million euros, compared to 104.3 million euros the previous year, Borussia Dortmund recorded significant revenues from various sources, including gaming operations, TV marketing, advertising, merchandising, and other activities. Net transfer income was a key driver, totaling €82.3 million, up from €62.0 million the previous year.

4) AFC Ajax

AFC Ajax (Euronext, AJAX) is one of the most prestigious European clubs capable of nurturing world-class talent. Despite its exit from the Champions League, it boasts important revenues from the sponsorship and television rights sectors. The financial results for the fiscal year ended June 30, 2023, reflect this continued growth, with revenues increasing to €196.3 million compared to €189.2 million in the previous year. Furthermore, the club recorded a significant net profit of €39 million, marking a notable improvement compared to the previous year’s net loss of €24.3 million. The approaching earnings date of March 7, 2024, raises interest among investors, with positive expectations for future financial results. AFC Ajax presents itself as a continuously growing sporting reality, with a solid financial base and promising prospects for the future.

5) AS Roma SpA

AS Roma SpA (BIT, ASR) made significant gains from its participation in last year’s Europa League, as reported in UEFA’s annual financial report. Despite the defeat in the final in the 2022/2023 season, the club accumulated a total of €30.7 million, establishing itself as one of the main beneficiaries of the tournament. Only Manchester United achieved more than the Giallorossi team, with €32.7 million, thanks to a market share almost double that of Roma. Despite this, the European experience represented an important financial contribution for AS Roma, demonstrating its value and competitiveness also at an international level.

Tomorrow the Giallorossi will face Feyenoord for the third year in a row in the Europa League play-offs, after a 1-1 draw in the first leg.

6) Olympique Lyonnais

Olympique Lyonnais, a pillar of French football, continues to demonstrate robust financial management and effective business diversification. Its growing popularity offers new perspectives in the sponsorship and broadcast industry.

In Q1 2023/24, the club recorded a 22% increase in total revenue to €123.1 million, an increase of €22.1 million on the previous year. Box office revenues fell by 38%, while revenues from media and marketing rights fell by 73% due to an unfavorable Ligue 1 ranking, which negatively affected revenues. However, event revenues increased by 20% to €6.2 million, thanks to events such as the Rugby World Cup and concerts. Player sales contributed significantly, with revenue of €90.5 million, up 106% compared to the previous year. Late last year, the group announced a preliminary agreement to refinance the majority of its debt, while work on finishing the LDLC Arena is at an advanced stage. On the sporting front, the club is determined to improve its performances and consolidate its position in Ligue 1, to regularly participate in the European Cup.

| DISCLAIMER The information and considerations in this article should not be used as the sole or primary basis for making investment decisions. The reader retains full freedom in his own investment choices and full responsibility in making them, since he alone knows his risk propensity and his time horizon. The information contained in the article is provided for informational purposes only and its disclosure does not constitute and should not be considered an offer or solicitation to the public for savings. |

Original article published on Money.it Italy 2024-02-29 16:11:00. Original title: Finanza e calcio: 6 titoli da valutare per investire nei club più famosi al mondo