The Dax collapses in the morning immediately after the data relating to the GDP which shows that a recessionary climate is starting in Germany

Germany is in recession, this is what emerged from the data released this morning at 8:00 in the morning about Germany’s GDP, the driving economy of Europe. The bad data led the Dax to break yesterday’s lows and make new ones with a very strong bearish acceleration which actually scared most operators, who initially shouted at the market collapse. As we’ll see later in the analysis, it could be a lot of ado about nothing.

Yesterday was also the turn of the minutes of the Fed which in fact did not say anything new, except to further increase the uncertainty about the possible moves of the Fed. As for Europe, the next moves of the Feds are data-driven, i.e. guided by data on inflation, the debt ceiling, and the situation of regional banks in the US.

Uncertain climate on the markets

The situation on the markets is paradoxical, i.e. most of those who denigrated the long-term bears last week find themselves speechless by a simple market retracement, something absolutely physiological considering the strong bullish dynamics seen last week, moreover on the market peaks. A small movement like that of the Dax this morning is enough to put fear again on the market which is currently very focused on the issue relating to the debt ceiling in the US, an issue that has not found any resolution at least for the moment.

Meanwhile, in the morning, the wave of sales was triggered by the data on German GDP which came out below expectations which saw a drop of only -0.1% and which in fact later shown to be a -0.5%. As for the "recession" situation in Germany, it has been talked about for a long time, especially since the Dax broke its all-time highs and many analysts have wondered how such an event was possible with a lot of negative economic data.

On a technical level, the situation is special and the Dax, just in the morning, saw a sharp rise after a fall that we could define as a flash crash but which in reality proved to be a simple market squeeze. So let’s see together the short-term dynamics of the Dax and its possible closure on a weekly basis with an analysis of the most important levels in the short term.

Dax, short technical situation

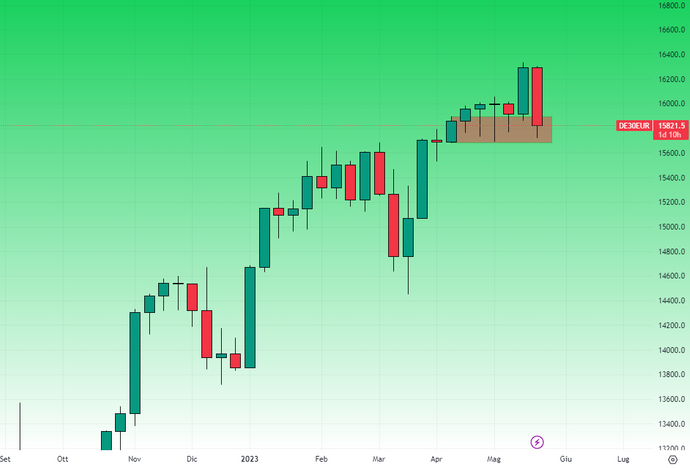

Let’s look at what happened on the Dax on a weekly basis over the past few weeks. As we can see from the red area highlighted in the graph, the Dax is testing the lows of the past 6 weeks, a very important test that is unlikely to fail at least in the short term.

- DAX weekly graph

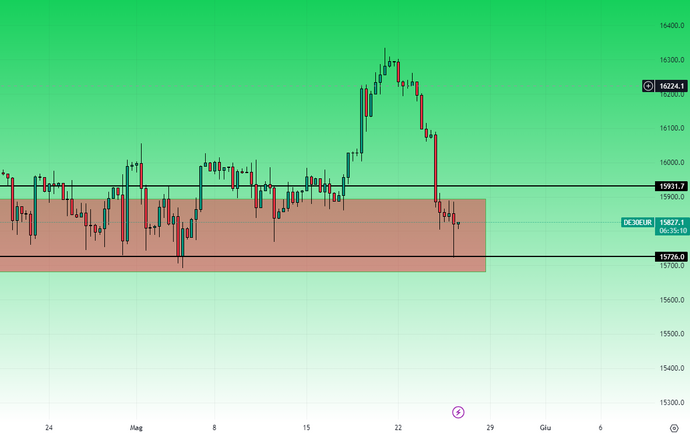

Looking at the 7-hour chart, therefore analyzing the trend of the Dax even more specifically, a strong bullish shadow has formed which could lead to an increase during today and tomorrow, however going to close a tendentially bearish weekly trend. At the moment the Dax seems to aim for 15900-15950, given the strong reaction in the 15700 area confirming the test of the lows on a weekly basis.

- DAX 7-hour graph

DISCLAIMER: The information contained in all the articles on this site is for EDUCATIONAL and INFORMATIONAL purposes only. Users who will use this information to invest their resources have full responsibility for their work and results. Trading activity is highly risky, therefore operating with information taken without risk calculation and money management can seriously risk the integrity of the invested capital.

Original article published on Money.it Italy 2023-05-25 13:31:37. Original title: Trading Dax: Analisi e Livelli Operativi su Recessione Germania – 25 Maggio 2023