The latest investment trend is certainly the bond market, a very important market for those who trade and invest.

In recent months we have seen strong "publicity" for the bond market, both in terms of government bonds and corporate bonds, i.e. those bonds issued by companies listed on the financial markets.

Most investors evaluate a bond solely and exclusively on the basis of the returns offered over time, the first true evaluation parameter of a bond and its risk, but not many know that to evaluate the risks it is necessary to know the surrounding macroeconomic situation and above all what is defined as the yield curve, i.e. a curve which essentially tells us the various yields offered by the issuer on the various maturities.

In this last period, the frightening inflation has led many investors to resort to investment instruments aimed at protecting themselves from this financial "Monster". Beyond the macroeconomic context, beyond the yields offered, what does the yield curve of a specific issuer tell us, such as a state, for example? Let’s see it together in this article

Government bonds and macro situation

The macroeconomic situation is a fundamental component in selecting government bonds. To make a brief recap on government bonds, we can say that they are securities that allow the issuer (State) to collect money from investors and in exchange reward the latter by means of coupons with repayment of the capital at the end of the "loan".

For example, a government bond with a maturity of one year causes the investor to receive a coupon and the repayment of the capital after one year. A government bond with a ten-year maturity allows the investor to receive coupons for 10 years and at maturity the return of the capital, usually returned together with the detachment of the last coupon.

As we can see there are different maturities, a fundamental element for establishing the risk and return of the investment, these returns on the various maturities are perfectly expressed in the yield curve. The yield curve actually tells us, at each maturity, the yield offered by the issuer and its trend varies according to the issuer risk and according to the macroeconomic context.

In the current macroeconomic environment, where we find ourselves with high inflation and rising interest rates, bond issuers are theoretically inclined to raise the rate of return of their bonds as liquidity, the underlying of which is the interest rate, has a great value in the market. Remember that a high interest rate corresponds to a high value on the market, as if liquidity had a price, it is no coincidence that when we talk about interest rates we are also talking about "cost of money”.

Another important element is the inflation rate which impoverishes investment returns in the long run. To compensate for high inflation, we must have securities in our portfolio that have yields equal to or higher than the inflation rate, therefore returns offered on the market that fail to compensate for the inflation rate will be less attractive and the market will not he will be inclined to buy what actually does not yield at least as much as the inflation rate.

In practice, issuers that are in a high-inflation macro environment will have to increase the rates of return offered if they want to raise financial resources, therefore it is assumed that an acceptable rate of return in the long run is equal to or equal to the target rate rate set by the central bank, in the case of securities issued in Europe we are talking about a rate equal to or greater than 2%. Given these premises, we can say that the macro environment we are in is an environment in which we have the coexistence of these factors, namely high inflation and rising interest rates. So what happens to the bond market? Now let’s look at the yield curve

The yield curve

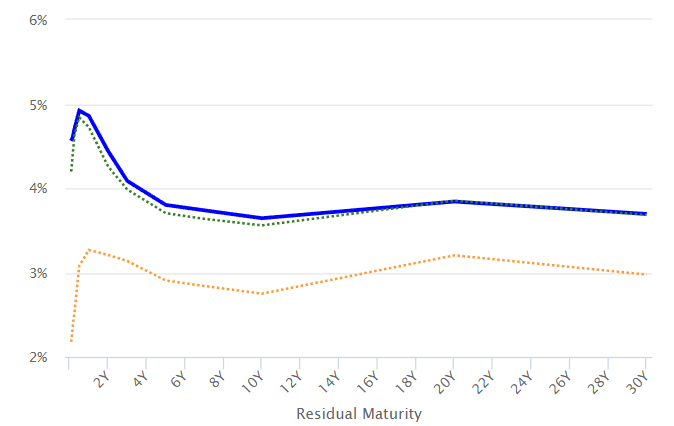

The yield curve, as mentioned above, expresses the yields offered by a particular issuer on various maturities. The result is therefore a real curve that expresses the risk premium at each maturity. Under normal conditions, i.e. in conditions in which we have a healthy macroeconomic situation where interest rates are aligned with inflation and where no adjustments due to economic shocks are foreseen, the government yield curve usually has a positive slope, with yields which tend to rise as maturities increase.

For example, in a healthy yield curve, the interest rate on 30-year bonds is higher than that on 10-year bonds, just as the yield on the latter bonds will be higher than the yield on bonds shorter deadline and so on. The tendency of this curve is defined as “upward sloping” i.e. an upward trend in yields.

However, what happens in the current situation? In the current situation we instead have inverted curves and in some cases curves that tend to flatten. The inverted curves, i.e. curves that present higher yields in short maturities than in long maturities, are telling us that the issuer has a strong need for liquidity in the short term and therefore is inclined to pay this liquidity immediately and well, precisely to avoid problems in the long run.

Just think that this is the case of US bonds which have an "Inverted" curve which, in addition to heralding a period of recession, tells us that the State needs immediate money. A delicate situation also for European stocks, such as for example Italian ones that have a "flattening" curve i.e. that is flattening out over the long term. Here too, the need demonstrated by the Italian state is similar to that of the United States.

What does all this mean? Most likely the risk expressed by the bond market as a whole is relatively high considering the fact that under normal conditions we find an opposite condition of the yield curve and therefore, to invest in this market, it is necessary to make even more specific technical assessments, well far from the classic "I buy because it pays". Basically, let’s pay attention to the bond market because the pitfalls it is presenting at the moment are the result of years of bond purchases by central banks, tensions that are not resolved in a short time if not with an adjustment by the market itself and that is a very time consuming job.

- US yeald curve

- Note the inverted yeald curve in the US bond market.

Original article published on Money.it Italy 2023-02-09 08:57:00. Original title: Trading e investimenti: obbligazioni e importanza della curva dei rendimenti