Buy safe-haven assets such as gold, even ignoring entry prices as it is a strategic asset.

Last week was particularly important for the markets and for the macroeconomic data, especially on inflation but also for the start of the earnings season, with the opening of the ball by JP Morgan, which tore up the consensus as profits and turnover, also thanks to the acquisition of First Republic. Now, that there will be a recession is beyond any discussion, for the simple fact that it is one of the four economic cycles, and there is no escape.

In the future, it’s relevant regardless of whether a hard or a soft recession occurs, because the consequences will be quite different, but there is no doubt that there will be a recession.

But the essence of the problem is not "if", but "when".

Have we forgotten that expert forecasts in January 2023 were all in favor of bonds, which should have been overweighted compared to equity.

Things then went exactly the opposite, and the rise in bond yields, which continued until the middle of last week, represented a veritable drag on portfolios, giving the feeling that the rise in equity indices hadn’t moved to our Wallets too.

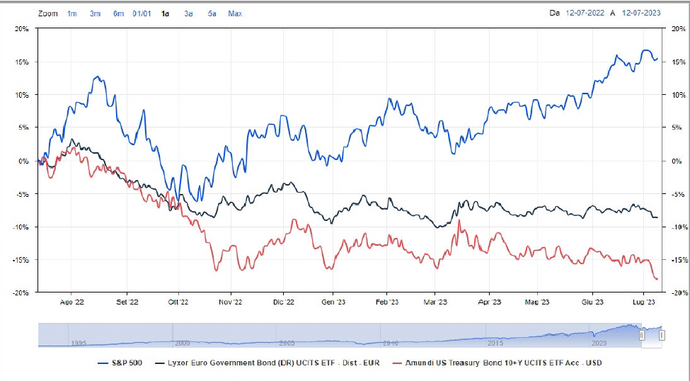

But look at this graph: the blue line is the S&P500, the red represents the 10-year US government bonds and the black represents the euro area government bonds.

Now it is clear why markets don’t rally in the same proportion.

But now it’s interesting to ask another question and, since it doesn’t seem to me that anyone around takes the responsibility of clearly providing his vision, let’s try to make an exception to prudence:

If the bond component is a ballast, what should we do? Take notice and sell? Increase equity exposure accordingly? Looking for different diversification?

Let’s go in order.

The graph dates back to last Monday. In the last four sessions - too few to draw any conclusions - not only has there been a significant drop in bond yields and therefore a recovery in prices, but an upward trend reversal especially on the short parts, and consequently the curves, slowly, are reversing.

Was the bond a "ballast" in 2023? Sure, we’ve seen it in the charts. And it didn’t protect us in 2022 when, with a correlation that has never manifested itself in the entire last century, this Asset lost as much as Equity, blowing up the diversification benefit.

Was it predictable? No, it was not.

Is there anything we can do today? Yes, but only if we abandon the assumption that we can choose the timing and that we are able to predict the markets.

What to do? Remain more anchored to data and less to our sensations? It seems the only wise choice.

Inflation, for example:

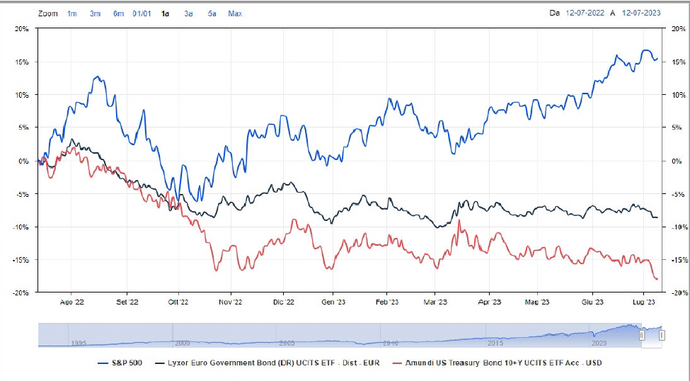

US inflation in June went from 5.3 to 4.8% with all 4 valuation areas in decline, including the services sector. The cost of energy contributes greatly, dropping for the fourth consecutive month. Now, it is likely that the FED will raise rates again on July 26th by 25 bp. However, look at the previous graph and consider what is happening with Equity and the first attempt by bonds to recover positions: for how long will the red line be so divergent from the blue and green lines?

Wall Street hits new highs after 2022 drop, with the S&P500 at 4500 points. Bond yields have been falling for three sessions, but inflation is clearly falling, and it seems that at least in the USA there will not be a recession.

So what should we do?

- The managers, who at the beginning of the year gave Bonds as the best asset, now say they are reducing their equity exposure;

- It’s not because they were wrong once, but I don’t think so at all, and if our Risk Budget allows for it, why not increase our equity exposure? Generally, 5% or 10% is sufficient;

- Increase diversification within the stock market, remaining on a global approach but inserting small and mid-caps and Value shares, which provide a good diversification compared to the always too prevalent "growth";

- Maintain the Bond components, bearing in mind that it is not necessary to take risks to obtain returns, which means preferring Investment Grades, therefore high ratings and durations that can start to be extended up to 5-7 years;

- Maintain safe-haven assets such as gold, but here really with an approach that ignores entry prices as it is a strategic asset, and the percentage to be had is around 5% depending on the portfolio and 10%;

- Exit or decrease the other Commodities, they have been showing weakness for many months and do not seem to be able to have a great push;

- Consider instead the sector of some raw materials - for example Germanium and Gallium - and everything related to the production of microchips and the development of machine learning.

Original article published on Money.it Italy 2023-07-17 07:23:09. Original title: Mercati, come gestire il portafoglio in caso di recessione?

Argomenti