Meaning and complete guide to hedge funds: what they are, how to invest in them, and other useful information.

Hedge funds: what are they? Why and how to invest through these famous financial instruments?

Wanting to offer a first and concise definition of hedge funds, these are speculative investment funds. They aim to yield a higher return than that of the reference index, a sort of surplus called Alpha.

To generate this extra, however, hedge funds, or speculative funds, use various strategies, such as the use of derivatives and financial leverage on the national and international market or the opening of short or long positions. The target is one: to have a higher return.

It should be noted that hedge funds are generally only accessible to accredited investors as they require fewer SEC restrictions than other funds.

With this premise, below are all the details on hedge funds, how they work, and why they are increasingly used.

Hedge funds: what are they? Definition and meaning

Every hedge fund is created to take advantage of well-identified opportunities in the market. These investment funds use different strategies and are often classified based on their style and risk.

At a legal level, hedge funds are identified as private investment partnerships, open only to a limited number of accredited traders who require a rather high minimum initial investment.

Investment in these funds is not difficult to liquidate as investors are often required to keep their money in the same fund for at least a year (the so-called lock-up period).

Withdrawals can however be made at defined time intervals (quarterly or semi-annually). What hedge funds or investment funds are and what their definition is is finally starting to become clearer.

Difference between hedge funds and normal investment funds

One of the peculiarities of hedge funds is their risk, as well as the type of return to which they refer.

The majority of mutual funds, SICAVs, and speculative funds have the objective of “replicating” the reference market index, depending on the type of investment made. If, for example, a mutual fund invests in shares, the aim will be to generate a return equal to that generated by the reference stock index.

Unlike common ones, hedge funds do not want to replicate the return, but generate a higher one than that of the reference index.

This means that the return in question is not in any way correlated with the index, but still aims to be higher than that obtainable in other funds that simply replicate that index.

As already mentioned, the difference lies in the fact that the hedge fund manager aims to generate an extra return compared to the reference index, plus what in jargon is called Alpha.

Furthermore, hedge funds do not have the same security that ETFs can have, which are recommended by many for their simplicity of management.

Types of hedge funds

There are different types of hedge funds, defined according to the investment strategies adopted:

- Macro Fund: a fund that speculates on the trend of interest rates, currencies, or stock markets;

- Arbitrage Fund: a fund that carries out arbitrage operations by buying, for example, security traded on market X and reselling it on market Y, thus speculating on different price values. It is the type of hedge fund considered least risky;

- Equity Hedge Funds: funds that buy and sell shares short on regulated markets depending on whether the stock is expected to rise or fall.

How to access hedge funds?

As already mentioned previously, accessing hedge funds is an operation limited to a small number of accredited investors, i.e. individuals who possess broad knowledge of the subject.

Having access to a hedge fund involves a fairly large initial minimum investment, which means that in addition to being accredited, investors must have large sums to work with.

It’s important to note that the money is tied up in the hedge fund, generally, for at least a year.

How do you obtain Alpha or extra costly return?

If the hedge fund’s objective is to obtain a higher return, one wonders how it is possible to access this Alpha. Its cost is very often quite high, as is already included in the commissions that the fund manager charges members.

To generate Alpha it is necessary to take several steps including obtaining economic-financial data of companies, analyzing them, participating in conferences, and carrying out inspections.

Alfa also has a production cost, the so-called TER (Total Expense Ratio), generally corresponding to 2-3% of the total amount invested within the fund. This cost has often been pointed out as exaggerated given that the initial purpose of the investment fund is savings.

Hedge funds: when is Alpha generated?

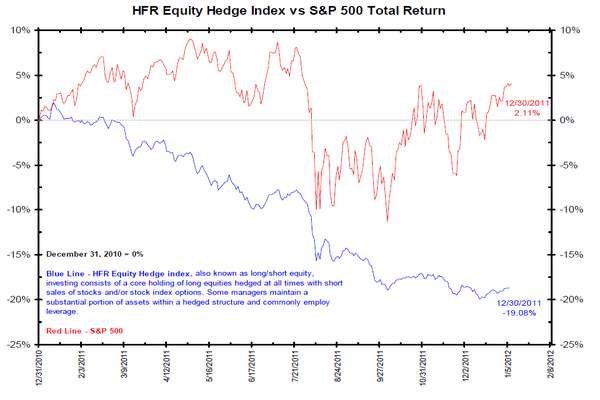

The graph (processed by Hedge Funds Research) referring to a few years ago allows us to observe how the performance of the Equity Hedge funds did not reflect the set objectives, in short, it did not generate the Alpha return.

In blue, we find the performance of Equity Hedges, while in red the performance of the S&P 500 index, i.e. the US stock market. The failure of the fund, in this case, is clear: Equity Hedges invest mainly in shares for which they should not only be completely uncorrelated with the reference index but also generate a higher return than its own.

As can be seen from the graph, however, these hedge funds recorded significantly worse performances than the market ones, therefore generating a Negative Alpha.

Be careful, therefore, when using liquidity in hedge funds. Much safer could be ETFs, which by definition replicates the reference indices and guarantees transparency and access to the information specific to the shares.

Original article published on Money.it Italy 2022-03-07 15:35:00. Original title: Che cosa sono gli hedge fund e come investirci?