With the stock market above 5,100 points, many investors are wondering whether there is still room for further gains. These 5 stocks could grow more than the index.

There are 5 stocks to beat the S&P 500 by 60%, according to Goldman Sachs. As the benchmark index approaches 5,100 points, the market is pervaded by a climate of confidence, fueled by slowing inflation and the prospects of interventions on interest rates by the end year. The bank’s strategists, who raised their earnings estimates, attribute this increase to economic growth and expected profits in the information technology and communications services sectors.

However, despite the focus on the “Magnificent 7,” Goldman Sachs does not overlook the potential of other, lesser-known stocks. Analysts at the investment bank see rally potential of up to at least 60% for some lesser-known stocks, offering investors an intriguing opportunity for profitability.

1) Visa

- Visa weekly graph

- Source: Tradingview

Visa, the electronic payments giant, is one of the 5 stocks selected by Goldman Sachs capable of outperforming the S&P 500 by 60%.

Since its stock market debut in 2008, Visa has demonstrated an extraordinary ability to generate returns above the market average, with an annual growth rate of 21.5%. This makes Visa an attractive option for investors looking for reliable, long-term dividends.

Not only has Visa demonstrated robust performance over the years, but it also recently reached its all-time high, reflecting its dominant position in the industry.

The company enjoys an established leadership position, which has allowed it to build a global network of merchants and customers, with over sixty years of experience in the payments industry. However, this same position of dominance has brought Visa into the spotlight of regulators, who are calling for more competition in the industry. Despite these pressures, Visa continues to thrive, showing exceptional resilience even in times of rising inflation and interest rates.

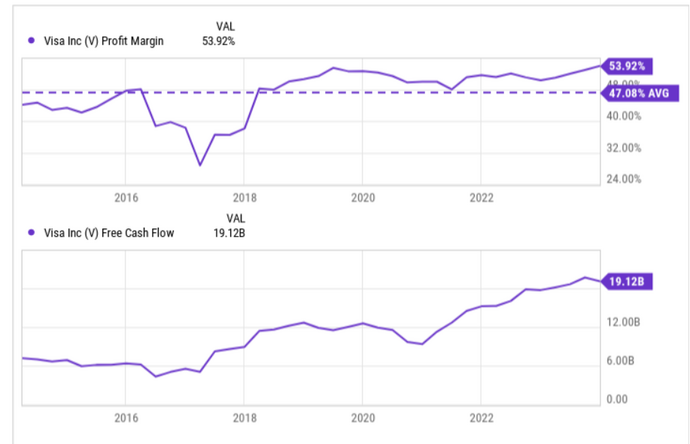

Its global network is one of its key competitive advantages, allowing it to process a total transaction volume of $14.1 trillion in 2022, well above its closest competitors. With commissions earned on every transaction processed, Visa is a true cash-generating machine, with a net revenue of $32.7 billion in 2023. The company is well-positioned to continue growing.

- Visa profit margin and free cash flow

- Source: The Motley Fool

While the stock is currently near its all-time high, its valuation remains reasonable, with a P/E ratio of 32.5x, slightly lower than the 10-year average of 33.8. Ultimately, Visa offers investors a compelling mix of stability, growth, and long-term profitability potential.

2) Mastercard

- Mastercard weekly graph

- Source: Teletrader

Mastercard, according to Goldman Sachs, is an opportunity not to be underestimated, in light of the significant performances in recent years.

Currently trading at 474 dollars, the stock is just above the fair value estimated by analysts, equal to 471, with an increase of 12% since the beginning of the year. Momentum indicators highlight a growing growth trend in the financial market.

In addition to price performance, it is important to observe the steady growth of earnings per share over time. Over the past five years, Mastercard has delivered compound earnings per share (EPS) growth of 16% per year, in line with the 16% average annual increase in its share price. This suggests a consistency between market sentiment and long-term company growth. Additionally, total shareholder return, which also includes dividends, has grown 116% over the past 5 years and 27% over the past year.

The analysis of free cash flow also offers a further interesting insight. Mastercard’s intrinsic value, calculated using the earnings-based DCF method, stands at $307.01, significantly lower than current levels. This suggests an excessive valuation of the stock.

- Mastercard EPS growth

- Source: Yahoo Finance

3) KKR

- KKR weekly graph

- Source: Tradingview

Also present in Goldman Sachs’ selection are KKR & Co, a private equity firm based in New York. With significant growth expected in the credit capital markets, KKR represents an attractive investment opportunity in the alternative asset sector.

Over the past 52 weeks, KKR shares have seen a notable increase of 71.74% in their value, with a monthly return of 8.74%.

In fourth quarter, KKR shares received a boost from the Federal Reserve’s accommodative policy, but that’s not the only thing at play. The company also experienced fundamental acceleration and made positive changes to its employee compensation structure and reporting framework. This new compensation structure provides for a greater distribution of commission-related profits to shareholders while reducing their share of the realized performance income. The new reporting framework will highlight the recurring portion of the company’s realized investment income, which could reduce the discount at which shares currently trade over time.

Analysts have expressed a positive view on KKR, with an average 12-month price target of $82.60. Goldman Sachs raised its price target from $79 to $87 and gave the stock a "buy" rating, while Wells Fargo raised its target from $93 to $103, giving the company an overweight rating.

4) Workday

- Workday weekly graph

- Source: Tradingview

Another stock to beat the S&P 500 according to Goldman Sachs is Workday, a leader in enterprise cloud applications for finance and human resources.

The company reported solid fourth-quarter results, with a significant 18% growth in subscription revenue and a non-GAAP operating margin of 24%. The recent leadership change laid the foundation for strategic initiatives aimed at guiding Workday to sustained growth for fiscal 2025 and beyond.

A commitment to innovation and customer success, supported by investments and partnerships to enhance AI capabilities, lays a solid foundation for expanding the existing customer base.

For the next fiscal year, Workday expects subscription revenue growth of between 17% and 18%, with non-GAAP operating margin expected at 24.5% for the first quarter. Workday also projects an operating cash flow of $2.25 billion and capital expenditures estimated at $330 million for fiscal 2025.

Despite challenges, such as slowing subscription revenue growth in prior quarters, Workday remains optimistic about the future. Strong order book growth of 20%, a positive outlook for margin expansion, and cash flow growth, coupled with strategic investments in finance, partnerships, international expansion, and AI innovation, are sources of trust for the company.

5) Danaher

- Danaher weekly graph

- Source: Tradingview

Rounding out Goldman Sachs’ list is Danaher, a leader in life sciences and diagnostics with a solid financial foundation and an ongoing commitment to innovation.

A complex picture emerges from Danaher’s recent quarterly results, characterized by a decline in profits and net sales on an annual basis, despite some positive data. Adjusted earnings for the fourth quarter of 2023, excluding non-recurring items, decreased 17.7% compared to the prior year. Net sales beat estimates, but fell 10.2% year-over-year, primarily due to lower sales of COVID-related products and weakness in the Biotechnology and Diagnostics segments.

Margins also came under pressure, with a reduction in gross and operating margins.

However, the industrial and medical device maker continues to demonstrate key strengths, such as industry resilience and an ongoing commitment to innovation, which could position the company on a long-term sustainable growth trend.

|DISCLAIMER

The information and considerations in this article should not be used as the sole or primary basis for making investment decisions. The reader retains full freedom in his own investment choices and full responsibility in making them, since he alone knows his risk propensity and his time horizon. The information contained in the article is provided for informational purposes only and its disclosure does not constitute and should not be considered an offer or solicitation to the public for savings.|

Original article published on Money.it Italy 2024-03-03 08:02:00. Original title: 5 azioni per battere l’S&P 500 del 60% (secondo Goldman Sachs)