After breaking the $60,000 level, Bitcoin reached a maximum of over $64,000, and retraced and found support at $60,000. What’s next, and what was the U.S. government doing by moving around almost $1 billion in BTC?

Bitcoin’s march upward took it past the $60,000 mark without a dip on February 28. The crypto breached $64,000 before a flash crash dropped the price down to $59,900 for a short period on CoinDesk. The short drop seems to have given market players pause, as the price has held at the $61-63,000 mark for the last 24 hours, at the time of writing. Given that our ‘escalator or roller coaster to $60k?’ article now has its answer, let’s take a look at where Bitcoin is going, including a whale of a mysterious movement.

Before the halving

The interest generated by the impending halving is helping drive demand, as is institutional interest due to the rise of ETFs. Trading volumes for ETFs continue to set records. Analysts do see a new all-time high as possible before the halving as well.

After the halving

investor reactions to the halving event are relatively well known. What happens after a halving is now pretty well understood. Halvings are generally followed by a drop then a gain above the initial price, though the gains have dropped compared to the first.

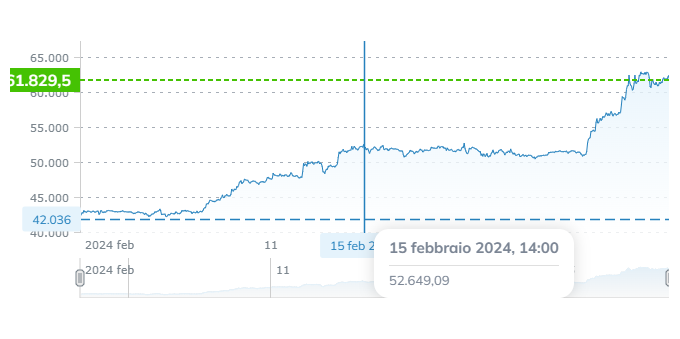

One effect will be the increased scarcity of Bitcoin. The amount of Bitcoin produced at one time will be cut in half. Given the introduction of Exchange Traded Funds on the crypto market, and the resultant surge in demand well beyond what miners can produce on a day, analysts see an adjustment down to as low as $42000, then moves upwards. Less efficient miners will also be forced out of the market due to increased costs.

What about the U.S. Government?

The American government is often in the news regarding macroeconomic or regulatory issues. However, as BTC was crossing the $60,000 mark, something else, which did not move the price dynamic, came out. It’s odd.

On February 28, the government moved almost $1 billion between wallets. According to Arkham Intelligence, four movements were made, two with nominal amounts, followed by two with 2,818 and 12,267 BTC respectively. All told, at current prices, this would equal approximately $980 million in BTC.

The destination wallets were previously unknown. However, the wallets where the crypto came from were known to be holding Bitcoin connected to the Bitfinex heist. On the day before the transfers, the perpetrator of the crime, Ilya Lichtenstein, testified as a government witness against the crypto mixer involved.

The moved Bitcoin is not the full extent of the amount recovered from Lichtenstein’s thefts. Moreover, it is not even a large part of the U.S. government’s Bitcoin holding. The government currently has over 194,000 Bitcoin, according to data published by Decrypt. The movement between wallets, then, seems to have nothing to do with the price movement.