California gas prices have reached a new high, but the entire United States faces a similar problem.

California, the richest and most populous state in the US, is experiencing the biggest surge in gas prices in the entire nation. Governor Gavin Newsom addressed the issue, saying that he is taking measures to ease prices in the state.

California, home to 39 million people, fuels its immense economy (the fifth largest in the world if it were an independent nation) with oil coming from outside the state. California imports 75% of its oil consumption.

California gas prices now surged to $6.03 per gallon, a 24-cent increase since last Thursday. “If prices do remain at these levels,” Gov. Newsom stated in a letter, “it may cause unacceptable cost impacts for consumers and small businesses, significant economic disruption, and serious harm to public safety and welfare.”

Indeed California residents are struggling to make ends meet, amidst an ongoing housing market crisis and high inflation.

California oil refiners are required to make two types of gasoline blend, one before the summer and one before the winter. According to Newsom, refiners already started manufacturing the winter blend, which is scheduled to be released at the end of the month.

Newsom will try to make refiners release the winter blend immediately, without waiting the entire month. With this move, he expects gas prices to fall by 50 cents before November.

Why are oil prices so high

Although California has the most expensive gas prices in the United States, they are rising pretty much everywhere.

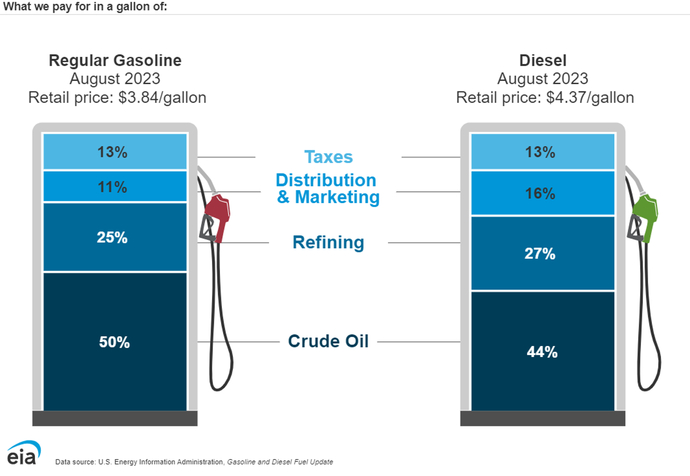

As a matter of fact, crude prices are the biggest driver in determining the final gasoline prices, and they are rising very fast.

West Texas Intermediate, the benchmark for US crude oil, spiked last week at $95 per gallon, an 11% increase compared to the end of August. Many experts predict prices will rise to $100 per gallon, with some forecasting a jump to $150.

Crude prices are usually determined by the Organization of Petroleum Exporting Countries (OPEC), an organization de facto led by Saudi Arabia, the world’s largest crude exporter. Although the United States is the largest oil producer, it exports only a tiny share abroad.

OPEC, in cahoots with Russia, slashed oil production in order to artificially increase global prices. This strategy serves the interests of the Kremlin, whose illegal invasion of Ukraine is largely financed by Russia’s oil exports.

In an effort to control nationwide crude prices, the US government deployed the strategic oil reserve and increased imports from Canada. But that, unfortunately, does not appear to be enough.