As Ethereum races towards the $4,000 price point, the foundation for a new altseason could be created. What is driving the value of ETH/USD higher?

In recent days, the price of Ethereum has recorded incredible growth, exceeding investors’ expectations and getting dangerously close to the psychological threshold of $4,000. But what is driving this surge and what can we expect in the coming days?

What pushed the price of ETH up?

Ethereum’s rally found fertile ground in a slight downtrend in Bitcoin. After reaching a high of $64,000, Bitcoin suffered a rapid 14% loss in a single session, a correction that caught the attention of investors across the decentralized landscape. This contraction paved the way for an influx of capital into Ethereum, which initially reacted negatively but then demonstrated surprising resilience.

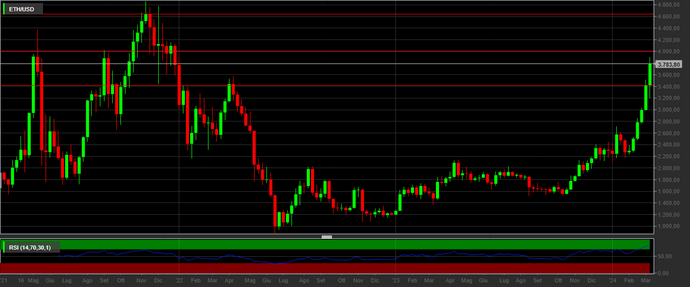

After the correction on March 5, Ethereum rose by 18%, even surpassing previous all-time highs. ETH price is currently hovering around $3,800, having successfully surpassed the critical resistance of $3,400. Investor attention is now focused on the ambitious target of $4,000, which would represent a 20% increase from all-time highs and could pave the way to reaching $5,000.

Oscillators have been indicating for some time that the overbought threshold has been exceeded, so theoretically we are already in a "danger" zone, however, judging from past cycles, reaching this zone hardly meant an imminent contraction.

- ETH/USD, 1W

- Source: Baha.com

What could the ETH surge mean for the altcoin world?

Bitcoin’s temporary collapse had a significant impact on Ethereum trading volumes. This phenomenon is of particular importance to on-chain traders, as Ethereum’s dynamics can often be an indicator of the overall health of the alternative cryptocurrency market.

The reduction in Bitcoin’s dominance, accompanied by a relative increase in that of Ethereum, seems to lay the theoretical foundations for the start of an altseason. This term refers to a market period where alternative cryptocurrencies to Bitcoin outperform the leading cryptocurrency. The reason for this is that many alternative projects choose the Ethereum blockchain to launch their ventures, and investors use ETH to purchase these new cryptocurrencies. As a result, the increase in demand for Ethereum can fuel interest in alternative tokens, generating a virtuous cycle that benefits the entire cryptocurrency sector.

leggi anche

4 cryptocurrencies to beat Bitcoin (by a lot)

So, what to expect from ETH?

Ethereum is at a particular moment, approaching $4,000 and fueling hopes of a new alt season. Its predominant role in on-chain transactions and its resilience during Bitcoin’s recent collapse suggest that a new positive wave may be coming to the alternative token market.

Original article published on Money.it Italy 2024-03-07 13:13:54. Original title: Ethereum, sempre più vicino ai $4.000. Presto nuovi massimi?