The rate hike in May was supposed to be the last one by the Fed. However, the latest economic data revealed a brighter picture than expected.

Despite reassurance of interest rate stabilization coming from the latest Federal Reserve meeting, a change in strategy might be happening in the American central bank. On Monday, markets put the Fed’s chance of raising interest rates again at just 5%. Today, it rose to 35%.

At the beginning of May, the Federal Reserve raised interest rates once again by 0.25%. However, Fed’s chairman Jerome Powell expressed his will to put an end to rate hikes, letting inflation slowly come down to target level (2%).

This strategy was necessary to avoid recession in the US by the end of the year, or at least mitigate its effects. Between April and May, fears of a banking crisis were still very much present, and indeed have yet to go fully away.

Three major banking institutions had collapsed in America in less than 90 days, signaling a larger crisis incoming. Again, to avoid recession but still allow inflation to come down, this had to be the last increase in interest rates.

Luckily, however, the macro-economic data coming out in May lightened pressure on banks a little bit. Specifically, US inflation lowered more than expected and, most recently, the American labor market proved to be rock solid despite rate hikes.

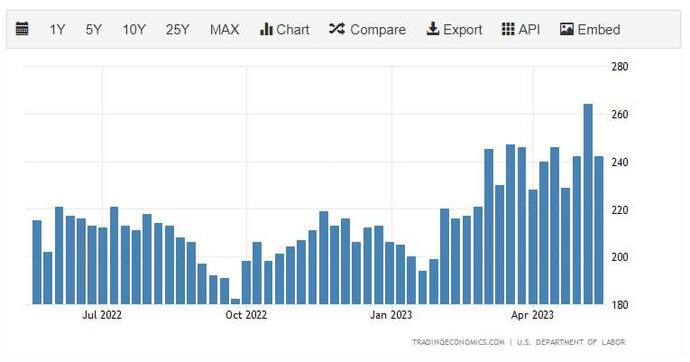

According to the US Department of Labour, requests for unemployment subsidies came down by 22,000 units in May.

The Fed’s new strategy

All of this gave the Fed a reason to rethink interest rate strategy. This week, Dallas Federal Reserve president Lorie K. Logan said there was no reason for Jerome Powell to stop rate hikes.

In her opinion, as well as other economic analysts, another raise in interest rates should be due in June. With that, inflation should come down faster and, if the economy remains overall stable like it appears to be, recession will be avoided anyway.

Other investors are even betting on two/three rate cuts by the end of the year. The most optimistic rumors have the last rate hike in June and the first rate cut immediately thereafter in July. This scenario is, however, extremely unlikely.

What’s certain is that markets feel good about the situation. The Fed has more options than previously thought and the future looks bright. For now.

The same cannot be said for Europe, however, as inflation remains high in the Eurozone as well as in the UK. Both the European Central Bank and the Bank of England signaled they will continue raising interest rates, even if the Fed stops.

This means that a European recession is almost completely unavoidable.