Why buy gold bars and coins? In this guide you will find all the information on investment gold as a safe and profitable opportunity during periods of economic uncertainty.

Gold is an increasingly popular safe-haven asset among investors, especially in times of economic uncertainty.

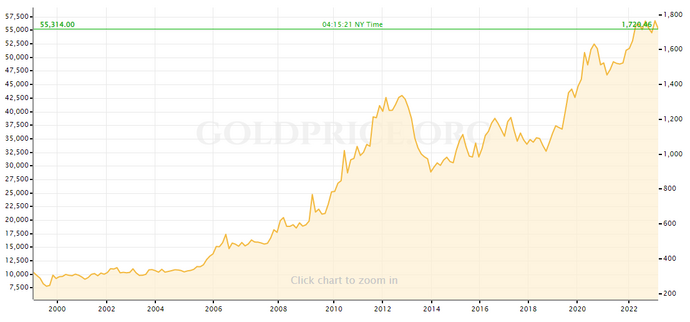

Gold has always been an excellent investment option thanks to its portability, divisibility and indestructibility traits, as well as its ability to preserve value over time. Furthermore, during times of uncertainty and market volatility, gold becomes a highly coveted safe-haven asset, as evidenced by the increase in its value by around 500% over the past 20 years, going from 9 .55 euros per gram in 2000 to 55.30 euros per gram in 2023.

In this article, you will discover what investment gold is and why many people decide to buy gold bars and coins as a form of investment. You will also find valuable advice on how to buy and store investment gold safely.

What is investment gold

Investment gold is a form of investment which consists in the purchase of gold bars or coins with the intention of preserving one’s assets or diversifying the investment portfolio. Investment gold specifically refers to gold that is purchased for investment purposes, as opposed to gold used for industrial or aesthetic purposes. Investment gold can be purchased as gold bars or coins, which are valued according to their purity, weight and current market price.

Gold has been used as a medium of exchange and store of value for millennia. In modern history, gold was used as an official medium of exchange until the gold-based monetary system was abandoned in 1971. Since then, gold has primarily been used as a means of preservation of asset value and as diversification tool of the investment portfolio.

Gold is considered a safe haven, i.e. an asset that maintains its value even in times of financial crisis and economic uncertainty. Gold has a low correlation to other financial assets, such as stocks and bonds, making it an attractive investment option for portfolio diversification. Gold is also a finite and difficult to extract resource, meaning its supply is limited and prices could rise over time. The purity of gold is expressed in carats, and investment gold is usually sold in purity of at least 22 carats.

Why buy gold bars and coins

Buying gold bars and coins can offer numerous advantages over other types of investments.

Advantages of gold over other types of investment

Gold is a safe haven that has been shown to maintain its value over time, even in times of financial crisis. Unlike stocks, which can experience sudden and significant price fluctuations, the price of gold tends to remain relatively stable. Furthermore, gold has a low correlation with other financial assets, such as stocks and bonds, making it an attractive investment option for portfolio diversification.

Inflation Protection

Gold can offer some protection against inflation. When inflation rises, the value of the currency falls and as a result the price of gold can rise. This means that the value of gold can also increase when the value of other financial assets decrease.

Investment portfolio diversification

Buying gold bars and coins can help diversify your investment portfolio, reducing your overall risk. Since gold has a low correlation with other financial assets, its inclusion in the portfolio can reduce the overall volatility of the portfolio.

Investment security

Gold is a physical financial asset, which means that it does not depend on banks or other financial institutions for its existence. This means that gold is not subject to the same counterparty risks as digital financial assets, such as stocks or bonds. Also, when stored safely, physical gold has a very low chance of losing value over time.

In general, buying gold bars and coins can be an attractive investment option for those looking to protect their assets, diversify their portfolio and reduce their overall risk of your investment. However, as with any form of investment, it is important to conduct proper research and understand the risks and rewards before purchasing gold bars and coins.

Types of gold bars and coins available for investment

There are different types of gold bars and coins available for investment, each with its own unique characteristics.

Gold bars are blocks of pure gold that have been melted down and stamped in various sizes and weights. Gold bars come in a wide range of weights, from small bars of one gram to large bars of 1 kilogram or more. Gold bars are produced by various refineries around the world, some of which are famous for their quality and history, such as PAMP Suisse or Valcambi Suisse.

Gold coins are coins produced by different mints around the world. Gold coins come in a variety of denominations and designs, with some of the most popular gold coins being the American Eagle, Canadian Maple Leaf, and South African Krugerrand. Gold coins are often used for investment because they are legal tender in many countries, which means they have legal value and can be used as currency.

There are some major differences between gold bars and gold coins. One major difference is that gold bars are typically sold by the weight of pure gold they contain, whereas the value of gold coins can be influenced by their design, rarity, or history. Additionally, gold coins often have legal tender in many countries, which means they can be used as currency. Gold bars, on the other hand, have no legal value and are mainly used for investment.

In general, both gold bars and gold coins can be an interesting investment option for those looking to invest in gold. The choice between gold bars and gold coins comes down to personal preference and from the investment objective. However, no matter what type of gold you buy, it’s important to buy from reputable suppliers and store your gold safely to protect your investment.

How to buy gold bars and coins

How to purchase investment gold may vary according to the market and the type of product chosen. For example, the purchase of gold bars may require the presentation of identification documents and payment by bank transfer, while the purchase of gold coins can also be made in cash.

For the purchase of investment gold it is important to pay attention to the prices and commissions applied by the sellers, in order to correctly evaluate the actual cost of the investment. Furthermore, it is advisable to purchase only products certified and guaranteed by the LBMA (London Bullion Market Association) or by the World Gold Council, to ensure their quality and liquidity in case of resale.

Some investment gold buying tips include evaluating the price-to-weight ratio of the product, checking the seller’s reputation, and choosing standardized size and weight products to ensure greater liquidity in the market. In any case, it is important to carry out a careful evaluation of the available options and the characteristics of the products in order to make an informed and informed purchase.

Conservation and security of investment gold

The correct storage of investment gold is essential to ensure its integrity and value over time. Gold is a very resistant material to corrosion and tarnishing, but it is still subject to physical damage and chemical alterations if stored incorrectly.

To store investment gold it is important to keep it away from sources of moisture, heat and direct sunlight. Also, you should keep it in a safe and secure place, such as a safe or secure vault. Some investors choose to outsource the conservation of gold to specialized institutions that offer custodial services and insurance against theft or damage.

The safety of investment gold depends on correct storage and the choice of guaranteed and certified products. Also, it is important to keep in mind that investment gold can be prone to scams and fraud, such as selling fake or inferior products. For this reason, it is advisable to buy only from reputable and certified sellers, and always check the quality and authenticity of the product purchased.

Investing in investment gold therefore requires a good knowledge of the market, of the products available and of the preservation and protection methods of the gold purchased.

Is it worth investing in gold?

Investment gold is an investment option that can offer several benefits, such as inflation protection and investment portfolio diversification. However, before deciding to invest in gold, it is important to think deeply about your investment needs and goals.

First, you need to assess whether investment gold suits your your investment strategy and whether it is compatible with your risk profile. Investing in gold can involve risks, such as price volatility, which can affect the value of your investment portfolio. Additionally, investment gold can be less liquid than other types of investments, meaning it may be difficult to convert into cash quickly.

Secondly, you need to consider the economic and political context in which you live. Investment gold can be an attractive option in times of economic and political uncertainty, when financial markets are unstable and currencies can lose value. In these cases, investment gold can offer protection against currency devaluation and inflation.

Finally we must consider the historical value of gold. Gold has been used as a store of value for millennia and has weathered many economic and political crises throughout history. This means that gold can be considered a safe investment in the long term, but it must also be borne in mind that the value of gold can also undergo significant fluctuations in the short term.

Original article published on Money.it Italy 2023-03-08 16:53:26. Original title: Oro da investimento: cos’è e perché comprare lingotti e monete