Bitcoin and the crypto world are experiencing explosive growth, sparking the interest in artificial intelligence (AI). Find out if it’s legitimate to worry about price manipulation.

AI manipulates the price of Bitcoin? With the enormous growth in popularity of cryptocurrencies, the complexity, and the huge amount of data involved, the intervention of AI allows to optimize critical processes such as trading, risk management and market forecasting.

However, it is vital to recognize that using AI in the cryptocurrency market also comes with challenges. Some concerns involve price manipulation of Bitcoin and other cryptocurrencies by influential players who may be using the technology to their advantage. AI’s complexity and sophisticated ability to analyze data require careful reflection on its impact on cryptocurrencies. In addition, it requires adequate regulation to ensure a fair and trustworthy market environment for all actors involved.

Does AI manipulate the price of Bitcoin?

Artificial intelligence (AI) is a powerful technology gaining popularity that has attracted interest in various sectors, including cryptocurrencies such as Bitcoin. However, it is important to clarify that AI does not have the power to directly manipulate the price of Bitcoin or other cryptocurrencies.

The Bitcoin price is determined by a complex combination of factors, including market supply and demand, adoption by large financial institutions, macroeconomic news, regulatory changes, and speculative investor tendencies. AI can be used to analyze huge amounts of financial data and identify patterns and trends, but it cannot manipulate the price on its own. In addition, financial regulators, such as the Italian SEC (Securities and Exchange Commission) or Consob closely monitor the cryptocurrency market to prevent fraud or manipulation, regardless of the technology involved.

This does not mean that AI does not have a significant impact on the cryptocurrency industry. Machine learning algorithms can be used to create automated trading strategies, which allow investors to make more informed decisions and adapt quickly to market changes.

Relationship between cryptocurrency and artificial intelligence

The convergence of cryptocurrencies and artificial intelligence is redefining the digital financial landscape, opening up new opportunities for investors and making the cryptocurrency market more secure, efficient and accessible. The continued evolution of these technologies promises to further revolutionize the cryptocurrency industry and accelerate their adoption across different economic sectors.

AI offers numerous advantages in the cryptocurrency industry, including the efficiency in analyzing data related to transactions, the ability to predict price movements and improve the security of transactions. Thanks to its ability to analyze large amounts of data and learn from past patterns, AI enables investors to make more informed decisions when trading cryptocurrencies.

Some of the key areas where AI is having an impact include:

- Improvement of mining: AI can be used to optimize the efficiency of the cryptocurrency mining process, allowing for greater speed and reducing operating costs, both in financial terms and in terms of technological equipment and hardware.

- Security of the blockchain: AI can detect suspicious activity or fraudulent behavior on the blockchain, increasing the safety and security of transactions through the automation of KYC processes and analysis of cryptographic data.

- Smart Contracts: AI can contribute to the development and management of bug-free and inefficiency-free smart contracts, automating and facilitating the negotiation and execution of agreements without intermediaries. AI can also help generate images and videos, types of content that can then be minted into NFTs.

- Market Prediction Tools: AI can analyze historical data and trends of the cryptocurrency market to provide more accurate predictions of price fluctuations, improving portfolio optimization and minimizing the risk of losing money due to incorrect steps taken to make a profit on each individual trading asset.

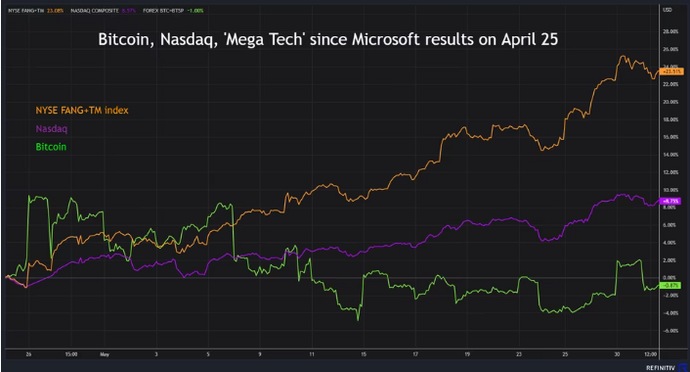

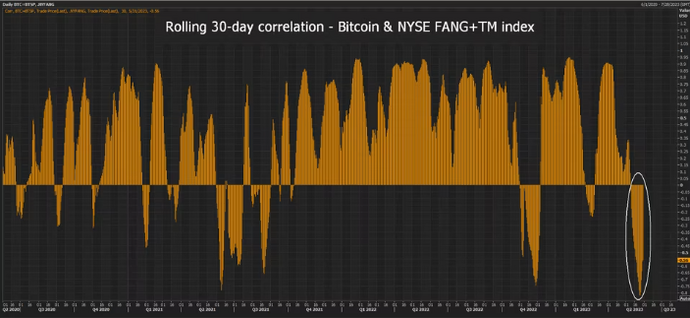

From this interconnection between cryptocurrencies and AI one would expect a strong positive correlation between the price, for example of Bitcoin, and that of technology stocks, in particular those of Big Tech which exploded in the last year.

As seen in the next chart, in June, the 30-day correlation between Bitcoin price and the Nasdaq index fell to its lowest point in six months, while the correlation between Bitcoin and Big Tech’s NYSE FANG+TM index plunged to its lowest level in four years. These data suggest considerable diversification in market dynamics between Bitcoin and major stock indexes.

Limits of the development of artificial intelligence in the cryptocurrency sector

There are several factors that limit the development and practical application of artificial intelligence in the cryptocurrency market. One major obstacle is the lack of sufficient data to build accurate AI models. Since the cryptocurrency market is relatively young and poorly known, there is still little historical data available to properly train AI algorithms.

Furthermore, the human mind remains a significant limitation in cryptocurrency trading. Trading tools created by humans can be affected by biases and cognitive limitations, which can lead to errors in trading decisions.

limited computing power is another factor hindering artificial intelligence development in the cryptocurrency industry. To analyze large amounts of data and optimize trading strategies, high processing capabilities are required, which can be expensive and complex.

Finally, the lack of public trust in AI and the cryptocurrency market in general is a significant obstacle. Demonstrating the practical benefits of using AI in cryptocurrency trading and ensuring data security could help overcome this mistrust.

Despite these challenges, artificial intelligence has the potential to revolutionize the cryptocurrency industry by improving operations security, efficiency, and scalability. With the continued development of AI technologies and the ever-increasing adoption of cryptocurrencies, it is likely that current barriers will be overcome, opening up new opportunities for innovation and growth in the cryptocurrency market and beyond Bitcoin.

Original article published on Money.it Italy 2023-07-23 18:55:00. Original title: Come l’AI (e non solo) manipola il prezzo del Bitcoin