The slowdown in inflation increases the probability that the Fed will pause the rate hike cycle that started in March 2022: what are the effects on gold? Here’s why invest now.

Experts agree that investing in gold now could present a very valuable opportunity. The recent inflation slowdown in the US, with data showing a decline to 4.0% in May from 4.9% in April, coupled with the likelihood that, at the next meeting, the Federal Reserve will keep interest rates unchanged, creating an extremely favorable environment for gold to rally.

These combined factors clearly indicate that gold could be an optimal choice for investors looking to provide stability and protection during a time of economic uncertainty.

In summary,

- The prospects of an imminent end of the Federal Reserve’s tightening program have triggered a decline in the dollar and in real rates, ie rates adjusted for inflation. This backdrop of falling real rates and a weaker dollar creates a supportive environment for gold.

- Gold has demonstrated resilience in times of heightened investor fear, as we saw during the banking turmoil in March. During such situations of uncertainty and volatility, gold has been considered a safe haven for investors, increasing its attractiveness as a portfolio diversification and protection asset.

- Gold does not generate returns, but it can help increase diversification within portfolios and provide hedge against possible shocks and uncertainties in financial markets. Gold’s unique nature as a safe asset independent of traditional economic dynamics can offer additional protection in times of volatility and instability.

Slowing Inflation: What Does It Mean For Gold?

The most recent data on inflation in the US, released today by the Commerce Department, points to a slow to 4.0% in May, from 4.9% in April. This data exceeds the expectations of analysts, who predicted a decline limited to 4.1%. Furthermore, consumer prices increased by 0.1% on a monthly basis, in line with forecasts. These results highlight a positive trend and offer a more stable picture of the economy.

The prospect of the Fed leaving interest rates unchanged at its next meeting tomorrow, in response to falling inflation expectations, has caused the dollar to weaken to the advantage of gold whose price is denominated in dollars.

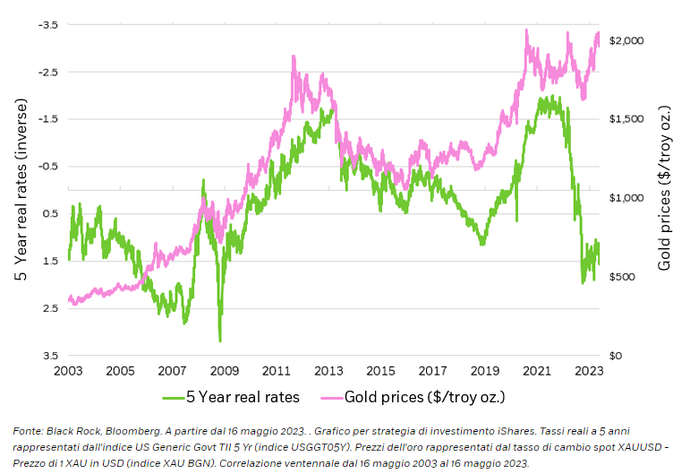

In parallel with the decline in the dollar, 10-year government bond yields, adjusted for inflation, have also fallen by around 50 basis points from their peak at the end of 2022. This reduction in real rates and the weakness of the dollar create a solid supportive environment for gold. An analysis comparing 5-year real rates and current gold prices showed a significant negative correlation over the past 20 years, indicating that trends in gold and real rates tend to be opposites.

However, the inflation slowdown can have mixed effects, as it could indicate that the US economy is heading towards a recession, as some economists are reporting. However, this translates into a positive for gold, which tends to generate good returns during times of higher market volatility. For example, during the turmoil caused by regional bank failures in the US in March, investors took refuge in gold as a "safe investment". Year-to-date, exchange-traded gold funds have seen inflows of $2.7 billion.

Investing in gold: opportunities in view of the Fed

Historically, during periods of rising rates, investors have preferred fixed-income assets that offer higher yields than gold, which is notoriously low yielding. However, with the prospect of a probable Fed pause at its June 14th meeting, gold could offer good investment opportunities.

- Gold vs 5-year interest rates

Additionally, the weakness of the US dollar makes gold more attractive to foreign buyers, as it is denominated in dollars.

Gold can also be seen as a potential protection against geopolitical risks. The controversial presidential election could increase ongoing geopolitical tensions on the US-China axis, to the advantage of gold, as happened during the Russian invasion of Ukraine in early 2022.

However, Fed Chairman Jerome Powell signaled that the hike cycle is not entirely over: if inflation does not fall further, rates could rise again at the July meeting. According to analysts, Fed rates will remain above 5% at least until the first half of 2024. Therefore, all that glitter is not gold.

Original article published on Money.it Italy 2023-06-13 18:38:04. Original title: Perché investire in oro adesso: gli effetti dell’inflazione e delle decisioni sui tassi Fed

Argomenti