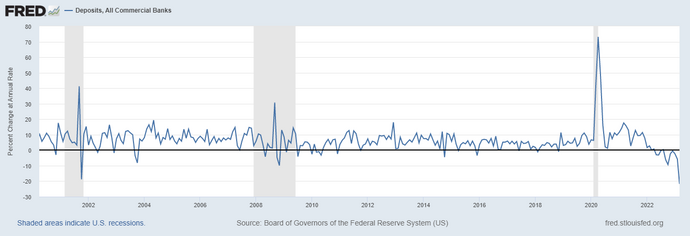

In April 2023, worldwide bank deposits fell to their lowest since 1981, though the overall decrease was the worst in history. Recession might truly be inevitable.

94,9%. This number is the percentage of how much bank deposits worldwide have shrunk in just 3 years, from April 2020 to today. This data comes from the research division of the Federal Reserve Bank of Saint Louis, an important economic authority in the United States.

In fairness, bank deposits in April 2020 were exceptionally high. The Covid-19 pandemic had just broken out and the first lockdowns were being implemented all over the world. In fact, according to the same graph, in April 2020 worldwide deposits were 73,1% higher than usual.

Nevertheless, today bank deposits are 21,8% below normal levels, the lowest percentage since 1981. For comparison, in 2008 worldwide deposits fell to a maximum of -9,9%. During the dot.com bubble in 2001, they fell to -18,8% before rebounding.

- The graph shows worldwide bank deposits since the year 2000. Shaded areas represent US recessions.

To put it in another way, the fall in bank deposits since April 2020 has been the steepest and fastest in history. And it doesn’t seem that it will stop any time soon.

The first symptoms of such monetary shrinking have already been felt. “Sickly” banks like the Silicon Valley Bank (SVB) and Signature Bank have collapsed last month. Their fall sent shock waves to Europe, where historic institutions like Deutsche Bank and Credit Suisse shivered.

“The banking system is sound and resilient”

SVB, Signature Bank, Deutsche Bank and Credit Suisse were immediately patched up by governments and other financial institutions. The two American banks were allowed to fail as others like HSBC covered their assets.

They were blamed for poor management and long-standing issues for their failure. Governments and central banks immediately reassured the markets that the overall banking system was going to be fine.

Nevertheless, such a massive shrink in bank deposits is difficult to ignore. It is clearly a result from the strong monetary tightening strategy pursued by central banks in the last year.

While announcing another 0.25% hike in interest rates last March, Federal Reserve chairman Jerome Powell assured that “The banking system is sound and resilient”.

This strategy is most definitely working, as US inflation dropped to 5% year-on-year in March. Nevertheless, it might be strangling banks too much, rendering a recession absolutely inevitable.

Talks of recessions started months ago, though the economy proved to be extremely resilient. To that end, perhaps the large bank deposits shown in the graph helped a great deal. Now, however, those deposits are gone and the banks are dipping into their last reserves.

We might have an unpleasant surprise when revealing GDP data for this quarter. Though, as they say, hope springs eternal in the human breast.