What are the risks of a global banking crisis? How will investors react to the collapse of Credit Suisse?

Uncertainty around Credit Suisse has overshadowed published macro readings and other economic issues, with new information about the bank’s health emerging at an unusual pace. How will investors react?

Yesterday morning saw a huge sell-off in the Swiss bank’s shares, with the scale reaching 30%. However, that changed abruptly around noon as shares of the company rebounded and trimmed losses by nearly 15%. At the end of the session, the Financial Times initiated further downward momentum, after reporting that CS had approached the SNB for the central bank to publicly assure the bank of its potential support in times of uncertainty.

Why did Credit Suisse lose so sharply?

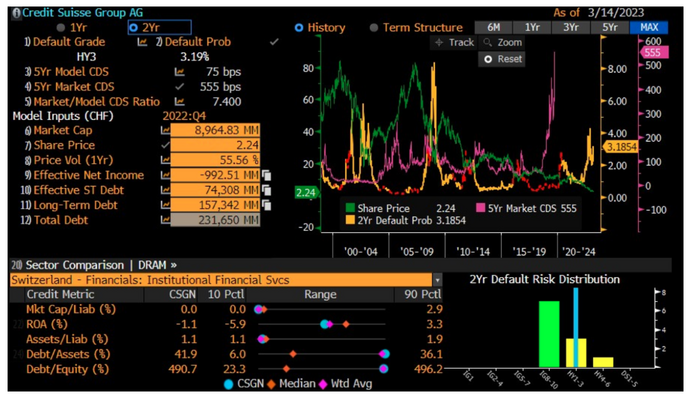

The bank’s shares, as well as the CS business itself, have been under enormous pressure for many years now and the persistent downtrend actually started as early as 2007. The current downtrends have worsened and mainly triggered by the uncertainty surrounding the US banking sector and systemic liquidity. It is worth mentioning, however, that the CS crisis has been going on for many years and the company’s financial structure seems currently immune to liquidity risks. However, investors’ attention is focused on another aspect, namely the Credit Default Swap (CDS), which yesterday hit new historical highs.

- Yesterday, Credit Suisse had 3.19% failure probablity on a biennal base

Credit Suisse seeks public support from the SNB

Credit Suisse has asked the SNB public insurance companies for possible assistance, reported the Financial Times. If the situation worsens, Swiss regulators will have to react and provide support to the key bank globally, the financial analysts added. Additionally, government regulators in Europe and the US said they were looking into Credit Suisse’s exposure to local markets, further spooking investors.

- The news from the Financial Times on SNB’s requests for aid started once again a bearish trend for the bank.

SNB to the rescue?

However, global equities reversed some losses last night after reports that Swiss authorities and Credit Suisse are discussing ways to stabilize the bank. Swiss National Bank (SNB) officials have reassured that Credit Suisse will receive cash if needed, which has eased some selling pressures. Obviously the Swiss lender would have to meet the capital and liquidity requirements to receive support. The SNB considers that Credit Suisse satisfies the capital and liquidity requirements imposed on systemically important banks

FINMA and the SNB say the problems of some banks in the US do not pose a direct risk of contagion for Swiss financial markets. Former Swiss member of parliament Thomas Matter said that there is currently no discussion of state aid for Credit Suisse. Matter said he wouldn’t be surprised if the SNB makes an announcement about Credit Suisse by Monday morning. There have also been some rumors that Credit Suisse may be merged with another entity, possibly its biggest rival UBS.

- Not only did the Nasdaq manage to defend the key support at 12000 points, it also reversed the original losses and is slightly bullish.

Original article published on Money.it Italy 2023-03-16 15:47:37. Original title: Quali sono i rischi del crollo di Credit Suisse?