Swing trading: what is it, how to use it and what are its pros and cons?

What is swing trading? How does the swing trading technique work? These are two of the questions that inexperienced traders may ask themselves.

Anyone who wishes to try their hand at trading on Forex, whether they are a novice trader or a market expert, must decide which trading technique to use.

Swing trading is one of the most widespread and effective techniques, characterized by many aspects that facilitate its practice.

This investment method is halfway between intraday trading and buy and hold: in a nutshell, swing trading means taking a position in line with the main trend of the underlying, maintaining it for a few days.

This operational methodology represents the most flexible method of trading, a middle ground that seeks to eliminate the major problems of other methodologies.

So let’s delve deep into what swing trading is and how it works

Swing trading, what is it? Definition and application

Swing trading is a technique used for trading where you can open a position (either short or long) on the market and then close it a few days later. The aim is to capture the sentiment that governs the price trend and the resulting expected price fluctuation.

The trend of prices follows continuous swings, bullish or bearish, lasting one or more market days. You therefore do not have a fixed price, but your position adapts to price fluctuations.

The swing trader is the one who identifies these oscillations and "rides the wave" for a variable period of time, which is neither too short to limit the profits nor too long to risk reversal.

In simple words, take advantage of the moment of favorable trend for a short period, and then move on to the next profit opportunity.

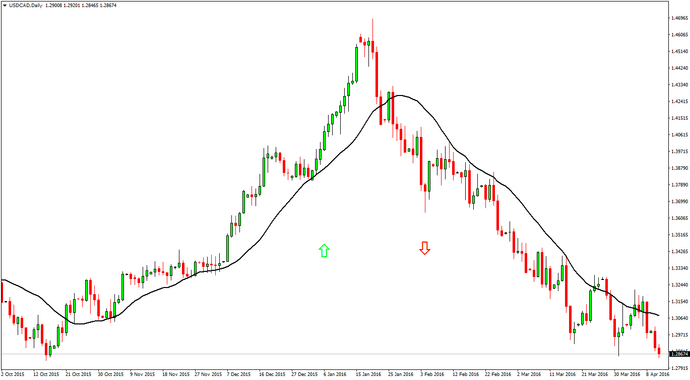

In the chart, the green lines indicate the swing to follow with long operations.

As can easily be seen, on the USD/Cad hourly chart, inserted in a strong uptrend, all tests of the SMA 200 are considered entry signals, which traditionally provide a quick overview of the ongoing trend.

Thanks to its liquidity, Forex is the ideal market for swing trading.

Swing trading: practical example and ideal market

To swing trade successfully, it is necessary to identify a market that is in a strong upward or downward trend.

For this reason, those who want to practice swing trading should avoid the lateral market or consolidation phases.

From the point of view of the operational time frame, this should never be less than the hourly one (H1). This choice actually allows us to have an overview of the graphic structure of the last few days.

In this daily chart of USD/CAD, you can see how the exchange rate has essentially followed two major trends over the course of 7 months.

This represents the ideal scenario: both with regards to the bullish and bearish phases, tests of the 20-day moving average always represent valid operational opportunities.

Swing trading: the advantages

Thanks to the high planning required to operate via swing trading, the number of stop losses will be lower than in the intraday operating mode.

The rhythm of trading is also ideal, present on a daily basis but less intense than other types of operations.

Finally, swing trading allows greater elasticity. In long-term trading, you try to take a downward or upward movement and enter/exit the position at the maximum/minimum points, in an attempt to broaden your profit prospects as much as possible, given the few operations carried out.

With swing trading, however, you aim for a part of the bullish or bearish movement, without the need to buy on a minimum level or sell on a maximum level, but simply try to follow the movement principle.

Swing Trading: the best way to trade?

Trading techniques are very personal and change depending on your attitude. Every trader has their own market ideas and trades based on them.

Consequently, there are no ways of operating that are better than others, but only some that better suit your style.

Swing trading can be a perfect way for some traders, but completely useless for others. What we recommend is to operate in this mode especially when you are a beginner.

inexperienced traders can obtain advantages from this way of investing.

As we have already mentioned, this operation is particularly suitable for the Forex market. The great volatility of the market and its liquidity allow for excellent swing possibilities.

Original article published on Money.it Italy 2016-11-03 10:48:00. Original title: Swing trading: cos’è e come funziona? Guida completa