What is happening to the economy? After a surprising earnings season, Moody’s downgrades upset the balance. Here’s what analysts think in 5 charts.

The future of the world economy depicted in 5 graphs. After the records of the last quarterly season, Moody’s now drops the ax on American banks, questioning growth expectations. And the specter of recession is back (not only in the States).

Big picture of the economy

The leapfrog of the US economy in the first seven months of 2023 has left investors speechless, driving the global economy higher. After an annus horribilis in 2022, the worst since the financial meltdown of 2008, the stock market has put its wings back, giving away a rebound that has captured everyone’s attention.

Furthermore, the grip of inflation surprisingly eased faster than expected. House prices held steady, a result that may come as a surprise given that mortgage rates have at times approached or exceeded 7% in the US. Consumers are continuing to spend a portion of the savings accumulated during the pandemic, adding further momentum to the economy.

However, in the midst of these successes lurks a shadow of uncertainty. An underlying sense of unease simmers beneath this year’s seemingly calm surface, hinting that the wind may be shifting.

The credit markets are scrutinized with the utmost attention, looking for any crunches. Experts are on the prowl, watching with interest for prophetic signals among leading economic indicators. The echo of aggressive rate hikes, promoted by the Federal Reserve, is being carefully scrutinized. Furthermore, we are beginning to see faint signs of a slowdown in consumer spending.

In short, 2023 has already proven to be a year in which surprises, changes, and challenges are constantly mixed.

Will there be growth or recession? The answer lies in the nuances of the signals looming on the horizon. Here’s what some analysts think and what data they look at.

The predictions of the most optimistic analysts

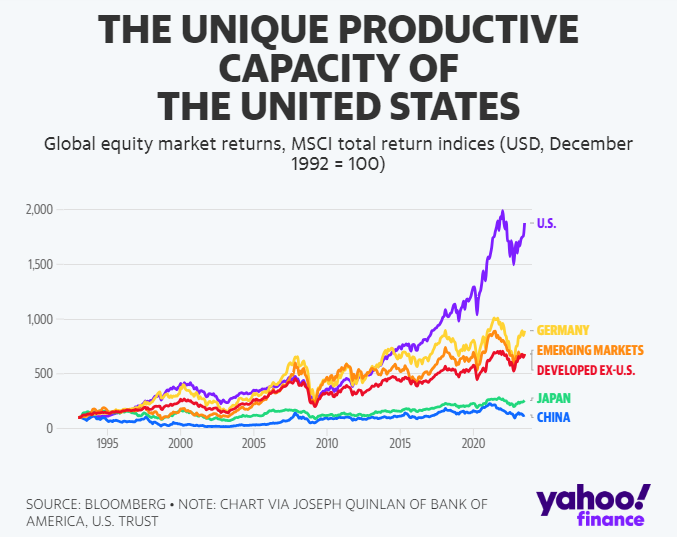

The US economy has an unparalleled growth rate

According to Joseph Quinlan, chief market strategist of Private Bank and Merrill, Bank of America, the American stock exchange is the ideal place to obtain profits from equity investments. The US’s outstanding performance relative to other parts of the world stems from its large, highly competitive, and dynamic economy. This economic power is reflected in the unprecedented productive capacity: America excels in sectors such as aerospace, agriculture, artificial intelligence, entertainment, education, energy, finance, life sciences life, and technology. The United States emerges as an economic superpower, a global leader in many fields, and will continue to grow in the long run.

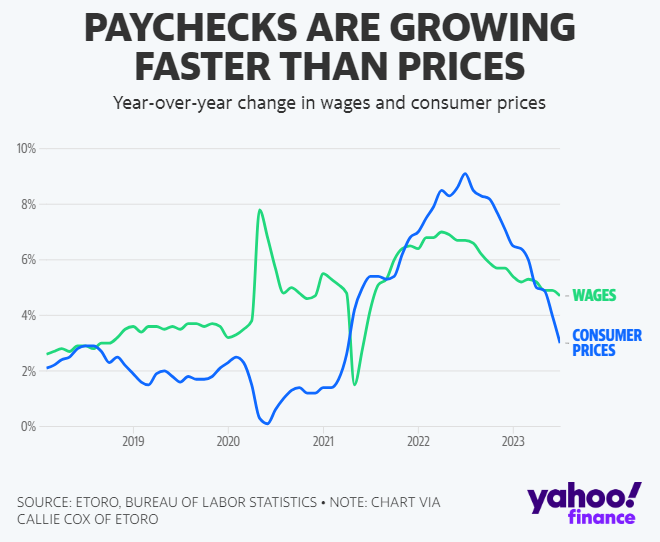

The real economy is growing

Callie Cox, an investment analyst at eToro, confirms the bullish thesis. She highlighted the significant impact of an apparently simple but powerful phenomenon. Currently, wages are outpacing price increases, reversing a year-and-a-half trend in which inflation has outpaced incomes. This reversal has caused a remarkable psychological shift in both consumers and investors. Improved payrolls, especially for low- and middle-income groups, result in stronger monthly budgets for everyday expenses, boosting consumer confidence. This situation, unusual before the recessions, could signal a rise in confidence and a sign that the economic recovery is starting to take root, bringing benefits both on an individual and on a market level.

The predictions of the most skeptical analysts

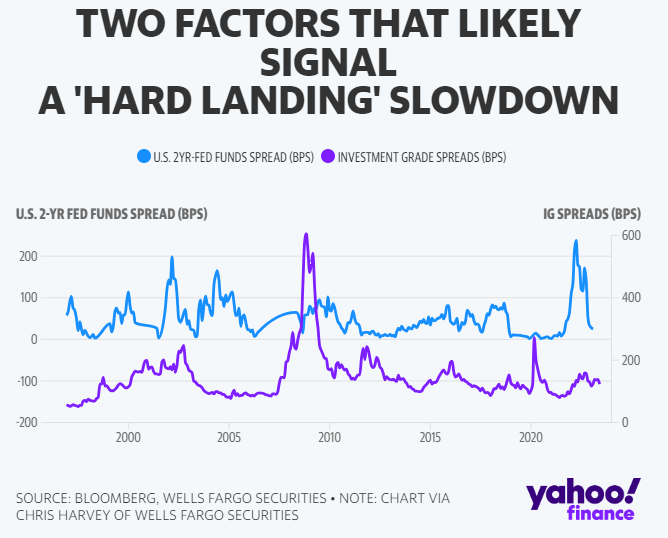

The economy has already overcome the crisis

Chris Harvey, head of equity strategy at Wells Fargo Securities, highlights the importance of two key macroeconomic factors in monitoring the US economy. First, the spread between 2-year US Treasuries (UST) and the Fed Funds rate (FF), which has historical significance in heralding slowdowns. The inversion of this spread in the past has signaled a monetary policy too restrictive with respect to economic conditions, foreshadowing possible recessions (as in 2000 and 2007-2008).

Second, the investment grade (IG) credit spread, which reflects investors’ concerns about the company’s outlook. The Silicon Valley Bank crisis widened these spreads, threatening an economic slowdown, but recently IG credit spreads have tightened, showing signs of stability.

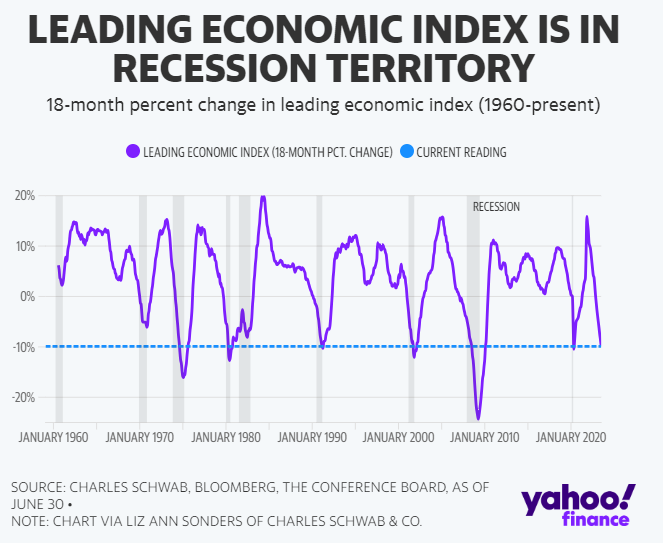

Some sectors are already in recession

Liz Ann Sonders, chief investment strategist at Charles Schwab & Co., points out that the slump in the Main Economic Index is typical of past recessions. The concept of "continuing recessions" is evident in sectors such as construction, housing, and manufacturing, along with consumer-related segments of the economy, many of which have already gone through or are still experiencing their own recessions. While resilience in services has so far buoyed the labor market, cracks are emerging that need attention, both in services and in employment.

Signs of crisis coming

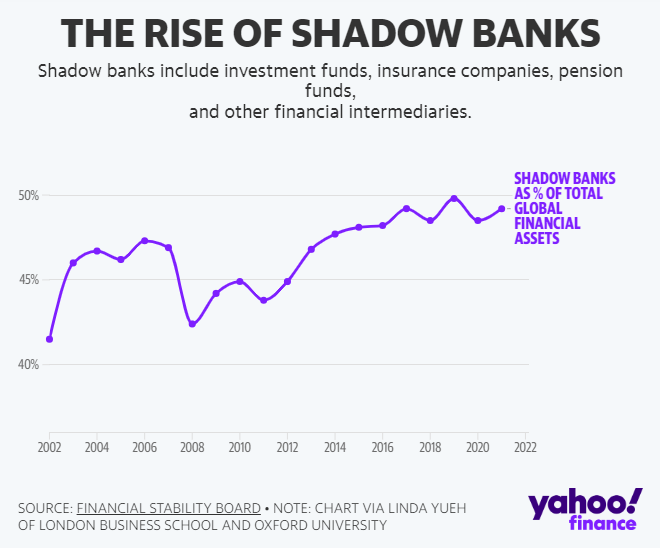

After the recent Silicon Valley Bank and Signature Bank collapse, which shook the US banking sector and sparked a run on deposits, the US financial landscape is still under pressure. Tight monetary conditions by the Federal Reserve have rekindled tensions in the banking sector. Moody’s reacted by cutting the credit ratings of several small and medium-sized banks, and even raised the possibility of downgrades for some of the country’s major lenders. This scenario sheds light on the growing role of shadow banks, which constitute a significant part of global financial activity but pose regulatory and systemic risks.

Linda Yueh, senior economist at the London Business School and the University of Oxford, points out the complexity and potential risks of non-bank financial institutions (NBFIs). Over the past year, this sector grew by 8.9% in 2021, exceeding its five-year average of 6.6%, to $239.3 trillion globally. However, the lack of regulation similar to the big banks raises concerns, as the FSB (the global body responsible for monitoring financial stability) has stressed the risk of a financial crisis stemming from excessive debt in the shadow banking system. Recently, the industry has experienced start-up slumps and instability in several financial areas, leading to a buildup of systemic risks.

Original article published on Money.it Italy 2023-08-10 15:55:00. Original title: Il futuro dell’economia mondiale in 5 grafici