These 3 stocks have untapped growth potential according to analysts and could rise by a further 50% in 2024. Let’s see what stocks they are and why they are on the top list.

2023 was a year of notable success for several titles. Despite the double-digit gains, analysts have identified 3 stocks that could rise 50% in 2024 after this year’s rally. What does the future hold?

The shadow of recession and an economic slowdown does not scare analysts who maintain a positive view of some stocks.

In this article, we will examine the reasons behind these optimistic outlooks and analyze the potential investment opportunities these 3 stocks could offer in 2024.

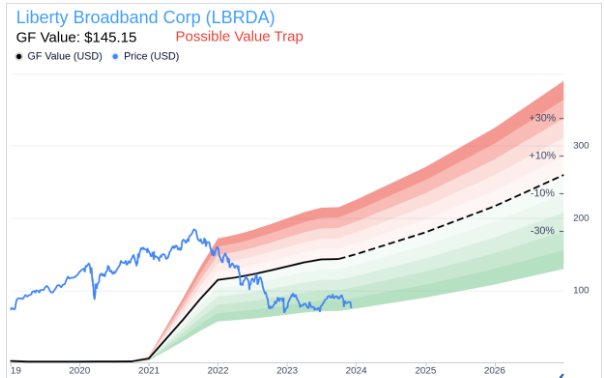

1) Liberty Broadband Corp (Nasdaq)

Liberty Broadband Corporation, a cable, broadband, and mobile location telecommunications holding company operating through Charter Communications (of which it owns 25%), and TruePosition, represents an attractive investment opportunity on the Nasdaq . With its holdings in major cable operators and broadband service providers in the United States, the company has a strong presence in the industry and is well-positioned to take advantage of the changing media and technology landscape. Liberty Broadband’s P/E ratio is 15.11.

- Liberty Broadband weekly graph

- Source: Tradingview

FactSet analysts predict a potential upside of nearly 70% from the current value of $75. Deutsche Bank sees the stock as a unique opportunity to invest in a company with a solid market capitalization, valued at $12.202 billion. According to the bank’s analysts, the target price of the stock is around $108, with a potential upside of 43%.

Investors could face a significant profit opportunity in 2024.

- Liberty Broadband forecast

- Source: Gurufocus

2) BT Group PLC (LSE)

For investors looking for promising opportunities in 2024, BT Group presents itself as a fascinating investment prospect in the telecommunications sector. The shares of the British company listed on the London Stock Exchange (LSE) have already increased by 18.3% during the current year and appear to offer further growth potential. According to analysts at Morgan Stanley, BT’s ace in the hole is its broadband network division, Openreach. This segment, currently undervalued, could be the driving force behind a significant revaluation of stocks.

- BT Group stock

- Source: Tradingview

The positive outlook widens with JPMorgan’s exciting outlook, which suggests that 2024 could be a turning point for European telecoms companies, with BT leading the way. The investment bank’s analysis is based on several factors, including price increases, EBITDA growth, free cash flow increases, and a "best-in-class" EPS outlook. BT has even been tipped as a top pick in the sector, with an “overweight” rating and a price target for the shares that could rise to 290p.

leggi anche

Investments, 4 trends to watch out for in 2024

BT’s macroeconomic environment and internal outlook paint an attractive picture, with expected structural growth of 2-3%, a potential 34% upside in free cash flow by the end of the decade, and dividend and growth prospects confirmed by the new CEO who will take office at the beginning of next year. In summary, investing in BT Group for 2024 could prove to be a strategic move, combining solid industry prospects with specific business dynamics that suggest a period of sustainable growth.

Barclays has a positive rating on the stock (buy).

3) JD Sports Fashion (LSE)

JD Sports Fashion, a leading player in the British sportswear landscape, has demonstrated an exceptional increase of 31.3% this year, outperforming the FTSE 100 Index and capturing the attention of investors for 2024. With over 3,000 stores, the company has a clear propensity to continue its growth, supported by solid financial results. Analysts, based on third quarter updates and the positive performance of similar companies in the United States, expect a further 50% increase next year, a figure that allows it to consolidate its leading position.

- JD weekly graph

- Source: Tradingview

JD Sports Fashion published growing half-year results at the end of September, a significant increase in the interim dividend and confirmation of its prospects despite the difficult macroeconomic context. In the six months to the end of July, the company reported an operating profit increase of 20% to £400m and pre-tax profit improved 25.8% to £375m, reflecting earnings per share growth of 30%. The board responded with a more than double interim dividend.

The company, driven by a strategy focused on growing the premium Sports Fashion business, achieved impressive results in Europe (+27%) and North America (+15%), confirming the success of its strategic plan. The expansion of the JD brand globally, with over 200 new stores expected during the financial year, combined with recent acquisitions, position JD Sports Fashion as an attractive choice for investors seeking excellence in the sportswear sector.

|DISCLAIMER

The information and considerations in this article should not be used as the sole or primary basis for making investment decisions. The reader maintains full freedom in his own investment choices and full responsibility in making them, since only he knows his risk appetite and his time horizon. The information contained in the article is provided for informational purposes only and its disclosure does not constitute and should not be considered an offer or solicitation to the public for savings.| Original article published on Money.it Italy 2023-12-09 16:03:00. Original title: 3 azioni che potrebbero salire del 50% nel 2024 dopo il rally di quest’anno