The Eurozone’s industrial output keeps declining more than predicted. Is there any solution to revive Europe’s economy?

Germany, France, and the Eurozone as a whole declined in manufacturing power in July, according to fresh data released on Monday. The downward spiral started in mid-2021, immediately after the Covid pandemic recovery.

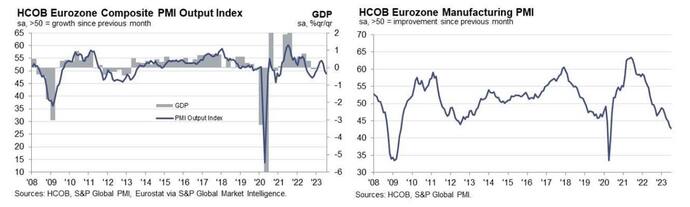

The Purchasing Managers’ Index (PMI) measures manufacturing and production health. It’s divided into the service and manufacturing sectors. 50 points is considered the break-even measure, where the economy produces enough services and goods to avoid contraction.

France’s manufacturing PMI dropped to 44,5 in July. Germany saw a severe dip to 38,8. In general, the Eurozone composite (meaning for both sectors) PMI dropped more than expected to 48,9.

These numbers signal increased weakness in the bloc’s industry, increasing the likelihood of a long-term recession. The Eurozone already fell into a technical recession in June.

"Manufacturing continues to be the Achilles heel of the Eurozone," said chief economist at Hamburg Commercial Bank Cyrus de la Rubia. "Producers have cut their output again at an accelerated pace in July, while the services sector’s activity is still expanding, though at a much slower rate than earlier in the year."

He added that, as the services sector continues to lose momentum in the coming months, the economy will likely move further into contraction.

The ECB solution: a quick recession

Europe’s industrial decline is caused by the energy war against Russia. The lack of cheap Russian gas and the unavailability of immediate new sources is hampering Europe’s production growth.

Further, as the European Central Bank (ECB) noted, the crisis is also caused by increased prices and persistent inflation. Core inflation measures consumer prices without volatile goods such as food, and is hardly declining in the Eurozone.

The EU’s July core inflation is 7.7%, far from the 2% ECB target. Despite the ECB’s unprecedented monetary tightening, interest rates have not been increased enough.

ECB President Christine Lagarde has made it clear interest rates will continue rising in July, with a possible upcoming hike in September too.

Rate increases plunged the Eurozone into recession in the first place, but they are necessary to fight inflation. Seemingly, however, inflation cannot be eradicated without strong manufacturing investment, itself impossible when interest rates are high.

The European Union (and the UK) are stuck in a vicious cycle resembling economists’ worst fears: stagflation. A situation where prices are high but the economy is not growing.

Combined with the hottest summer in the continent’s history and the war in Ukraine with no end in sight, Europe appears doomed for the foreseeable future.