How to invest in Bitcoin? Here is a simple and complete guide to investing in the world’s number one cryptocurrency.

Are you thinking about investing in Bitcoin but don’t know where to start? In this comprehensive guide, we’ll explore everything you need to know to safely and knowledgeably invest in the world’s most popular cryptocurrency: Bitcoin.

Bitcoin has gained great popularity in recent years, becoming a common topic of discussion in the financial sphere. But what exactly is Bitcoin and how does it work? Is it safe to invest in Bitcoin? How can you invest in this cryptocurrency? Read on to find out all the answers to your questions about Bitcoin and how you can start investing.

What are Bitcoins?

Bitcoin is the first cryptocurrency ever created and was launched in 2009. It is a form of digital money that uses blockchain technology to make transactions secure and transparent. Unlike traditional currencies issued by governments, Bitcoin is decentralized and is not controlled by any central authority such as banks or governments.

The Bitcoin network is based on blockchain technology, which serves as a shared public ledger of all transactions made with Bitcoin. Each transaction is recorded as a "block" of information that is added to the chain of previous blocks, creating a complete history of all transactions that have occurred.

To hold Bitcoin, you need to have a digital wallet where you can store your coins. A wallet is protected by a cryptographic key that allows you to access and control your Bitcoin. The security of Bitcoin is guaranteed by cryptography and blockchain technology which makes transactions extremely difficult to alter or falsify.

How to invest in Bitcoin

How do you get and invest in Bitcoin? In the same way as you invest in euros or pounds: Bitcoins can be exchanged like any other currency using specific exchanges or by doing online trading through a platform. Both options for buying Bitcoin offer advantages and disadvantages, and it is important to understand the differences between the two before making a decision.

Investing with online trading brokers

Online trading brokers offer the opportunity to invest in Bitcoin through contracts for difference. CFDs allow you to speculate on the price of Bitcoin without actually owning the cryptocurrency. With CFDs, you can open both bullish and bearish positions and use leverage to amplify your potential profits.

Online trading brokers offer advanced platforms that allow you to analyze price charts, use technical indicators, and set conditional orders. Additionally, these brokers often offer free demo accounts, which allow you to practice and familiarize yourself with Bitcoin trading without risking real money.

Investing through cryptocurrency exchanges

Cryptocurrency exchanges are online platforms that allow you to buy and sell Bitcoin directly. With exchanges, you become the beneficial owner of the Bitcoin you purchase and can store it in your digital wallet. Exchanges offer a large selection of cryptocurrencies, allowing you to diversify your portfolio.

Cryptocurrency exchanges usually charge fees for buying and selling Bitcoin. It is important to consider these fees and compare the fees between different exchanges before making a transaction. Additionally, some exchanges offer custodial services for your Bitcoin, which can be more secure than a simple digital wallet.

Why invest in Bitcoin?

It seems absurd to some that a single Bitcoin can now be worth thousands of dollars. What defines the value of Bitcoin?

Bitcoins are scarce and useful. Let’s take gold for example - there is a limited amount of gold on earth. The more new gold is mined, the less gold is available and it becomes harder and more expensive to find. The same goes for Bitcoin.

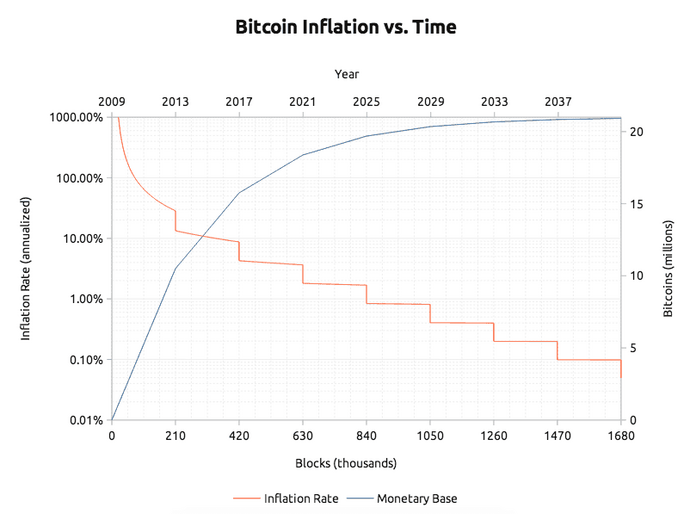

There may only be 21 million Bitcoins, and as time goes by it will become increasingly difficult to find them. Take a look at the inflation rate along with the Bitcoin supply rate:

But beyond being scarce, Bitcoin is useful.

Bitcoin has a sound and predictable monetary policy that can be verified by anyone, one of its most important features. It is always possible to see when new Bitcoins are created or how many Bitcoins are in circulation.

Bitcoins can be sent from anywhere in the world to any other part of the world. No bank can block payments or close the account. Bitcoin is a censorship-resistant currency.

Cryptocurrency makes cross-border payments possible and also provides an easy way for people to escape a government’s failed monetary policy.

The Internet has made information globalized and easy to access.

Understanding the potential impact of Bitcoin on the world of finance, it is not difficult to understand why investing in Bitcoin can be a good idea with a well-diversified investment portfolio in hand.

leggi anche

Is Bitcoin Undervalued?

Advantages and risks of investing in Bitcoin

Investing in Bitcoin offers numerous advantages, but it is important to also be aware of the risks associated with this form of investment. Here are some of the main benefits and risks of investing in Bitcoin:

Advantages of Investing in Bitcoin

- High-Profit Potential: Bitcoin is known for its volatility and has seen significant increases over the years. This means that there are high-earning opportunities for those who manage to take advantage of Bitcoin’s price movements.

- Portfolio Diversification: Bitcoin can be an attractive addition to a diversified investment portfolio. Because its value is not correlated to that of traditional currencies or financial markets, it can act as an anchor of stability in times of economic uncertainty.

- Accessibility and ease of transaction: Investing in Bitcoin has become much more accessible thanks to the presence of online trading brokers and cryptocurrency exchanges. With just a few clicks, you can open an account and start investing in this cryptocurrency.

Risks of Investing in Bitcoin

- Price Volatility: Bitcoin is known for its extreme volatility, which means its price can fluctuate greatly in a short period of time. This can lead to quick gains, but also significant losses.

- Regulation and Security: Bitcoin is still a relatively new form of investment and its regulation is still evolving. Additionally, investments in Bitcoin may be subject to security risks, such as hacking or fraud.

- Technical Aspects: To invest in Bitcoin, you need to understand the concepts of blockchain, cryptography, and digital wallets. These technical aspects may be complex for some less experienced investors.

How to start investing in Bitcoin

If you are interested in investing in Bitcoin, here is a step-by-step guide on how to get started:

- Research and Education: Before you start investing in Bitcoin, it is important to thoroughly research the cryptocurrency and understand its technical aspects, factors that influence prices, and associated risks. There are numerous books, podcasts, and online resources that can help you deepen your knowledge of Bitcoin.

- Choose an investment platform: Decide whether you prefer to use an online trading broker or a cryptocurrency exchange to invest in Bitcoin. Evaluate the different options available and compare the fees, features, and security of the platforms before making a decision.

- Open an account: Once you have chosen the platform, open an account by following the instructions provided. You may be required to provide some personal information and complete the identity verification process.

- Deposit Funds: If you have chosen an online trading broker, you will need to deposit funds into your account to start trading. If you have chosen a cryptocurrency exchange, you will need to transfer funds from your bank account or another cryptocurrency to your exchange account.

- Start investing: Once you have deposited funds into your account, you can start investing in Bitcoin. Use the tools and features offered by the platform to analyze price charts, set orders and monitor your positions.

- Manage your investment: Regularly monitor your Bitcoin investment and make any adjustments based on market performance. Remember to keep a long-term view and not be influenced by short-term price fluctuations.

Conclusion

It is important to understand how Bitcoin works before investing money in the cryptocurrency.

Investing in Bitcoin can be an interesting opportunity for those who are willing to understand the risks and spend time researching and analyzing. With the advent of online trading brokers and cryptocurrency exchanges, the accessibility of investing in Bitcoin has increased significantly.

However, it is important to remember that Bitcoin is still a high-risk investment and that price movements can be extremely volatile. It is crucial to do thorough research, educate yourself on how Bitcoin works, and make informed investment decisions.

Investing in Bitcoin can be an interesting addition to a diversified investment portfolio, but it is important to be careful and only invest what you are willing to lose. With a prudent investment strategy and careful risk management, investing in Bitcoin can offer significant earning opportunities in the long term.

Always remember to consult a qualified financial advisor before making investment decisions and rely on reliable sources for your Bitcoin research.

Original article published on Money.it Italy 2023-11-27 16:12:52. Original title: Come investire in Bitcoin