As NVIDIA’s market cap reaches $1 trillion, investors seem distracted from what’s really coming.

A dark secret lurks beneath the current stock rally on the American market, which topped out in May after positive financial news came out. The surge in stock prices is mainly driven by the AI trend, which has dominated the market for the entire year.

This week, NVIDIA saw a +6.94% rise in stock market price, passing $1 trillion in evaluation. NVIDIA provides chips for AI companies and recently proposed their own LLM to “fact-check” ChatGPT’s answers.

In 2023, the Nasdaq 100 index gained $4 trillion in total, and recent news about a newly-found debt ceiling agreement increased market optimism.

But a close analysis of the Nasdaq 100 index, as well as the S&P 500, reveals that only 7 companies are responsible for the current rally. As Bank of America strategist Michael Harnett puts it, the “Magnificent Seven” stocks are Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, and NVIDIA.

Of them, four actively drive AI research, though mostly competing against each other. Alphabet’s Google and Microsoft, for example, are battling over the most advanced AI search engine, with Microsoft currently ahead.

In any case, these stocks are responsible for 84% of the Nasdaq 100 gains, with the remaining 93 companies amounting to just 15.9%.

The calm before the storm

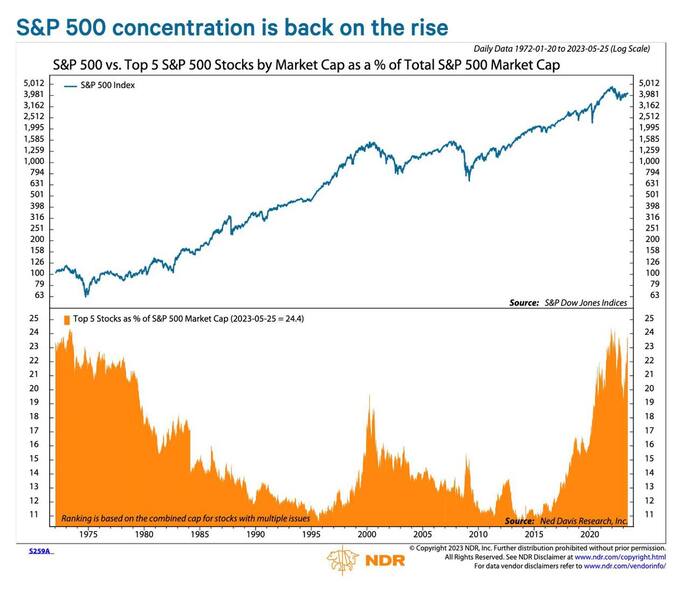

A similar pattern is taking place with the S&P 500 index, with the five most valuable companies driving the overall upward trend.

Indeed, there are more Nasdaq 100 companies that have reached a yearly low than a yearly high. In short, as Allianz analyst Mohammed El-Erian puts it, “Today’s US price action is another reminder that this year’s favorable equity market performance is still about a handful of tech stocks.”

Similar stock movements occurred only three other times with this intensity. In 1970, 2000, and 2007, all of these trends occurred before a severe recession.

Fears of a recession in 2023 are all but gone. Inflation is still high and the US economy is resilient enough to allow further interest rate hikes by the Federal Reserve. Many state-level regulators already expressed their opinion on the matter, explicitly stating that more rate increases are coming.

In early May, Fed chairman Jerome Powell signaled an end to rate hikes and the start of a stabilization period. That strategy might have been thrown out by May’s new economic data.

In short, core inflation is still high and the economy is holding up well. As a result, new hikes are coming.

But every rope eventually snaps, and it only takes one bad quarter for the United States to slip into recession. And many believe it is unavoidable.