Corporations raised prices with inflation but are now refusing to bring them down.

One of Hollywood’s most popular tropes is the greedy, selfish corporation whose CEO wants all the profits for himself. Judging from economic data in recent years, this stereotype might not be that far off from reality.

Inflation is high. Everyone should have gotten the memo by now. The pandemic and the Ukraine war have soared prices and living costs. Everything from paying rent to buying groceries to embarking on a Christmas shopping spree costs more. And wages have not adjusted, remaining at pre-pandemic levels.

Europe reached double-digit inflation, peaking at close to 10% in the United States. At the moment, inflation is still high at 6.1% in the Eurozone and 4.9% in the United States.

To reduce inflation, central banks increased interest rates. Since March 2022, the American Federal Reserve, the European Central Bank, and the Bank of England have hiked rates by several percentage points.

This week, the Fed and the ECB will likely continue their tightening policy despite promises otherwise. Increasing interest rates will likely cause a mild crisis in the United States. The Eurozone, on the other hand, has already fallen into recession.

Why corporate greed matters

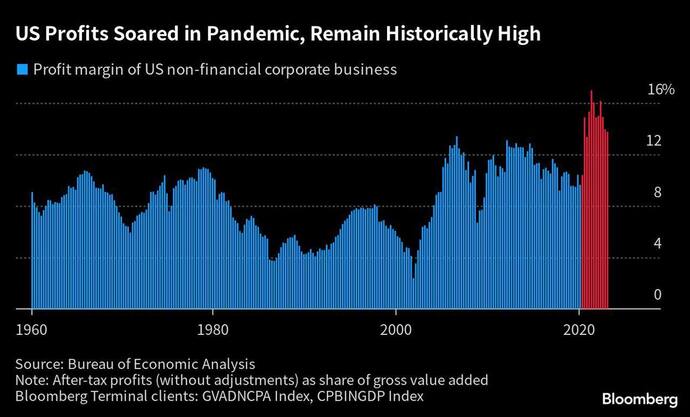

A recent Market Live Pulse poll interviewed 288 investors and financial analysts on inflation and monetary tightening. 90% of respondents said that American and European corporations raised prices more than costs after the pandemic.

In fact, according to the poll, central banks’ monetary tightening policy is caused by corporate refusal to lower prices. They exploited inflation to raise prices more than necessary, thereby increasing their profits, and are now refusing to turn back even as inflation decreases.

In a normal "free market", prices are regulated by demand and offer. Essentially, the consumer dictates how much it’s willing to pay, and producers set prices around that level.

This concept, however, clearly does not apply to our reality, where consumers are forced to accept producers’ prices. According to the analysts interviewed in the poll, this is caused by the excessive monopolization of large companies. This allows them to set prices at their preferred levels: if there is no competition, no one can set prices lower.

In a recession, markets should reshuffle, bringing down large players and welcoming smaller ones. This would theoretically increase competition and decrease monopolies, reducing prices down to consumer willingness to pay.

Hence why pollsters approved of the Fed’s tightening policy. Yes, increasing interest rates will result in a recession, but it should also help the consumer in the long run.

In other words, corporate greed is causing a recession.