The recent appreciation of the dollar, with Powell’s announcement, has brought the hypothesis that the euro-dollar exchange rate could return towards parity back into play. Is this hypothesis really possible?

Despite strong sales expectations, the dollar is gaining more and more strength every day compared to the reference basket made up of other currencies, as evidenced by the bullish trend of the DXY.

There are many variables that push the cross EUR/USD downwards, and for this reason, the hypothesis is that the exchange rate could return to close to parity, as it did in 2022. Is this really a plausible hypothesis?

Euro-dollar exchange rate, what’s happening?

The rise in US Treasury yields accompanied the increase in the value of the dollar, as evidenced by the performance of the DXY index. The Fed’s actions appear to once again positively influence the expectation of further interest rate increases in the United States, stimulating capital inflows towards the dollar. This phenomenon, from a mathematical point of view, increases the demand and consequently the relative price of the currency. All this happens to the detriment of the Euro, which instead does not seem to benefit, from a technical point of view, from this situation, probably because the European economy seems to be more affected than that of the United States.

EUR/USD, technical analysis

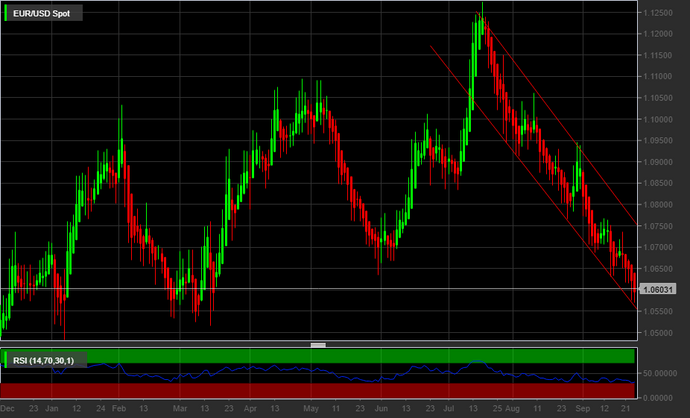

It is no coincidence that the EUR/USD exchange rate has accentuated its bearish trend, which had begun after reaching the highs in July 2023. This downward trend developed steadily and any attempt at recovery by demand was quickly held back by supply. On a daily time frame, this is evident by the formation of a negative channel that pushes the price down. The next reference level is found at 1.051, a zone that acted as support on two occasions during 2023, in January and March. Once this technical level has been passed, parity between the USD and EUR is not that far away, although many economic analysts exclude this possibility for political reasons.

Although on a daily time frame, the application of oscillators suggests the possibility of having already reached a minimum level, for example by applying the RSI to 14 periods (1D), by widening the time frame there seems to be still room for further movement. The oscillator itself has not yet reached the oversold zone on the weekly timeframe, which may indicate that the price has not yet reached a zone of strong buying (for the euro) and selling interest ( for the dollar). This situation is also reflected in the respective price indices, such as EXY and DXY.

For a more complete technical evaluation, the application of Haikin Ashi candles could be useful, especially on a weekly time frame. At the moment, it seems that the eleventh consecutive red candle is forming on the chart trend. Therefore, the first green candle could mark at least a first break in the current trend.

- EUR/USD, 1D

Original article published on Money.it Italy 2023-09-26 15:19:13. Original title: Cambio euro-dollaro verso la parità?