If the economy turns out to be stronger than expected, this tends to reward stocks and high-yield bonds to the detriment of more defensive assets.

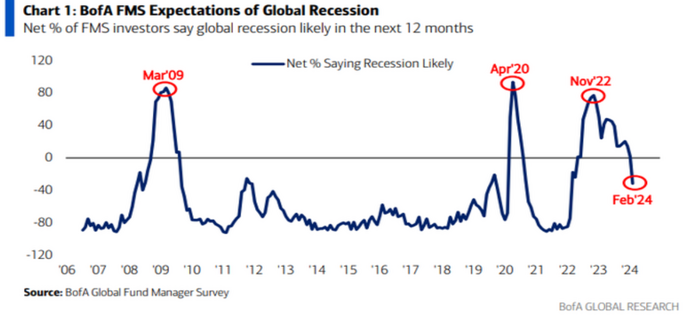

Financial markets are starting to think that the "no recession" scenario may have better chances now than before. Global fund managers surveyed by Bank of America do not expect a recession in the next 12 months for the first time since April 2022:

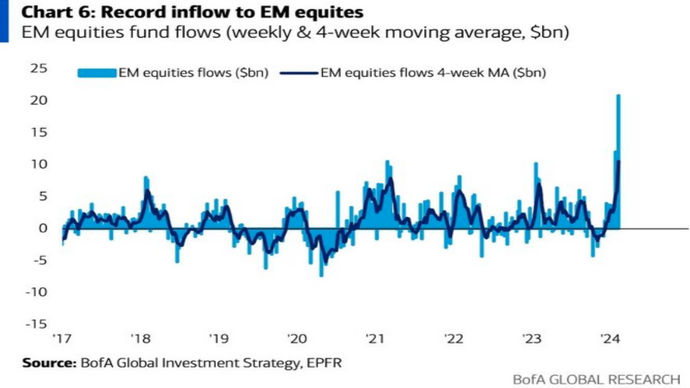

This is consistent with the bullish sentiment of the managers, the decrease in the cash reserve to 4.2%, the continuous increase in flows on the money market, and the allocation to equity in general with preference for the US and the markets emerging:

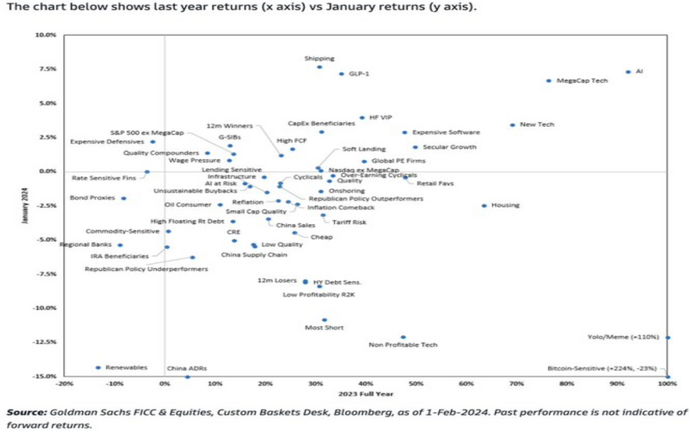

It is interesting to note that not "everything goes up" but rather that investors selected themes in the first month of the year. In January, MegaCap, Tech, pharmaceuticals linked to the obesity theme, and the shipping sector were the themes that returned the most (over 5%) while China, renewables, unprofitable Tech, and sensitive sectors performed negatively for over 10%:

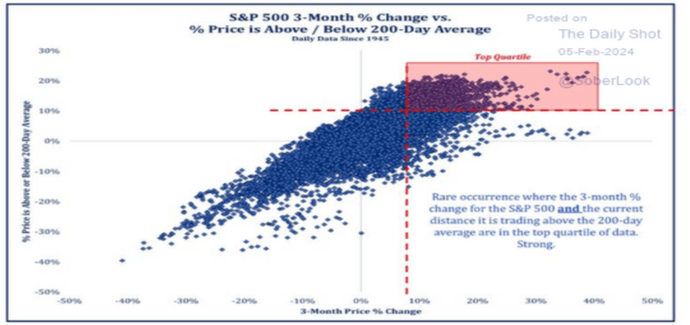

Another interesting fact is that the recent rally in American stocks was more broad-based. That is, it was not concentrated on a small group of shares of mega-capitalization companies but more shared by the rest of the stocks in the index:

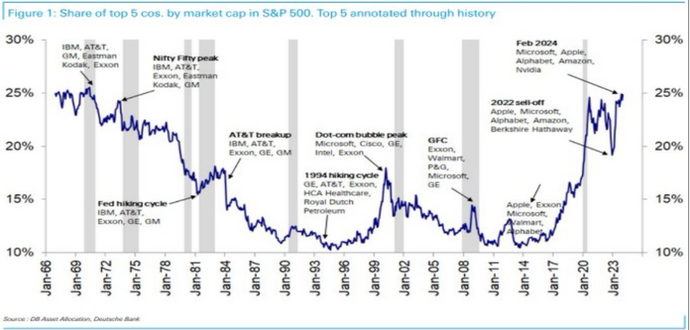

However, concentration is starting to be one of the major current market risks. Today’s Wall Street, in these terms, is starting to resemble that of 2000 and 1929 given that the first 5 stocks of the S&P 500 index represent 25% of the market capitalization of the entire US list:

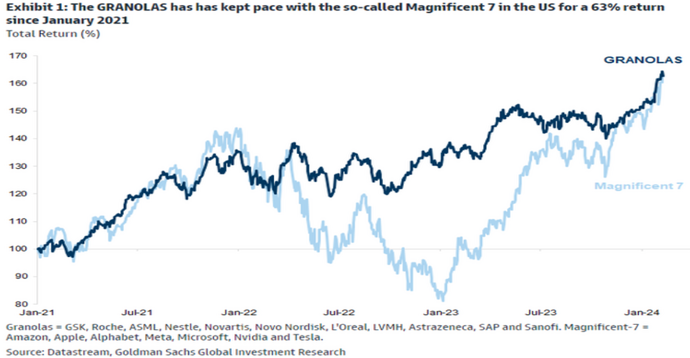

This is not a phenomenon isolated to the United States, Europe also has a sort of Magnificent 7, a small group of companies with global exposure: the so-called GRANOLAS (Gsk, Roche, Asml, Nestlé, Novartis, Novo Nordisk, L’Oreal, LVMH, AstraZeneca, Sap, and Sanofi):

Not only that, the recent peak on the 2001 highs of the EuroStoxx 50 was driven by the 2 largest European technology stocks: SAP and ASML Holding (which together make up almost 10% of the weight of the index).

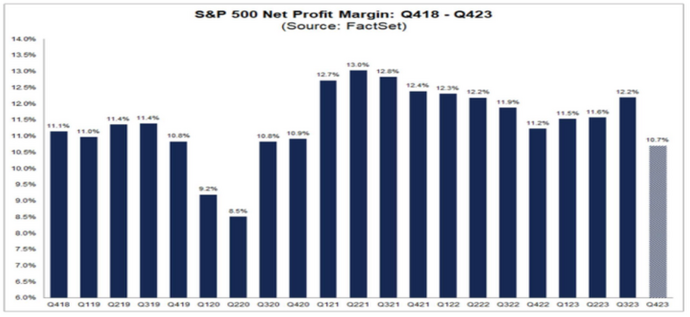

Therefore, there is a general predisposition towards risk assets although with greater sensitivity in sector picking which remains unbalanced on Big Tech stocks. There is a reason: the sector is the one that has proven to continue to grind out revenues and margins compared to companies in other economic sectors and also for the fact that profit margins were reported in the last round of quarterly reports lowest net for over 3 years:

The American economy is demonstrating greater resilience supported by: favorable financial conditions, huge fiscal stimuli that tend to sterilize the actions of the central bank, and a solid labor market that is normalizing in terms of openings of new jobs (i.e. jobs are not being destroyed). All these forces, as long as they have fuel to act, are unlikely to allow the triggering of a recession in the USA, hence the reason why investors are inclined to buy predominantly American risk assets. Indeed, there is only one indicator that still points with medium-high certainty to a US recession.

However, it will be necessary to evaluate whether the good health of the American economy will not be overshadowed by the performance of the rest of the world amid a China that is unable to re-establish a sustained economic recovery (and with the approach of the US elections which could trigger new Beijing-Beijing tensions Washington), a two-speed and stagnating Europe and Japan and the United Kingdom in a technical recession, the “no recession” path is full of pitfalls. And inflation? Without a recession it is unlikely that this will return to the levels desired by the central banks, also considering the international geopolitical tensions and the problems with the supply chain in the Red Sea, the battle against inflation is still not far from being won.

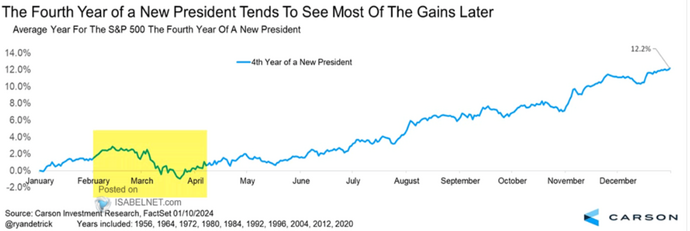

Markets have revised the rate cut prospects but if the economy turns out to be more solid than expected, this tends to reward stocks and high-yield bonds to the detriment of more defensive assets and longer-duration bonds. If you look at history, we can expect a correction in stock indices soon, given that 2024 is an election year globally:

However, at the moment any corrections are still to be seen as purchasing opportunities at least until we begin to glimpse signs of a real worsening of the economy (using the American economy as a benchmark) or of a sustained increase in inflation (an option still on the table). Exogenous shocks are difficult to predict but given the numerous variables in place from a geo-political point of view (USDJPY represents a good barometer of risk) and sectoral (such as the difficulties of US commercial real estate or Chinese shadow banking), they must be taken into account.

It is likely that in the short term, Quality Growth shares will be favored with a re-emergence of interest in Value given the better earnings prospects of the latter from an equity point of view. On bonds, the view remains to maintain a preference for securities with a maximum duration of 2-3 years while also being able to count on the returns offered by high-yield bonds. Emerging country bonds could represent an interesting opportunity if the possibility of rate cuts by the Federal Reserve materializes.

Original article published on Money.it Italy 2024-02-24 07:23:00. Original title: Mercati, lo scenario “no recession” prende consenso. Ecco come investire