According to almost every economic indicator, recession in the US is highly unlikely. One of them, however, paints a more worrying picture.

The United States is likely to avoid recession in 2024, according to almost every metric available. The US economy is booming, with better-than-expected macro data being released almost weekly. There is, however, one indicator that points to a very likely recession by January 2025.

The question of recession comes at the end of the Federal Reserve’s tightening policy. Interest rates were raised by 5,500 points between March 2022 and June 2023, battling rampant inflation and the energy crisis.

Now, the Fed signaled that interest rates reached their highs for this cycle. Many analysts are therefore wondering when will the Fed start cutting rates.

At the beginning of 2024, the US defied expectations once again, showing incredible resilience and strong economic growth. GDP in the last quarter of 2023 had grown 3.3%, more than doubling Wall Street’s forecast.

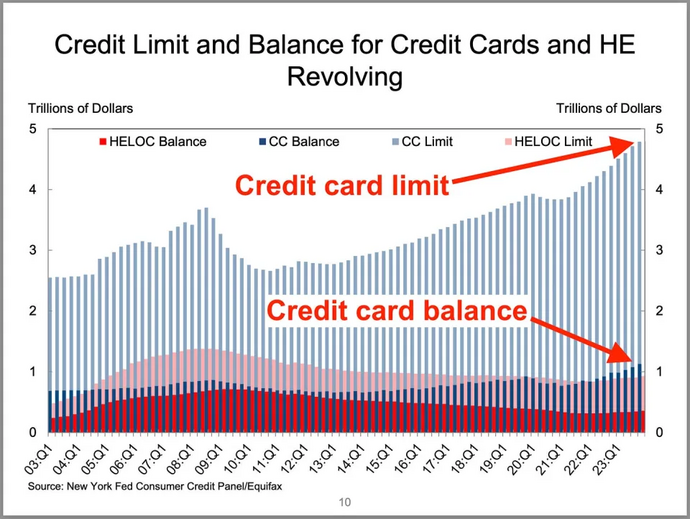

Unemployment sits at a comfortable 3.7%, and while credit card debt is at its highest in US history, when adjusted for inflation it shows it’s just following historic trends.

- Source: YahooFinance

Moreover, US manufacturing and services have restarted their growth. The combined Purchasing Manager’s Index (PMI) shows a steady expansion in economic output for the second half of 2023 and the beginning of 2024.

The one pessimistic indicator

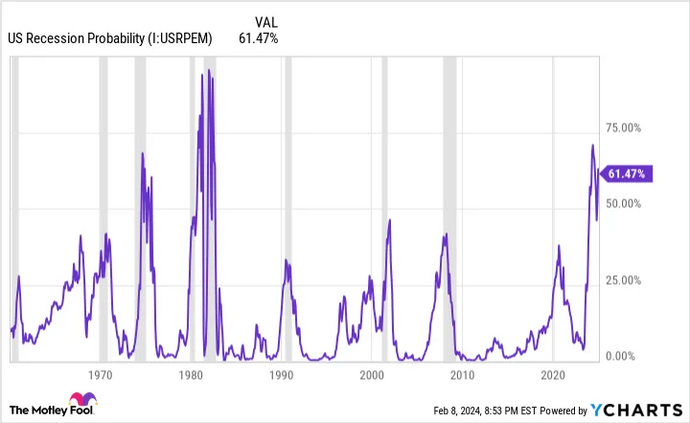

Against the backdrop of this optimistic economic outlook, there is one indicator that gives the likelihood of a recession by January 2025 at 61.47%. The US Recession Probability Index has never been wrong since 1966: every time it passed a 32% likelihood, a recession occurred within the following year.

The US Recession Probability Index measures the difference between the yield of three-year and 10-year treasury bonds. When the latter passes the former, it means markets have more trust in long-term treasury bonds than short-term ones.

- Source: YahooFinance

It’s no surprise that markets mistrust short-term treasury bonds. The US debt reached its all-time high at $34 trillion, or 129% of GDP.

JPMorgan CEO Jamie Dimon called the US debt crisis “the most predictable in the country”, and also the one with the highest destructive potential.

On the other hand, US stock exchanges are also at their highest in history. The S&P 500 broke historic highs for the second time this year last week, as well as the NASDAQ and Dow Jones indexes.

Tech stocks on the backdrop of AI are what’s driving stock exchanges up. Indeed, the S&P 500 without tech stocks is at its lowest level of all time.

Is this the first time the US Recession Probability Index is wrong? Or are markets overvalued and the bubble will burst any time soon?