Tensions keep increasing in the oil trade as Saudi Arabia slashes production by 1 million barrels per day.

As promised by Energy Minister Prince Abdulaziz bin Salman, Saudi Arabia announced on Sunday a deep cut in oil production starting in July. "This is a Saudi lollipop," Prince Abdulaziz said. "We wanted to ice the cake. We always want to add suspense. We don’t want people to try to predict what we do... This market needs stabilization."

Saudi Arabia will drop production by 1 million barrels/day (bpd) from 10 million to 9 million. The drop represents 1% of global oil demand and comes on top of recent OPEC+ production cuts.

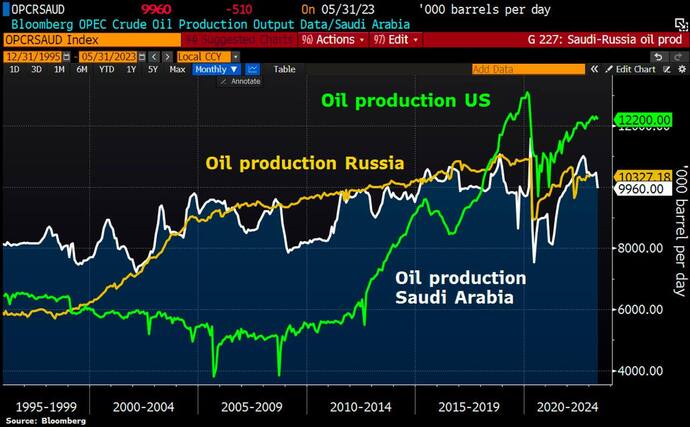

- Oil production by Russia, the US and Saudi Arabia per June 2023

OPEC (Organization of Petroleum Exporting Countries) agreed to a 2 million bpd cut last year and a further 1,66 million bpd in April 2023. OPEC has slashed 3.66% of global oil demand.

While OPEC is de facto controlled by Saudi Arabia, the rest of the organization did not follow through with Sunday’s cut. Therefore, Saudi Arabia will decrease production by itself, leading to the largest drop in oil exports in Saudi history.

Saudi Arabia is the world’s biggest oil exporter, accounting for roughly 40% of global oil demand. Its oil reserves are so large that it can afford a similar dip in production, unlike any other OPEC country.

The new global oil war

Since Russia illegally invaded Ukraine on February 24th, 2022, Saudi Arabia has pursued a conservative oil output policy. This aligned them with Moscow as Western countries unilaterally stopped oil purchases from Russia.

In short, Saudi Arabia exacerbated the already tenuous energy availability in Europe. Saudi cuts increased oil prices and worsened the Western energy crisis.

A few years ago, a similar move would have been unthinkable. Saudi Arabia was a close, albeit ambiguous, US ally. Along with Israel, Saudi Arabia was the American bastion in the Middle East against Russian and Iranian spheres of influence.

Now, however, everything is changing. Saudi Arabia wishes to align itself closer to American enemies such as Russia and China. Recently, they asked to join the BRICS New Development Bank, a Shanghai-based financial institution that fights American influence worldwide.

Beijing and Riyadh are in talks to replace the yuan as the currency for their oil trades. If it were to be implemented, it could question the US dollar’s role as the global reserve currency.

Finally, China recently brokered diplomatic talks between Saudi Arabia and Iran, historical rivals in the region. A friendship between the two would shatter decades of American "divide and conquer" strategy in the Middle East.

The new global oil war is unfolding before our eyes, and the West has little to no power in the matter.