AMD, Broadcom, Netflix, and Eli Lilly are just some of the title candidates to replace Tesla in the Magnificent Seven. Here’s which of these stocks is most likely to take its place (and why).

Will this title replace Tesla in the Magnificent Seven? For months, Elon Musk’s company has been facing a series of significant challenges, which have called into question its privileged position in the financial markets: the stock traded on the Nasdaq has dropped by 25% in five weeks. The latest earnings report missed expectations and sent a dangerous warning about slowing sales volume growth. In response, several analysts cut their ratings and reduced their price targets on the stock.

Tesla’s sharp fall also significantly reduced its weight in the S&P 500, dropping the stock to tenth place: according to experts, there are now 29 companies that contribute more earnings to the S&P 500 than Tesla and one in particular is a candidate to replace it in the group of stocks that lead Wall Street.

This title will replace Tesla in the Magnificent Seven

The “Magnificent Seven” represents a selection of leading stocks in the technology and digital sector. These companies, including Apple, Microsoft, Alphabet (Google), Amazon, Nvidia , and Meta, are characterized by strong market capitalization and significantly influence the performance of the stock market. With their central role in innovation and digital transformation, these companies are considered pillars of the contemporary technology economy.

Broadcom emerges as the ideal candidate to replace Tesla in the Magnificent Seven for several key reasons. The company has demonstrated significant growth in the networking and semiconductor sectors, with shares rising 100% last year, driven by enthusiasm for AI-related technologies.

The company is considered by many to be the world’s second-largest supplier of semiconductors for artificial intelligence, with more than $8 billion in estimated revenue for 2024.

- Broadcom weekly graph

- Source: Tradingview

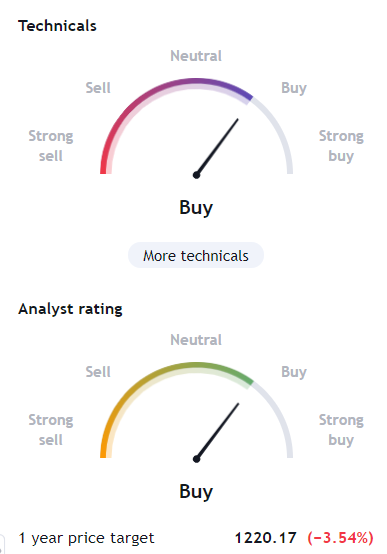

Recently, analysts at JPMorgan initiated coverage on the stock with an overweight rating, underscoring Broadcom’s leadership position in the sector. These factors point to a strong growth trajectory and significant expansion potential for Broadcom in the near future. With its continued success in the technology sector and growth prospects in AI and semiconductors, Broadcom presents itself as the best candidate to replace Tesla in the Magnificent Seven.

- Broadcom sentiment

- Source: Tradingview

Other potential Tesla replacements

In addition to Broadcom, these stocks could take Tesla’s place in the Magnificent Seven group.

AMD

Advanced Micro Devices (AMD) is among Tesla’s likely replacements in the Magnificent Seven thanks to its constant chip innovation and growing competition with Nvidia.

- AMD weekly graph

- Source: Tradingview

The recent launch of the MI300 chip, described as a 3D “superchip”, has been met with great enthusiasm and sales are expected to exceed $3.5 billion in its first year. This puts AMD directly in competition with Nvidia, a company that currently holds 86% of the AI accelerator chip market. AMD’s innovation doesn’t stop there: the company is working on accelerators and accelerated processing units that are considered better at inference operations than Nvidia’s products. Despite an increase in stock value of more than 136% over the past year, AMD still has interesting growth potential, especially considering the growing demand for AI solutions and its success in competing with Intel in the X86 server sector.

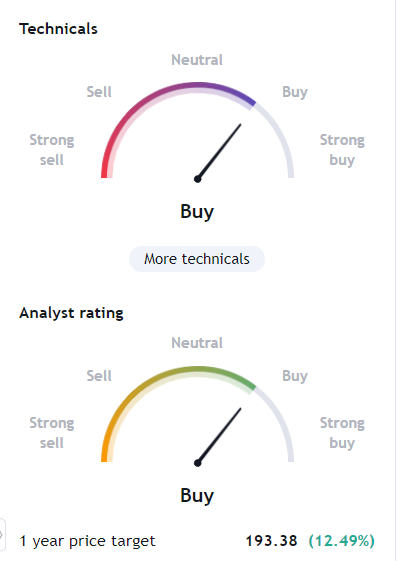

- AMD sentiment

- Source: Tradingview

Eli Lilly

Eli Lilly emerges as a strong contender to replace Tesla in the Magnificent Seven thanks to its exceptional success in the pharmaceutical sector. The recent beating of expectations in quarterly results was driven by the success of the new weight-loss drug, Zepbound, and higher prices for diabetes treatment, Mounjaro. These successes have led to an increase in stock value of 27% since the beginning of 2024. Additionally, the Food and Drug Administration recently approved Zepbound, confirming Eli Lilly’s effectiveness in treating metabolic diseases. This approval, along with the growing demand for weight-loss drugs and the expected growth of the pharmaceutical sector, makes Eli Lilly an attractive option for investors looking for opportunities in the health and biotechnology sector.

- Eli Lilly weekly graph

- Source: Tradingview

Netflix

Netflix also presents itself as a solid candidate to replace Tesla in the Magnificent Seven thanks to its global dominance in the streaming industry and its steady growth despite competition. Over the past few quarters, Netflix has continued to increase subscriber numbers and profit margins, confirming its leadership in the industry.

- Netflix weekly graph

- Source: Tradingview

Despite some risks related to US market saturation and relatively high valuations, Netflix has demonstrated a consistent ability to generate growth and meet investor expectations. With competitors like Disney and Amazon struggling to maintain momentum, Netflix could very well take the “Magnificent” spot among the Magnificent Seven.

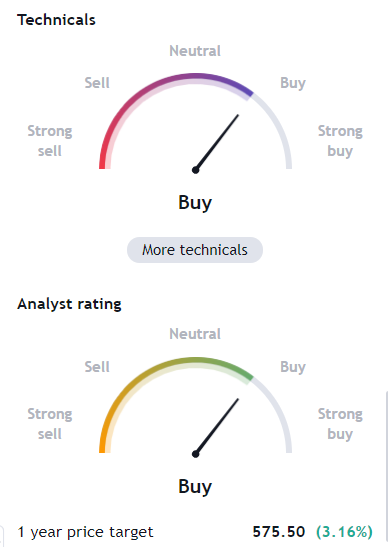

- Netflix sentiment

- Source: Tradingview

|DISCLAIMER

The information and considerations in this article should not be used as the sole or primary basis for making investment decisions. The reader retains full freedom in his own investment choices and full responsibility in making them, since he alone knows his risk propensity and his time horizon. The information contained in the article is provided for informational purposes only and its disclosure does not constitute and should not be considered an offer or solicitation to the public for savings.| Original article published on Money.it Italy 2024-02-18 08:06:00. Original title: Questo titolo sostituirà Tesla nel gruppo dei Magnifici Sette?