In 2024, Bitcoin could reach $100,000. This prediction is based on 3 catalysts that could define BTC’s next cyclical trends.

Bitcoin at $100,000? There are 3 key factors behind the next rally. After an impressive recovery during 2023, Bitcoin has all it takes to extend the run and reach new records. These are not just bold predictions, but also several crucial factors shaping the global financial landscape.

To reach $100,000, Bitcoin would need to increase in value by more than 90%. According to experts, there are some elements to consider in support of this thesis.

A careful analysis of these factors could offer a clearer perspective on the cryptocurrency’s potential future directions.

1. Bitcoin ETF

The approval of Bitcoin exchange-traded funds (ETFs) marked a turning point in the cryptocurrency market. These financial instruments offer investors a convenient way to participate in Bitcoin market movements without having to hold the cryptocurrency directly. The accessibility and familiarity of ETFs have attracted a broad audience of institutional and individual investors, contributing to greater adoption and acceptance of Bitcoin as a legitimate asset. After the launch of the first Spot ETFs on Bitcoin, the value of the cryptocurrency rose by more than 20% and now trades above $52,000.

- Bitcoin weekly graph

- Source: Tradingview

The implication of this trend is significant: the more investors, especially institutional ones, enter the Bitcoin market through ETFs, the more its position as a mainstream investment asset is consolidated. This increase in participation could fuel further price increases, as demand for Bitcoin grows and its availability in the market may be limited, leading to a price increase.

leggi anche

How to buy Bitcoin ETFs

2. Bitcoin Halving

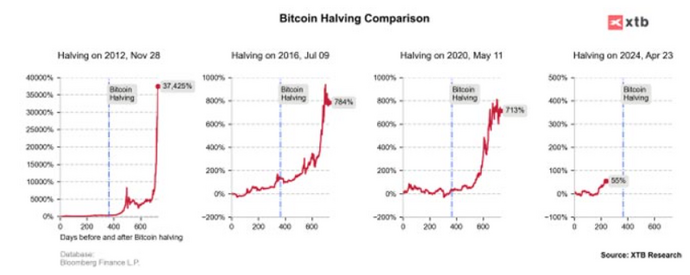

Bitcoin’s halving is the second factor that could contribute to its rise towards $100,000. The halving, scheduled for April 2024, will reduce the reward for mining new Bitcoin, consequently lowering the supply of new cryptocurrencies on the market. This intrinsic mechanism contributes to making Bitcoin increasingly scarce over time, increasing its perception as a reliable store of value. The expectation of greater scarcity could fuel investor confidence in Bitcoin and support rising prices.

But the impact of the halving goes beyond simply reducing the supply of Bitcoin on the market. This quadrennial event has historically coincided with significant Bitcoin price rallies. Reducing the reward for mining not only reinforces the cryptocurrency’s perception of scarcity but also its intrinsic value. Investors tend to see the halving as a sign of greater future demand, as the supply of new Bitcoin declines. This expectation may push investors to accumulate Bitcoin early, in anticipation of a price increase in the post-halving period.

Furthermore, the Bitcoin halving is accompanied by an increase in awareness and media interest in the cryptocurrency. Halving events are often followed by increased media attention, which helps spread awareness and adoption of Bitcoin. This increase in visibility can bring new investors to the Bitcoin market, further contributing to increased demand and prices. Historically, in the halving year, Bitcoin grew by 125%.

- Bitcoin: average yield post-halving

- Source: Bloomberg, XTB

3. Fed monetary policy

The Federal Reserve’s monetary policy can significantly influence the price of Bitcoin. The interest rate cuts expected in 2024 will favor risky assets like Bitcoin, as they make other forms of investment less attractive. When interest rates are low, investors may be pushed to seek higher returns in more volatile assets like Bitcoin.

However, recent US inflation data has cooled expectations for rate cuts, putting downward pressure on Bitcoin prices. The U.S. consumer price index beat forecasts, sparking concerns about higher-than-expected inflation. In response to these concerns, the Federal Reserve may be forced to review its monetary policies and adopt a more restrictive approach. When the Fed reduces the cost of borrowing, it could fuel a new upward push for the price of Bitcoin, as investors may reorient towards riskier assets in search of higher returns.

|DISCLAIMER

The information and considerations in this article should not be used as the sole or primary basis for making investment decisions. The reader maintains full freedom in his own investment choices and full responsibility in making them, since only he knows his risk appetite and his time horizon. The information contained in the article is provided for informational purposes only and its disclosure does not constitute and should not be considered an offer or solicitation to the public for savings.|

Original article published on Money.it Italy 2024-02-19 11:28:11. Original title: Bitcoin a 100.000 dollari? 3 fattori chiave dietro al prossimo rally