Russian revenues from oil are declining not because of sanctions but because of a lack in international demand.

Oil prices are worrying the Kremlin as they continue to rise despite Russia being the third-largest crude producer in the world. To counter rising oil prices, Russia enacted a temporary ban on oil exports except for a small circle of Central Asian countries.

Estimates say that 17% of the Russian GDP and 37% of its annual budget come from oil production and exports. Russia is by all means Europe’s largest and most successful petrostate.

The temporary export ban joins a series of recent developments in oil trading, with Russia, OPEC+, and China coming together to raise prices in the West.

However, Russia needs oil exports to finance the costly invasion of Ukraine, therefore most of its production is sold abroad. As a result, fuel prices in oil-rich Russia continue to rise. Before the ban, Brent prices (the global oil benchmark) sat at $93.39 dollars per barrel.

Contrary to what the Kremlin expected, Brent futures edged up again following Russia’s export ban. Brent prices increased by 0.56% in the immediate aftermath of the announcement.

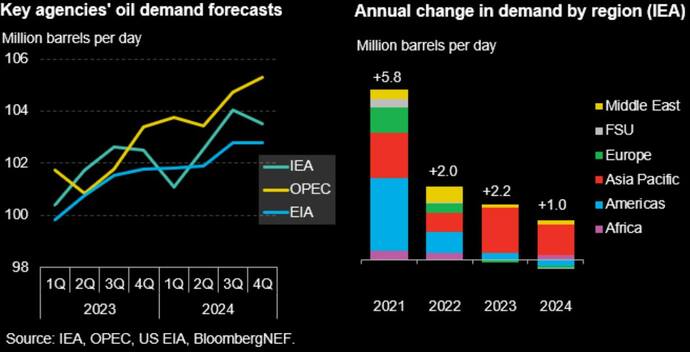

According to analysts, this signals that prices are driven by oil demand, not by its offer. "Trading remained choppy amid a tug-of-war between supply fears that were reinforced by a Russian ban on fuel exports and worries over slower demand due to tighter monetary policies in the United States and Europe," said analyst Toshitaka Tazawa.

The modern oil war

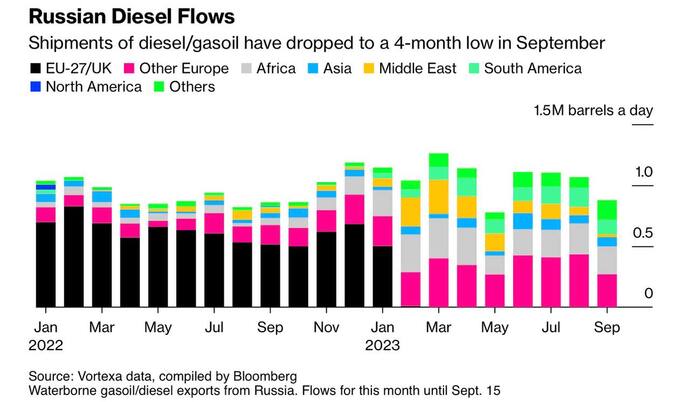

Russia’s illegal invasion of Ukraine changed the entire landscape of oil exchanges. Before the conflict, Europe was the Kremlin’s largest trading partner, fueling its thriving industries with Russian fossil fuels.

After the war erupted, however, Europe slowly halted direct transactions with Russia, looking for new commercial partners for oil and gas. By February 2023, shipments of Russian diesel to the European Union reached virtually zero.

Unfortunately for Europe, this strategy did not have the knock-on effect it hoped for. Russian revenues significantly declined, but remained afloat thanks to Chinese and Middle Eastern interference.

The Organization of Petroleum Exporting Countries (OPEC) cut oil production to artificially increase prices, while China became Russia’s main trading partner.

Russia is now strongly intertwined with China but faces fuel price problems similar to the West. Demand is simply not high enough to be damaged by Russia’s export ban.

Western goals to reduce Russian revenues were seemingly not achieved by sanctions but by the general global crisis. Industrialization is slowing everywhere, China included. And low industrialization means lower demand for oil.