Growth stocks are those stocks that have the potential to grow at a rate higher than the overall market average. Here we’ll see the top 5 for 2024.

Finding the 5 best growth stocks of 2024 after an extraordinary year for the US stock market could be a difficult task. Much of this positive trend - which gave the Wall Street indices double-digit returns of 24% for the S&P 500 and 43% for the Nasdaq - is attributable to the excellent performance of stocks related to artificial intelligence (AI) and other related sectors, confirming that AI is more than a fad, but a transformative technology in today’s world.

Focusing on growth stocks, i.e. on stocks of companies with the potential to increase financial flows over time significantly, therefore means identifying shares with a high P/E ratio, where revenues are now absorbed by costs and investments, but with the prospect of exponential growth in the long term.

For this reason, artificial intelligence will remain a main investment theme well into 2024. In this context, let’s see which are the high-quality stocks with a focus on AI that could prove to be smart choices in the coming years and months.

1) Palantir

Shares of data analytics company Palantir have soared 167% in 2023, a sharp recovery from the 65% decline it suffered in 2022. The company’s platform is renowned for its exceptional ability to analyze large data sets for government and commercial clients, leveraging advanced AI and machine learning algorithms.

Recently, Palantir launched an innovative Artificial Intelligence Platform (AIP) that combines its machine-learning capabilities with the power of large, advanced language models. This allows customers to improve productivity and operational efficiency. Additionally, with the introduction of the AIP Bootcamp go-to-market strategy, customers can test platforms with real-world workflows in five days or less, fundamentally changing the traditional pilot test approach and enabling faster negotiations and customer success.

- Palantir daily graph

- Source: Tradingview

With already strong results under GAAP, Palantir appears to be a smart investment choice.

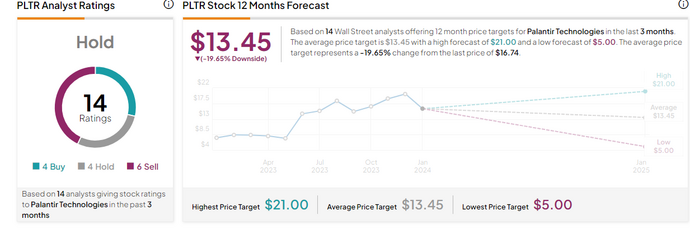

- Palantir target price

- Source: Tipranks

2) Super Micro Computer

Super Micro Computer excels at producing high-end servers and storage systems and is benefiting from growing demand for its AI platforms. In particular, the HGX-H100 solutions optimized for Large Language Models (LLM) have achieved great success, incorporating multiple H100 chips interconnected with cutting-edge networking technologies.

- Super micro computer graph

- Source: Tradingview

Supermicro’s partnerships with major chip manufacturers such as Nvidia, Advanced Micro Devices, and Intel give the company a distinct competitive advantage. Shipping advanced solutions to customers on time helps them make informed decisions earlier and results in incremental revenue opportunities for the company. All these positives make Supermicro a compelling choice for 2024.

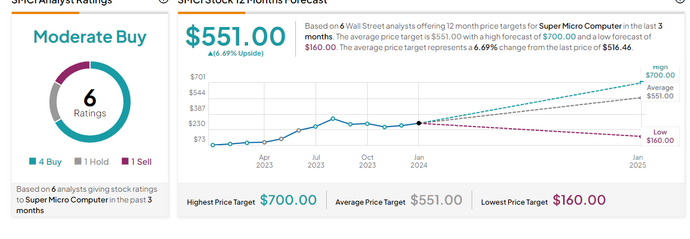

- Super micro computer target price

- Source: Tipranks

3) Snowflake

Snowflake, a cloud-native data platform, assists numerous organizations such as Salesforce, ServiceNow, Workday, and SAP in managing, storing, and analyzing massive amounts of structured and unstructured data from multiple sources and formats. Thanks to this capability, it plays a crucial role in providing organizations with a comprehensive view of the data landscape and running complex AI algorithms and models.

- Snowflake graph

- Source: Tradingview

A key advantage of Snowflake is its ability to process unstructured and streaming data. Over 30% of its customer base works with unstructured data, leading to a increase in consumption of unstructured data of 17x year-on-year as of October 2023. A new data streaming capability, Dynamic Tables, has already attracted 1,500 customers, with more planning to adopt it in the coming months. Additionally, Snowflake’s data marketplace allows organizations to access and share datasets, thereby enriching their data with additional insights and context. This further improves the results of their AI models, creating a strong network effect and a loyal customer base, especially positive in the current uncertain economic environment.

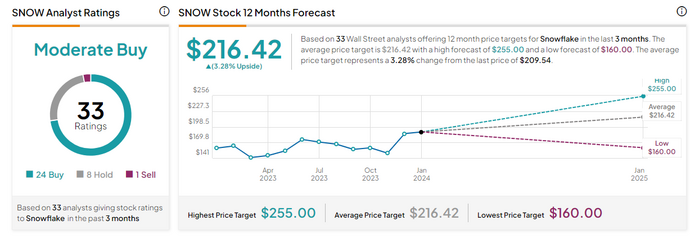

- Snowflake target price

- Source: Tipranks

leggi anche

AI titles continue to rally: 2 stocks to monitor

4) Nvidia

In this list, Nvidia cannot be missing, the undisputed leader in the AI market. Its GPU, CPU, networking, and software are used by data centers to upgrade for AI workloads.

CEO Jensen Huang predicts that data centers will spend nearly $1 trillion in capital expenditures to transition from a CPU-based to a GPU-based infrastructure. This transition is essential for high-performance computing, machine learning, and artificial intelligence workloads. Nvidia appears well-positioned to capitalize on this opportunity, with cutting-edge AI chips and a CUDA software stack used by nearly 4 million developers to optimally program these chips. The company also accelerated the release of new data center chip architectures every two years to yearly.

- NVIDIA daily graph

- Source: Tradingview

Despite a less stellar performance in recent quarters, Nvidia is finding strength in the gaming sector thanks to the availability of RTX tracking and AI technologies at affordable prices. The growing popularity of eSports is another major growth driver for the company’s gaming chips. Considering these positive factors, despite valuations at 34 times sales over the past 12 months, Nvidia’s strong position in the AI market makes it a potentially wise investment choice in 2024.

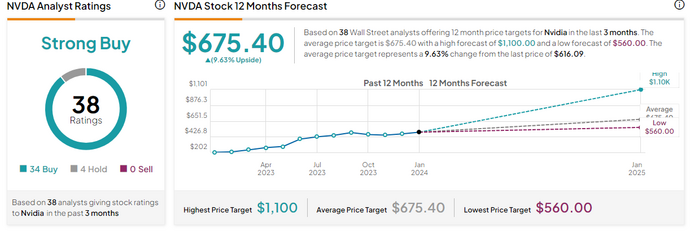

- NVIDIA target price

- Source: Tipranks

5) UiPath

The leading player in automated process robotics, UiPath helps companies automate routine and mundane tasks, thereby improving productivity and cost efficiency. The company is also leveraging artificial intelligence technologies to drive the automation of even more complex and nuanced tasks.

- Uipath graph

- Source: Tradingview

UiPath’s focus on industrial verticalization, i.e. the development of customized automation solutions for specific sectors, has been a key to competitive success. The company invests in playbooks, marketing events, and enablement programs to help its support teams better understand the unique needs and challenges of various industries, enabling them to deliver targeted solutions to customers. This has resulted in a rapid expansion of the customer base and a successful cross-selling strategy. With a portfolio of innovative offerings and a robust marketing strategy, UiPath could prove to be a very attractive investment for 2024.

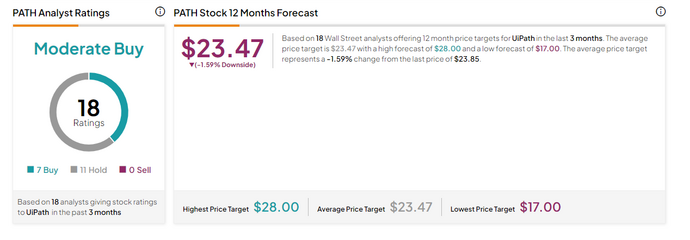

- Uipath target price

- Source: Tipranks

| DISCLAIMER The information and considerations in this article should not be used as the sole or primary basis for making investment decisions. The reader retains full freedom in his own investment choices and full responsibility in making them, since he alone knows his risk propensity and his time horizon. The information contained in the article is provided for informational purposes only and its disclosure does not constitute and should not be considered an offer or solicitation to the public for savings. |

Original article published on Money.it Italy 2024-02-01 07:50:00. Original title: Le 5 azioni growth migliori del 2024