Morgan Stanley has selected the 6 best-positioned AI stocks to benefit from the artificial intelligence boom, a disruptive technology worth 6 trillion dollars.

There are 6 AI stocks to hold until 2025 according to Morgan Stanley.

Generative AI has opened up revolutionary new horizons, with $6 trillion potential in the advertising, e-commerce, travel, shared economy, and cloud industries.

At the heart of this transformation is “Edge AI” technology, which involves running algorithms directly on user devices, promising to bring AI to new levels of penetration into life daily and in the corporate environment.

The impact of this innovation is so significant that professionals and analysts carefully monitor its trends, trying to identify the short and long-term effects that it could have on the entire industrial and economic landscape.

In this context of rapid and profound change, the American bank Morgan Stanley has identified the companies best positioned to profit from the mainstream adoption of artificial intelligence.

1) Apple

Apple is Morgan Stanley’s favorite in the AI landscape for many reasons. The Cupertino company’s strength is its integrated ecosystem of devices and services, which creates a harmonious and seamless environment for users, providing them with a flawless AI experience. Apple’s focus on user privacy is another crucial element, instilling confidence in an era where data security is at the center of heated debates.

While other tech giants have made notable progress in AI, Morgan Stanley points out that Apple’s unique approach positions it well to capitalize on the widespread adoption of this technology. With a history of innovation and a trusted user base, Apple has emerged as a leader in the AI revolution.

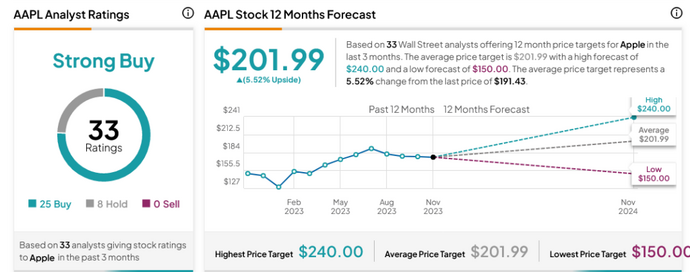

- Apple target price

- Source: TipRanks

According to Morgan Stanley, Apple’s capability in AI is still untapped with the company likely to soon integrate Machine Learning across its entire product range, including iPhone, iPad, and Apple Watch. Morgan Stanley is convinced that the company is ready to "expand all aspects of Edge AI", thanks to its proprietary silicon, believed to be the most powerful and efficient on the market. The bank gives Apple a price target of $210, implying a potential upside of 10% from current levels.

Despite fierce competition in the AI industry, Apple is well-positioned to benefit from the widespread deployment of AI.

- Apple weekly graph

- Source: Tradingview

2) Qualcomm

Qualcomm is among Morgan Stanley’s favorite stocks to take full advantage of the growing trend of artificial intelligence.

The tech giant is refining Edge AI capabilities through its Snapdragon line and establishes itself as a key enabler in this ever-evolving landscape. The Snapdragon platform, the subject of constant innovation, demonstrates Qualcomm’s commitment to developing chips for mobile devices, putting it at the forefront of the race for Edge AI.

Morgan Stanley has an optimistic but cautious view of the stock and gives Qualcomm a price target of $119, considering a possible 6% downside. This outlook reflects the bank’s confidence in Qualcomm’s leadership in Edge AI.

3) Dell

Dell is also considered by Morgan Stanley to be a key enabler in the evolution of infrastructures related to artificial intelligence. The prospect of long-term growth in the PC, server, and storage sectors makes Dell a strategic choice to capitalize on the growing demand for powerful hardware capable of supporting Edge AI workloads. The bank expects Dell to benefit from both the cyclical recovery in hardware markets and the continued expansion of AI.

- Dell weekly graph

- Source: Tradingview

“Dell plans to launch new AI-enabled notebooks and workstations in the next 12 months,” Morgan Stanley analysts said. “These devices are expected to have more powerful silicon, more memory, and higher prices.”

Morgan Stanley gives Dell a price target of $89, with a potential upside of 21% from current values, and confirms the company’s growth expectations.

4) MediaTek

MediaTek is the largest chip manufacturer in Asia and is at the forefront of riding the Edge AI era. MediaTek’s preparedness for Edge AI not only speaks to its ability to adapt to market dynamics but also its willingness to play a central role in digital transformation. With its focus on competition and the intelligent use of existing resources, MediaTek establishes itself as a key enabler of AI, ready to redefine the future of intelligent technologies.

leggi anche

The best ETF to invest in Taiwan

Morgan Stanley has set an ambitious price target of 1,000 Taiwanese dollars ($31.70) on MediaTek, about 6% away from current levels. This objective reflects the bank’s confidence in MediaTek’s ability to compete with the big names in the industry and strategically position itself in the evolving AI landscape.

- Mediatek stock price graph

- Source: Tradingview

5) Xiaomi

Xiaomi, the undisputed protagonist of smartphone hardware development in Asia, is identified by Morgan Stanley as a key enabler in Edge artificial intelligence. The positive outlook on the recovery of Xiaomi shares, already up 11% compared to the October lows, reflects the overcoming of the smartphone crisis in China, paving the way for a possible extension of the rebound.

- Xiaomi weekly graph

- Source: Tradingview

The American bank praises Xiaomi’s ability to extend into the Edge AI space, positioning it as a crucial player in this evolving space. However, the conservative price target of 15 Hong Kong dollars, with a modest upside potential of less than 1%, suggests a cautious valuation of Xiaomi’s growth.

Despite stagnating smartphone shipments, Xiaomi reported an increase in revenue in the third quarter, beating analysts’ expectations. With net profit jumping 183% from the previous year to 6 billion yuan, the company demonstrated efficient management of component costs and business operations. In this context, Xiaomi represents an interesting opportunity for the future, despite the headwinds of the economic crisis and challenges in the smartphone sector.

6) STMicroelectronics

The Italian-French chip manufacturer STMicroelectronics also appears on Morgan Stanley’s list, recently judged "Overweight" by the bank’s analysts who improved the rating from the previous "Equal-Weight", raising the target price from 45 to 48 euro. Analysts expect the chipmaker to embark on a “robust recovery” in the second half of 2024.

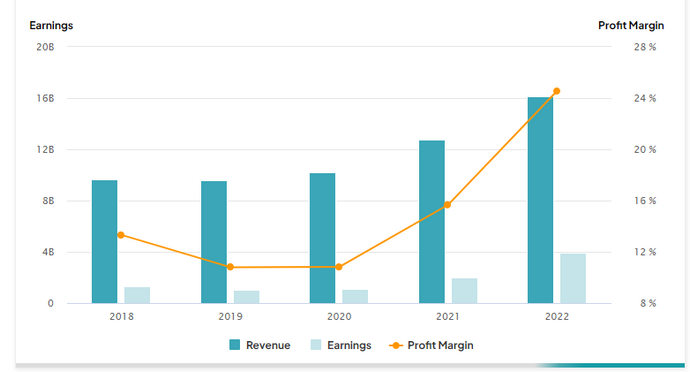

- STM Income statement

- Source: TipRanks

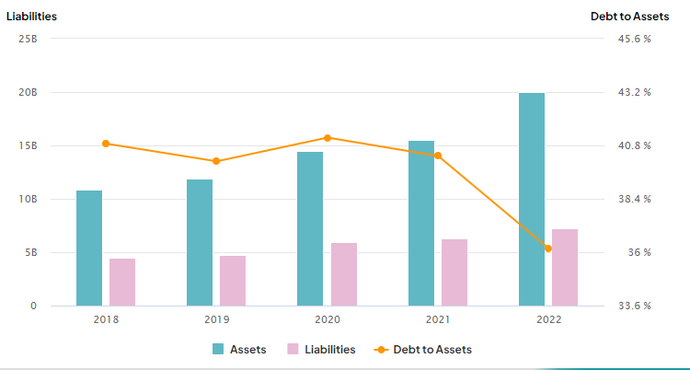

- STM Balance

- Source: TipRanks

According to Morgan Stanley, STM’s distinctive value in the field of Edge artificial intelligence lies in its ability to offer highly energy efficient processing through ultra-low power microchips. The bank believes that STM is in a prime position to take advantage of the positive cycle, with a good buying opportunity for investors. Strong sales of silicon carbide (SiC) chips, new products such as sensors, and long-term supply agreements justify investor optimism.

The bank believes the company can improve energy efficiency in computing by implementing Edge AI in the automotive, mobile, healthcare, and industrial Internet of Things (IoT sectors.

With a price target of 48 euros, Morgan Stanley indicates a potential upside of almost 16%, highlighting the positive outlook on growth and STM’s contribution to the evolution of Edge AI.

|DISCLAIMER

The information and considerations in this article should not be used as the sole or primary basis for making investment decisions. The reader retains full freedom in his own investment choices and full responsibility in making them, since he alone knows his risk propensity and his time horizon. The information contained in the article is provided for informational purposes only and its disclosure does not constitute and should not be considered an offer or solicitation to the public for savings.|

Original article published on Money.it Italy 2023-12-03 07:47:00. Original title: 6 azioni AI da tenere fino al 2025 secondo Morgan Stanley

Argomenti