According to Goldman Sachs, asset allocation changes over time but there are 4 securities that absolutely must not be sold until the beginning of 2024.

Goldman Sachs, one of the most authoritative financial institutions globally, recently developed a list of 4 stocks to buy and hold until the beginning of 2024.

According to Goldman Sachs CEO, Eric Sheridan, these companies offer an optimal balance between risk and return, with an established position in the market, the ability to manage a growth trajectory margins over the 2023/2024 period and expertise in addressing investor concerns regarding growth and profitability.

In 2023, these 4 stocks outperformed the Nasdaq Composite Index, which achieved a performance of 34% over the period.

Let’s see in detail which securities these are and why the investment bank suggests keeping them in the portfolio.

1) Alphabet (Google)

Google’s parent company, Alphabet, is one of the names on Goldman Sachs’ list. Alphabet shares are up 54% since the beginning of the year, and Sheridan is taking a bullish approach to the company. The positive outlook is tied to Alphabet’s potential to expand fourth-quarter revenue growth through 2024 and further monetize its search and YouTube segments. Alphabet’s presence in artificial intelligence is seen as a key point, with its Bard AI language model.

- Alphabet: weekly chart on the Nasdaq

- Source: Tradingview

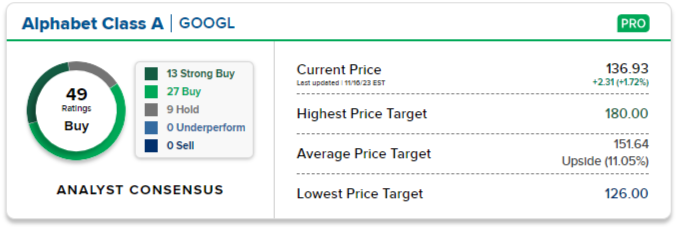

Goldman Sachs considers Alphabet to be “buy”, with a target price of $154. Compared to current values, the potential increase is 14%.

- Alphabet consensus market analysis

- Source: TipRanks, CNBC

2) Amazon

Amazon is part of the Goldman Sachs list. Over the course of 2023, the e-commerce giant’s shares have risen 70% and, according to the investment bank, there is room for further upside. Goldman Sachs highlights Amazon’s potential for continued margin growth and sees an opportunity for improvement in its cloud service, Amazon Web Services (AWS), and its new AI software: Bedrock.

- Amazon weekly chart

- Source: TeleTrader

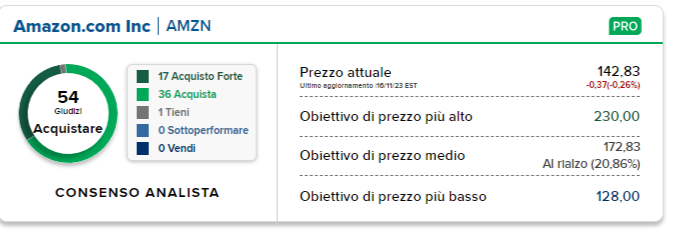

The stock currently has a “buy” rating with a 12-month price target of $190, implying a potential upside of 33% from current values. Goldman Sachs’ outlook on Amazon rests on a combination of solid revenue growth and expanding margins over the long term.

- Amazon consesus market analysis

- Source: TipRanks, CNBC

3) Meta Platforms

Meta Platforms, the parent company of Facebook, is up 175% in 2023, making it a notable stock according to Goldman Sachs. According to the bank, the social media giant will continue to benefit from steady revenue growth supported by AI projects. Goldman Sachs’ recommendation is also based on Meta’s “consistent messages on operational efficiency as we move beyond 2023.”

- Meta graph

- Source: TradingView

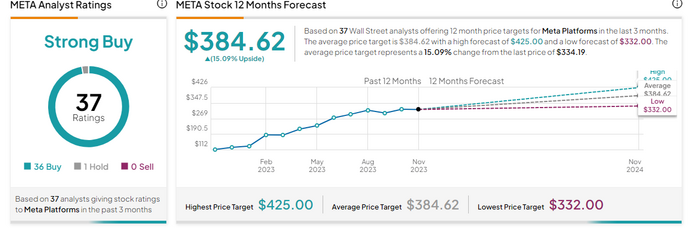

Meta Platforms has a “buy” rating, with a price target of $384, with a potential upside of 15% compared to current values.

- Meta consesus market analysis

- Source: TipRanks, CNBC

4) Uber

Uber has recorded a positive performance of 120% since the beginning of 2023. It is therefore no coincidence that it is on the list of stocks to hold in the portfolio according to Goldman Sachs.

According to Sheridan, the ride-sharing company will continue to benefit from strong supply and demand in the mobility sector. The stabilization of the Uber Eats segment is seen as a plus for Uber and Goldman Sachs is optimistic about the long term.

- Uber weekly chart

- Source: TradingView

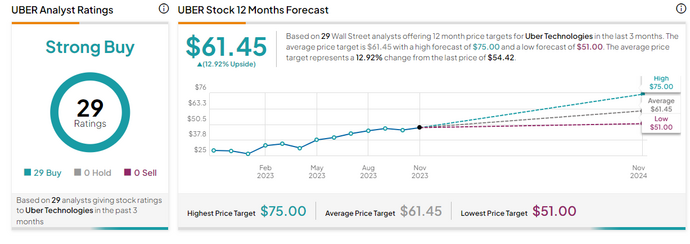

Goldman Sachs rates Uber with a "buy" rating and indicates a 12-month target price of 59 dollars, with potential price growth of 10% compared to current values. Goldman Sachs’ long-term view on Uber is optimistic, seeing the company as a platform on the rise and capable of capturing a large portion of consumer and business demand.

- Uber consensus market analysis

- Source: TipRanks, CNBC

In conclusion, the 4 tech stocks that Goldman Sachs recommends against selling until 2024 reflect confidence in their ability to grow, effectively manage margins, and dominate key sectors such as cloud, mobility, artificial intelligence, and social media.

|DISCLAIMER

The information and considerations in this article should not be used as the sole or primary basis for making investment decisions. The reader maintains full freedom in his own investment choices and full responsibility in making them, since only he knows his risk appetite and his time horizon. The information contained in the article is provided for informational purposes only and its disclosure does not constitute and should not be considered an offer or solicitation to the public for savings.| Original article published on Money.it Italy 2023-11-17 17:47:00. Original title: 4 azioni da non vendere assolutamente fino a inizio 2024